Curve Finance captures 44% of Ethereum DEX fees as activity surges

Curve Finance has moved back into the spotlight, not because of hype, but due to where users are actually paying fees on Ethereum.

- Curve captured about 44% of Ethereum decentralized exchange fees over the past 30 days, up from ~1.6% a year ago

- Growth is driven by crvUSD trading and deep Bitcoin liquidity pools via Yield Basis

- DAO grants and new deployments continue to support Curve’s role as core decentralized finance infrastructure

While DAO discussions continue in the background, on-chain data now shows Curve sitting at the center of Ethereum’s DEX activity.

According to DeFiLlama data, Curve DAO (CRV) has recorded an all-time high in Ethereum DEX fees, capturing about 44% of all DEX fees on Ethereum over the past 30 days. This marks a sharp change from a year ago, when Curve’s share stood near 1.6%.

Fees data shows Curve pulling ahead on Ethereum

Ethereum remains one of the most competitive DeFi markets, dominated by stablecoins, ETH pairs, and wrapped BTC rather than short-lived trading trends like memecoins. That makes fee data a useful measure of where real activity is happening.

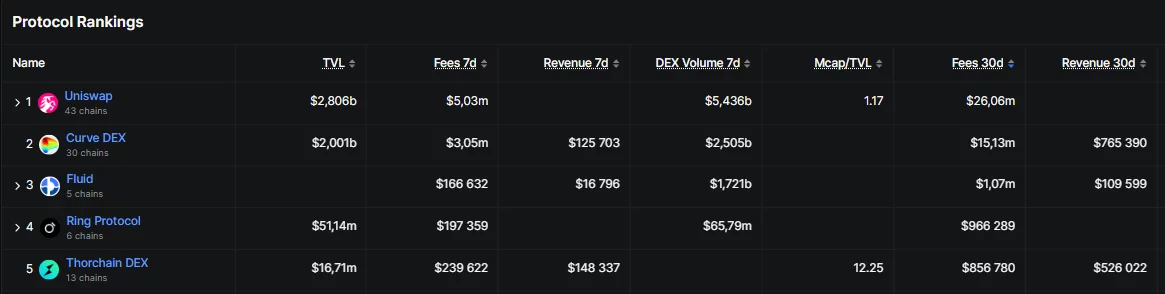

DeFiLlama figures show Curve ranking among the top Ethereum DEXs by fees over the last 30 days, overtaking several long-standing leaders. The attached chart highlights this shift clearly. Curve posted roughly $15.1 million in fees over 30 days, placing it just behind Uniswap while operating with a more focused asset mix.

Top Ethereum DEXs by fees (30-day view) : Credit: DefiLlama

Top Ethereum DEXs by fees (30-day view) : Credit: DefiLlama

This rise reflects increased usage, not protocol profit. Fees paid by traders do not equal yield distributed to liquidity providers or DAO revenue. Still, they point to sustained demand for Curve’s pools.

Two areas stand out. Trading around crvUSD has expanded sharply, making the stablecoin a key source of volume. At the same time, Curve has become home to some of the deepest on-chain Bitcoin liquidity in DeFi, following its integration with Yield Basis. Three BTC pools on Curve now rank at the top by both depth and TVL.

DAO decisions and ecosystem moves support activity

Governance and development have moved alongside this growth. The Curve DAO recently rejected a governance proposal to allocate 17.4 million CRV tokens, worth about $6.2 million, to the DEX’s development team.

An amended proposal has since been submitted. Several proposals to add liquidity gauges for new or existing pools are also live.

Recent deployments on X Layer and Plasma have widened Curve’s footprint. crvUSD adoption continues to grow, reinforcing Curve’s role as a base layer for stablecoin swaps and yield strategies.

Curve’s team has pointed to a shift in user behavior, with traders favoring protocols built around steady revenue and transparent mechanics rather than short-term speculation. The data now backs that view.

Ayrıca Şunları da Beğenebilirsiniz

Laser Cutting Services San Diego: Precision Solutions for Modern Manufacturing

Dogecoin Price Prediction For 2025, As Analysts Call Pepeto The Next 100x