Chinese Central Bank Warns Of Crypto Loopholes In Global Regulation

China’s central bank escalated its warning on stablecoins and reiterated a hard line against domestic crypto activity on Monday, with Governor Pan Gongsheng arguing that the rise of privately issued “virtual currencies”—particularly stablecoins—exposes gaps in global financial oversight and increases systemic fragility. Speaking at the opening of the 2025 Financial Street Forum in Beijing on October 27, Pan said stablecoins are still “at an early stage” but are already amplifying regulatory blind spots across borders and posing challenges to monetary sovereignty in weaker economies.

China Reaffirms Crypto Crackdown

Pan anchored his remarks in the policy debates that dominated the IMF/World Bank Annual Meetings held in Washington 10 days earlier, telling attendees that the prevailing view among finance ministers and central bank governors was that stablecoins, “as a financial activity, at this stage cannot effectively meet basic requirements in customer identification and anti-money-laundering,” thereby “magnifying loopholes in global financial regulation,” fueling “speculative hype,” increasing “the fragility of the global financial system,” and “impacting the monetary sovereignty of some underdeveloped economies.”

The governor coupled that assessment with a firm domestic enforcement posture: “Since 2017, the People’s Bank of China, together with relevant departments, has issued multiple policy documents to prevent and deal with risks from domestic crypto trading and speculation, and these documents remain effective. Next, the PBOC will work with law-enforcement authorities to continue cracking down on the operation and speculation of cryptocurrencies within China, maintain economic and financial order, and closely track and dynamically evaluate the development of offshore stablecoins.”

His statement effectively reaffirms the legal status quo—comprehensive restrictions on crypto trading and mining within China’s borders—while signaling ongoing surveillance of offshore instruments that touch Chinese users and firms.

Pan’s comments land at a moment when stablecoins have become embedded in cross-border commerce and crypto market plumbing, with dollar-pegged tokens dominating global volumes. They also intersect with a live policy debate inside China about whether and how to tolerate offshore, yuan-linked instruments to complement the official e-CNY.

Over the summer, major Chinese tech groups lobbied the PBOC to authorize an offshore, yuan-based stablecoin in Hong Kong to counter US dollar stablecoin dominance—an initiative that, if ever approved, would likely be ring-fenced from the mainland’s prohibitions.

For market participants, the signal is twofold. First, there is no domestic policy thaw for crypto trading or mining: the 2017–2021 crackdown architecture remains intact, and enforcement will be coordinated with police and other agencies.

Second, Chinese authorities are sharpening their scrutiny of offshore stablecoins used by exporters, importers, and savers, a vector that has grown as stablecoins have become de facto settlement media in parts of Asia and emerging markets. The central bank’s language—“continue cracking down” at home while “dynamically evaluating” offshore developments—suggests that any future experimentation will occur through official government channels rather than market-driven stablecoin adoption.

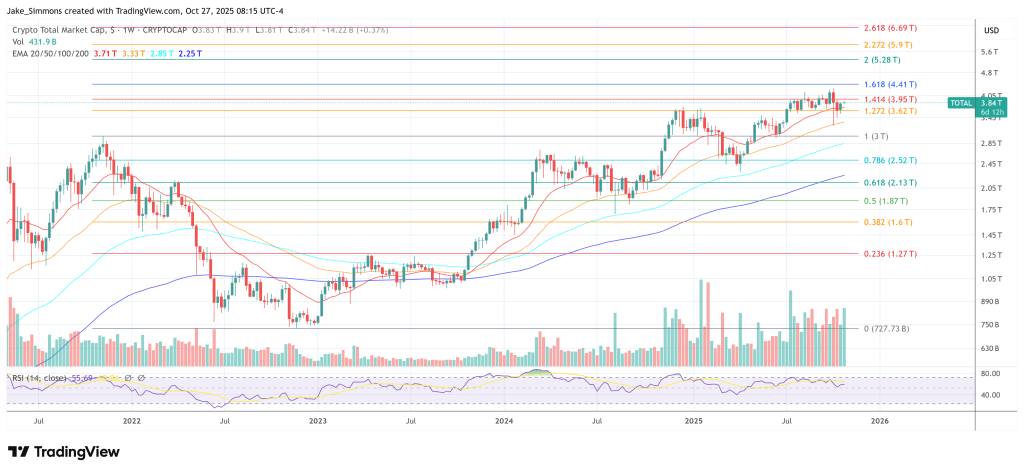

At press time, the total crypto market cap stood at $3.84 trillion.

You May Also Like

Zero-Trust Databases: Redefining the Future of Data Security

Unlimit revolutionizes payments: now Apple Pay available for crypto-fiat disbursements