Why Gold and Silver Prices Crashed Today and How It Dragged Bitcoin Lower

The post Why Gold and Silver Prices Crashed Today and How It Dragged Bitcoin Lower appeared first on Coinpedia Fintech News

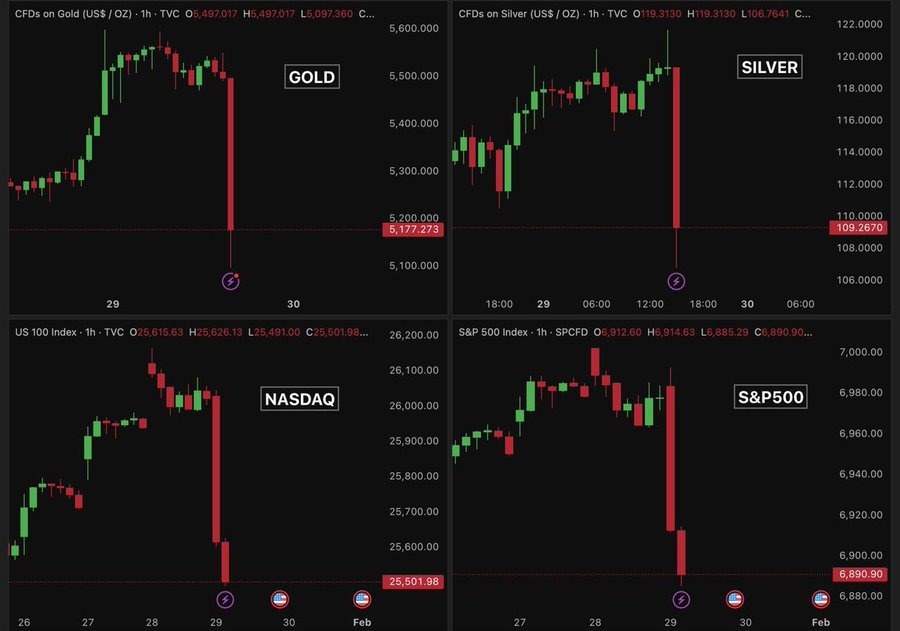

Today, gold and silver prices crashed nearly 10%, wiping out over $3 trillion in value, an amount equal to the entire crypto market cap. The sudden fall quickly spread to crypto, pulling Bitcoin down nearly 7% as leveraged positions were wiped out.

What began as a sharp sell-off in metals soon turned into a broader risk-off move, catching many traders by surprise.

Gold Prices Crash After Record Rally

According to market data, gold prices dropped from near $5,625 to around $5,100, while silver fell from over $121 to nearly $106. This sharp move erased an estimated $3.4 trillion in notional value, marking one of the fastest reversals in precious metals history.

The fall was not triggered by fresh geopolitical news or policy changes. Instead, markets were hit by heavy profit-taking.

Gold has surged nearly 90% in the past year, while silver climbed more than 270%, driven by central bank buying, geopolitical fears, and strong industrial demand.

Another key factor was excessive leverage. Futures markets were crowded with traders using 50x to 100x leverage. Once prices dipped slightly, margin calls kicked in, forcing liquidations and creating a chain reaction of selling.

- Also Read :

- Why Are Bitcoin, XRP, and Ethereum Prices Falling Today?

- ,

Bitcoin Drops 7% as Crypto Liquidations Spike

The chaos did not stop with gold & silver. The crypto market saw a sharp sell-off as Bitcoin fell nearly 7%, dropping from around $89,000 to below $82,000. Large-cap cryptocurrencies like ETH, XRP, BNB, SOL, and ADA also dropped between 6% and 10% in a single day.

According to CoinGlass, the crypto market recorded $1.68 billion in liquidations over the past 24 hours. Around 267,000 traders were forced out of positions, with long liquidations accounting for nearly 93% of the total.

At the same time, on 29 January, Bitcoin ETFs recorded heavy outflows of about $817 million, led by BlackRock, Fidelity, and Grayscale. Bitcoin ETFs have now seen outflows for eight straight days, except on January 26, when a small inflow of $6.8 million was recorded.

Stocks and Crypto-Linked Firms Also Hit

The sell-off also hit equitie market too. Microsoft shares dropped about 10–11% after weak cloud growth guidance and a downgrade, pulling major indexes lower. The S&P 500 erased $780 billion, while the Nasdaq lost $760 billion intraday.

Crypto-related stocks such as Strategy, Metaplanet, and Bitmine fell between 15% and 20%, reflecting the broader risk reset.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The metals sell-off sparked a broader risk-off move, forcing leveraged traders to unwind positions and pushing Bitcoin and altcoins sharply lower.

Stability depends on whether liquidation pressure eases and leverage resets. Upcoming macro data, ETF flows, and futures positioning will be key indicators to watch.

Many investors may reduce leverage, rotate into cash, or favor less volatile assets. Risk appetite typically stays cautious until price action and liquidity normalize.

You May Also Like

CME Group to launch Solana and XRP futures options in October

BlockchainFX or Based Eggman $GGs Presale: Which 2025 Crypto Presale Is Traders’ Top Pick?