VivoPower’s $300M Investment in Ripple Triggers 13% Stock Rally

VivoPower International PLC announced the execution of a definitive $300 million joint venture agreement with Lean Ventures, marking one of the company’s most significant digital asset initiatives to date. The deal, unveiled on December 12, will allow the parties to acquire and hold a substantial portfolio of Ripple Labs shares through a newly established, South Korea-focused investment vehicle.

Lean Ventures, a licensed and prominent asset manager based in Seoul, will structure and manage the investment vehicle targeting $300 million worth of Ripple Labs equity. The firm already oversees funds for the Government of South Korea and several private limited partners, giving it a strong institutional base for the venture.

VivoPower Finalizes $300M Ripple Share Acquisition Deal

According to the announcement, Lean Ventures has also canvassed interest from both institutional and retail investors in South Korea, potentially including K-Weather. VivoPower is currently finalizing due diligence on acquiring an initial 20% stake in K-Weather as part of its strategy to expand its footprints within the region.

Under the agreement, Vivo Federation, VivoPower’s digital asset investment arm, will originate and secure Ripple Labs shares on behalf of the fund. The company confirmed receiving written approval from Ripple Labs to purchase an initial tranche of preferred shares. Negotiations are ongoing for additional purchases from existing institutional shareholders, enabling the vehicle to reach its full $300 million target.

VivoPower expects to generate $75 million in management and performance fees over three years based on the initial fund size. The joint venture structure also grants VivoPower indirect economic exposure to potential future gains in Ripple Labs’ valuation and underlying XRP XRP $2.00 24h volatility: 0.9% Market cap: $120.98 B Vol. 24h: $2.97 B holdings.

Adam Traidman, Chairman of VivoPower’s Advisory Council, emphasized the strategic relevance of the South Korean market’s status as the world’s largest holder of XRP by both value and volume. He added that the partnership will offer Korean investors discounted access to Ripple Labs shares relative to XRP spot pricing. Lean Ventures’ Managing Partner Chris Kim echoed the sentiment, citing strong national demand for Ripple-linked investment products.

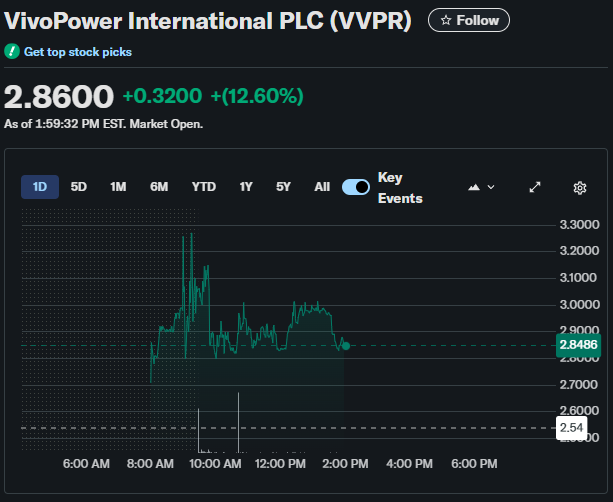

Founded in 2014 and listed on Nasdaq since 2016, VivoPower reported a 13% intraday surge in its share price to $2.88 following the announcement, according to Yahoo Finance data. Meanwhile, XRP remained flat near $1.98 as traders digested recent crypto-market volatility and rotation-driven losses.

VivoPower reported a 13% intraday surge | Yahoo Finance

Crypto Traders Lean Bullish as Maxi Doge Presale Nears $4.6M Target

As institutional investors like VivoPower expand their crypto portfolios with strategic plays on established assets like XRP, retail traders are turning to high-risk, high-reward opportunities in the meme coin sector and projects like Maxi Doge a meme-based leverage trading ecosystem that combines social entertainment with aggressive yield potential.

The Maxi Doge presale has now exceeded $4.3 million, nearing its $4.6 million target. The project, offering up to 1000x leverage with no stop-loss restrictions, has attracted attention from traders seeking amplified exposure to crypto market movements.

Maxi Doge presale

Each MAXI token is currently priced at $0.00027, with the next pricing tier expected to unlock within hours. Interested buyers can visit the official Maxi Doge presale website to secure early allocation and access exclusive early-joiner bonuses.

nextThe post VivoPower’s $300M Investment in Ripple Triggers 13% Stock Rally appeared first on Coinspeaker.

Ayrıca Şunları da Beğenebilirsiniz

Crypto Shows Mixed Reaction To Rate Cuts and Powell’s Speech

Vitalik Buterin Reveals Ethereum’s Long-Term Focus on Quantum Resistance