Solana Drops Viral “Hello Wall St.” After ETF Debut, 10x Speed Upgrade Fuels $200 Buzz

Key Takeaways:

- Solana launched a “Hello Wall St.” campaign immediately after its U.S. spot ETF debut, signaling a direct push into mainstream finance.

- The network rolled out a major performance upgrade, delivering 10x faster data loads and reducing RPC calls by 100x, boosting developer efficiency.

- With record on-chain activity and growing institutional attention, traders now watch whether SOL can challenge the $200 level in the next leg of the cycle.

A day after its first spot ETF hit U.S. markets, Solana delivered a high-impact message to traditional finance with a dramatic “Hello Wall St.” ad. The timing was intentional and the crypto community noticed. Solana is not just entering Wall Street conversations; it’s announcing itself as a serious player.

Read More: $BSOL Launch Shakes Wall Street: First SEC-Approved Solana Staking ETF

Solana Says “Hello Wall Street”, Literally

Solana’s marketing team dropped a cinematic spot across social platforms with a simple message: Hello Wall St.

The tone is confident, even defiant. It is a statement that Solana is no longer a niche product, but it has entered international capital markets.

This is after the first Solana spot ETF was approved and launched in the U.S., which is a significant milestone. Bitcoin and Ethereum are the only networks which are deep institutionalized until recently. This is a new step as Solana enters the ETF stage and blockchain is no longer a two-asset story.

News of the video rapidly disseminated on trading forums, crypto Twitter and Telegram groups, leading to a flood of optimistic discussion. It was simple to understand Solana feels that it has earned a seat at the financial table and it is willing to compete.

ETF Launch Drives Institutional Conversation

The ETF was characterized by high support within the first day of trade, which fuelled the popularity of Solana. Wall Street exposure translates to new inflows, new entrants and new credibility.

For years, Solana has been compared to Ethereum frequently or disregarded as another L1. The discussion nowadays has changed. Solana is increasingly viewed as a high-performance network powering next-gen finance from tokenization to real-time trading rails to consumer crypto apps.

Institutional desks that once only tracked Bitcoin and Ethereum pricing data are now actively analyzing Solana’s throughput, security profile, and staking yield dynamics.

The ETF does not just provide price exposure, it introduces Solana to asset-allocation models, long-term portfolios, and retirement products. That changes the demand curve and narrative trajectory.

Read More: SEC Pushes Final Decision on Solana ETFs to October 16 After Maximum 60-Day Extension

Massive Tech Upgrade: 10x Faster, 100x More Efficient

While the ETF grabbed headlines, Solana engineers quietly rolled out one of the biggest upgrades to date.

A new performance enhancement, developed in collaboration with infrastructure provider Helius Labs, reduces data loading times by around 10x and cuts RPC requests by roughly 100x.

This addresses real developer friction historically, heavy RPC traffic during peak activity created bottlenecks. Streamlining that layer means faster indexing, smoother app performance, and more scalable infrastructure for DeFi, gaming, and consumer-grade dApps.

The upgrade arrives at a critical moment. Solana has processed over 100 million daily transactions, demonstrating real user activity not just speculative bridging or wash trading.

As the network scales, infrastructure quality becomes a competitive moat. A chain that can handle global-scale applications without degradation becomes attractive not only to crypto startups but to fintechs, exchanges, and enterprise builders exploring on-chain systems.

Why This Moment Matters for Solana’s Positioning

For most of the last decade, traditional investment circles viewed crypto through a narrow lens: Bitcoin as digital gold, Ethereum as programmable money.

Solana now challenges that structure. Its message, both in marketing and technology is that the future of finance may not be limited to existing categories. Fast settlement, low fees, real-time program execution, and scalable system design are drawing serious interest from institutional builders and Web2-to-Web3 migration teams.

Solana’s ecosystem has matured:

- Liquidity depth is expanding

- On-chain trading volume is increasingly competitive

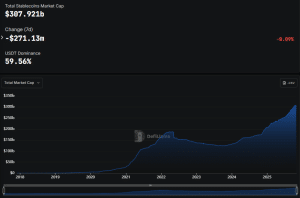

- The stablecoin market on Solana continues to grow

- Real-world asset pilots are exploring Solana rails

- DeFi protocols are recovering TVL momentum

With ETFs live and major performance upgrades secured, Solana is stepping into a new growth phase that blends crypto culture with Wall Street adoption, something few networks manage successfully.

The post Solana Drops Viral “Hello Wall St.” After ETF Debut, 10x Speed Upgrade Fuels $200 Buzz appeared first on CryptoNinjas.

You May Also Like

Coinbase Says Banks’ Stablecoin Fears ‘Ignore Reality,’ Dismisses Deposit Drain Concerns

Grayscale Ethereum Trusts Migrate to NYSE Arca’s Generic Listing Standards