NEAR Inflation Halving Voting Starts, 12% Missing for Approval

The Near Foundation is proposing an inflation halving for NEAR NEAR $2.24 24h volatility: 4.4% Market cap: $2.85 B Vol. 24h: $199.70 M , effectively reducing the token’s yearly tail emission from 5% to 2.5%. Voting started on October 28, with node-level governance, and 68.41% of all block-producing validators already signaled to favor the reduction—missing less than 12% staking weight for approval.

As reported by Coinspeaker last week, on October 21, the nearcore v2.9.0 release proposed one key change to the Near Protocol: cut emissions from 5% to 2.5%. Validators who favor this change can upgrade to the backwards-compatible Protocol Version 81, while those who oppose it need to remain in Protocol Version 80, not upgrading. Stake delegators can redelegate to new validators accordingly, directly influencing the vote outcome.

The voting ends in 23 days from October 23, with a “NO” outcome, keeping NEAR’s inflation as is, or when the 80% staking threshold is met, activating in the following epoch. An epoch is a unit of time that equals 43,200 blocks, lasting between seven and eight hours at a 600-millisecond block time.

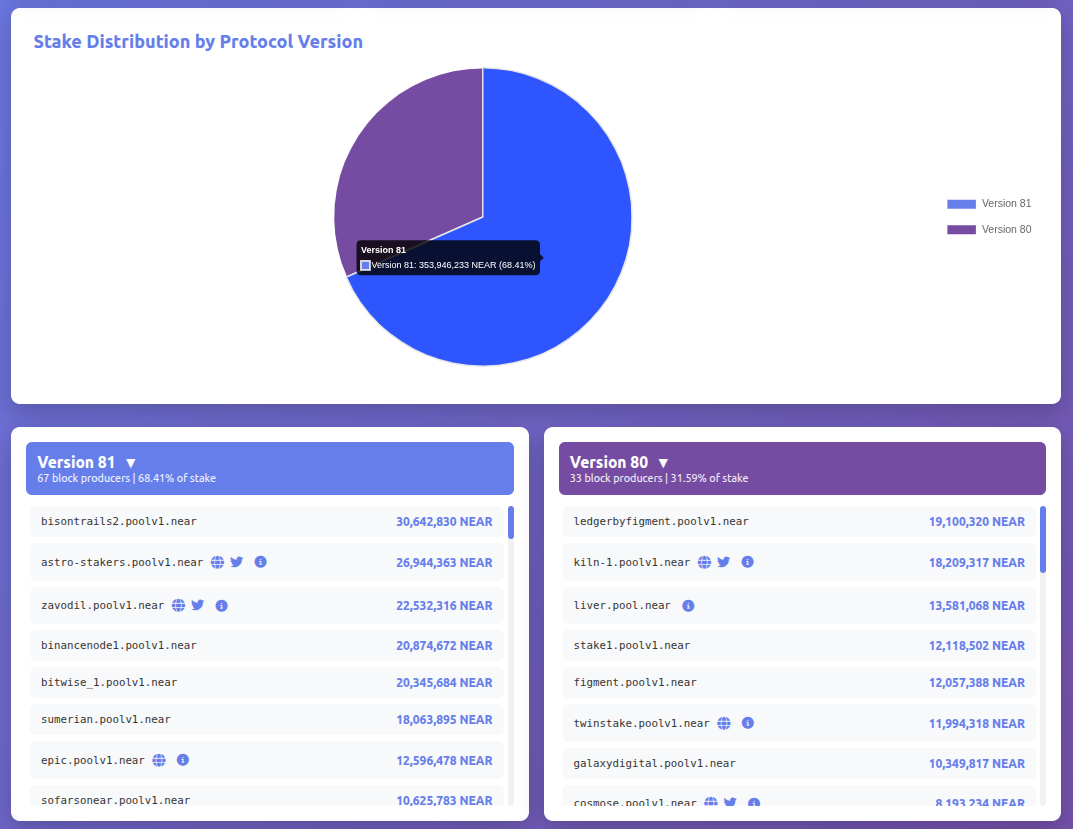

Data Coinspeaker gathered from NearSpace at the time of this writing shows 67 block producers already upgraded to Protocol Version 81, temporarily signaling a “YES” to NEAR’s inflation halving. Together, they sum up to 68.41% of the needed 80% staking to approve the proposal.

Meanwhile, 33 validators still did not upgrade, remaining in Protocol Version 80, temporarily signaling a “NO.” This scenario could change in the following 23 days as validators can upgrade or downgrade their nodes and NEAR investors can redelegate to new validators according to their choices.

NEAR: Stake distribution by protocol version, as of October 28 | Source: NearSpace.info

Controversy Around NEAR Inflation Halving Governance Mechanism

Interestingly, validators are voting directly against their own short-term benefit, bringing controversy to the process. If the network approves this proposal, validators should expect to receive half of the yearly rewards they now receive at the same percentage of the total staked tokens.

This has sparked some public discussions from industry-level staking providers like ChorusOne, who manifested against the reduction and, especially, against the governance mechanism being used for this proposal. Yet, Illia Polosukhin, NEAR co-founder, explained this same mechanism has been used for Near Protocol governance since its mainnet launch five years ago, being a normal procedure.

