Ethereum treasury ETHZilla sells $40M in ETH to buy back 600k shares

Ethereum treasury company ETHZilla has sold roughly $40 million worth of ETH from its treasury to support a share buyback program as it looks to narrow the gap between its stock price and net asset value.

- ETHZilla sold $40 million in ETH to fund share buybacks.

- Around 600,000 shares were repurchased for $12 million.

- ETHZilla shares rallied over 14% on Monday.

The Nasdaq-listed company acquired approximately 600,000 shares late last week for around $12 million after offloading a portion of its ETH holdings, an Oct. 27 press release outlined.

Net Asset Value, or NAV, is a financial metric that represents the per-share value of a company’s assets after subtracting liabilities. It’s commonly used by crypto treasury firms, especially those holding large crypto reserves like ETHZilla, to determine whether a stock is overvalued or undervalued relative to its underlying holdings.

ETHZilla hopes to narrow the gap between its share price and the net asset value per share, which reflects the market value of its Ethereum reserves, by trimming the number of shares in circulation and increasing each remaining share’s proportional claim on its assets.

“By opportunistically repurchasing shares while our stock is trading below NAV, we plan to reduce the number of shares that are available for stock loan/borrow activity, while increasing the NAV per share of the Company,” ETHZilla Chairman and CEO McAndrew Rudisill said in an accompanying statement.

The remaining funds procured in the sale have also been earmarked for share repurchases, the firm added, noting that it would continue to “repurchase its shares until the discount to NAV is normalized.”

Following this sale, ETHZilla continues to hold roughly $400 million worth of ETH in its treasury.

ETHZilla shareholders push for share buybacks

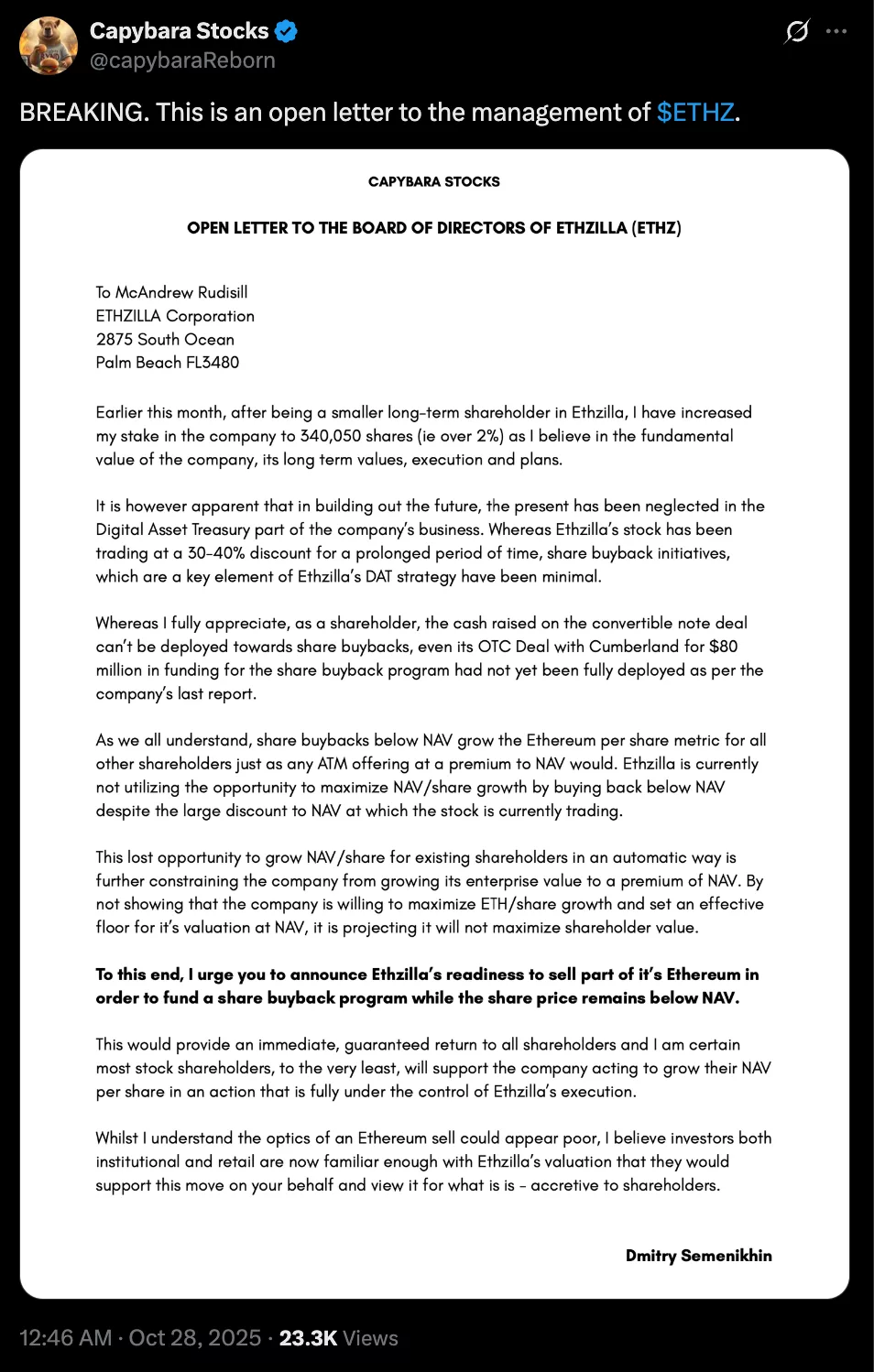

Major ETHZilla shareholders like activist investor Dimitri Semenikhin have been calling for more aggressive buybacks as the stock continued to trade at a steep discount to its net asset value.

ETHZilla’s announcement followed closely on the heels of an open letter published by Semenikhin, who recently disclosed a 2.2% stake in the company, urging management to deploy its Ethereum holdings to buy back shares and unlock immediate value for investors. See below.

ETHZilla shares, which have been struggling over the past month, have rebounded sharply since Oct. 23, climbing 14.5% on Monday to close at $20.65 and rising another 14% after hours to $23.55 according to Google Finance data.

Some of the market enthusiasm was fuelled by the company’s $15 million investment for a 15% stake in Satschel, Inc., the parent company of Liquidity.io, a regulated broker-dealer and digital alternative trading system.

ETHZilla announces $250m share buyback program

Back in August, ETHZilla’s board of directors approved a $250 million share repurchase plan, and the latest purchase follows over 6 million shares purchased in September.

At the time the repurchase program was approved, the company said it expects the program to run through June 30, 2026, with repurchases expected to be carried out either on the open market or through privately negotiated transactions at prevailing market prices.

You May Also Like

Change “Waiting for Overnight Surges” to “Daily Deposits”—TALL MINER · 2025: Using Cloud Computing Power to Transform Volatility Into Your Second Cash Flow

BTC Leverage Builds Near $120K, Big Test Ahead