Ripple Shuts Down IPO Talk After SEC Win, Prioritizes Private Capital

Ripple Labs has recently reaffirmed its decision to remain private with no plans for an initial public offering (IPO) despite its recent breakthrough in its long-term legal battle with the United States Securities and Exchange Commission.

Monica Long: ‘We’re Self-Funded and Loving It’

The statement addresses the speculation that followed the final resolution of Ripple’s four-year legal fight with the United States Securities and Exchange Commission. The SEC filed its $1.3 billion lawsuit in December 2020, alleging unregistered securities sales of XRP.

The case concluded with a mutual settlement and appeal dismissal on August 7, 2025, following a favorable July 2023 summary judgment and August 2024 remedies ruling, imposing a $125 million civil penalty.

Long’s recent statement contradicts the earlier comments from CEO Brad Garlinghouse, who in 2020 described an IPO as a “natural evolution.”

Two days before Long’s remarks, Ripple closed a $500 million strategic round led by Fortress Investment Group, with participation from Citadel Securities, Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace. The round increased Ripple’s value to $40 billion, up from $11.3 billion in January 2024.

Ripple has also actively repurchased more than 25% of outstanding shares since 2024 through a series of buybacks, including a $1 billion tender in October 2025 that saw limited employee participation and earlier programs totaling over $1.5 billion.

Why Staying Private Is Ripple’s Superpower

Ripple reported its strongest year to date in 2024, with CBI Insights estimating annual revenue at $1.3 billion, although the company did not disclose figures officially.

The customer base doubled year-over-year, mostly as a result of RippleNet’s cross-border volume, which is said to have exceeded $100 billion annually, and has ultimately increased use of XRP in on-demand liquidity (ODL) settlements.

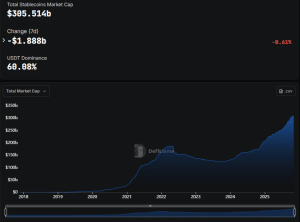

A major growth driver was Ripple USD (RLUSD), a U.S. dollar-pegged stablecoin that is native to both Ethereum and the XRP Ledger, launched December 17, 2024.

As of November 2025, RLUSD monthly volume stands above $860 million, with intraday peaks surpassing $10 billion during periods of elevated activity.

Regulatory licenses have also contributed greatly to the adoption. Ripple holds over 75 approvals worldwide, including full Major Payment Institution status in Singapore (2023), in-principle approval from Dubai’s DFSA in October 2024, and VASP registration in Ireland under the EU’s MiCA regime.

The company is on track for full MiCA compliance for stablecoins, effective June 2024, and CASP services, effective December 2024.

Ripple is investing capital in stablecoin infrastructure, enterprise custody through its 2023 acquisition of Metaco, valued at around $250 million, and strategic M&A, including Hidden Road, worth $1.25 billion; Rail, valued at $200 million; and GTreasury, a $1 billion 2025 deal.

The company employs more than 1,390, with expansion across compliance, engineering, and institutional sales.

By staying private, Ripple avoids quarterly earnings pressure and preserves its operational flexibility at a time of fast-changing crypto regulations. The strategy, self-funded, institution-first, and aggressively scaling, seems to be paying off.

This article was originally published as Ripple Shuts Down IPO Talk After SEC Win, Prioritizes Private Capital on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Privacy Coins Rally Driven by Technicals, Narrative

‘Survival Mode’ Activated: Bitcoin Miners Struggle As Hashprice Collapses