On the other hand, institutional crypto investors like Andrei Gachev from DWF Labs promised on June 11 that he would “buy another 10 [million] NEAR on [the] secondary market” if NEAR reduced the inflation to 2.5%, as is being voted right now. This would add to DWF Labs’ disclosed position of 5 million NEAR held liquid and 6 million NEAR staked with validators.

With NEAR currently trading at $2.30 per token, the next few days will play a significant role in defining the future of the project from an economic perspective, initiating discussions around potential improvements in its tokenomics, which should be discussed, proposed, and voted on independently, per official communication on this ongoing proposal.

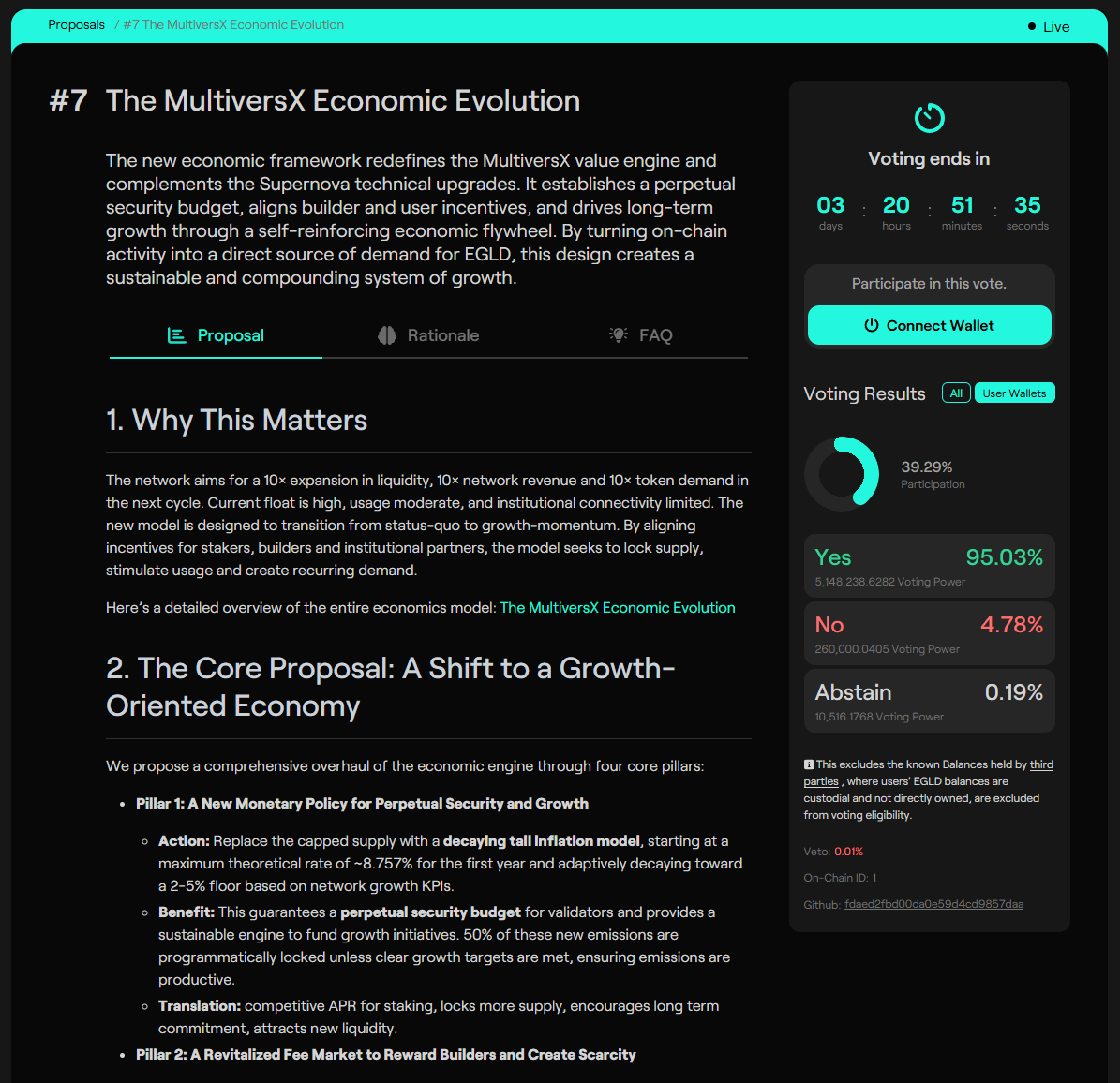

This all happens as MultiversX—another sharded blockchain similar to NEAR—has just voted favorably to remove the previously promised hard cap and add a theoretical maximum tail emission of 8.75% to EGLD EGLD $9.53 24h volatility: 2.4% Market cap: $272.56 M Vol. 24h: $19.90 M .

The MultiversX Economic Evolution | Source: Governance.multiversx.co

The post NEAR Inflation Halving Voting Starts, 12% Missing for Approval appeared first on Coinspeaker.

You May Also Like

Change “Waiting for Overnight Surges” to “Daily Deposits”—TALL MINER · 2025: Using Cloud Computing Power to Transform Volatility Into Your Second Cash Flow

BTC Leverage Builds Near $120K, Big Test Ahead