Burdened by power glut and debt, Laos turns to Bitcoin mining?

Author: SCMP

Compiled by Ivan Wu on Blockchain

Riding on debt and facing a power glut, the “battery of Southeast Asia” is turning to energy-intensive cryptocurrency mining for profits.

Laos aspires to become the "battery of Southeast Asia." Years of massive hydropower dam construction have created a surplus of electricity but also a rapidly rising debt burden.

Now, to monetize its excess electricity, the government is introducing energy-intensive cryptocurrency mining — a move that has drawn both international attention and domestic controversy.

The multi-billion dollar digital asset mining industry, in which participants earn rewards such as Bitcoin by solving complex blockchain algorithm puzzles, is known for its high energy consumption.

However, Laos has built dozens of hydropower projects on the Mekong River and its tributaries, and now has more electricity than the market can absorb.

Electricity accounted for 26% of Laos' exports last year, government trade data show. The landlocked country, long among Southeast Asia's poorest, is selling cheap hydropower to its energy-hungry Asian neighbors seeking to meet climate goals.

But this hydropower construction boom has come at a high cost. Environmentalists warn that dams are undermining the ecological health of rivers, harming downstream agriculture and fisheries that rely on highly silt-laden waters, and forcing the relocation of thousands, possibly tens of thousands, of people.

Critics say the policy sacrifices local livelihoods and ecosystems at a time of questionable economic returns.

Meanwhile, Laos is accumulating debt. The International Monetary Fund says the dams, largely financed by Chinese loans and overseas companies, are seeing slow returns on investment because Laos lacks the transmission infrastructure to export excess electricity.

Laotian officials are currently looking for new ways to monetize their idle electricity. The state-run Vientiane Times reported after a high-level meeting that policymakers are studying "long-term economic opportunities," including "digital asset mining... allowing the state to convert excess electricity into economic value."

Laos has begun issuing licenses for local cryptocurrency trading platforms and mining operations as regulators remain cautious about the risks of volatile digital assets.

The move comes as ordinary people face stubbornly high inflation, with the Lao kip, the local currency, losing about half its value against the dollar over the past five years.

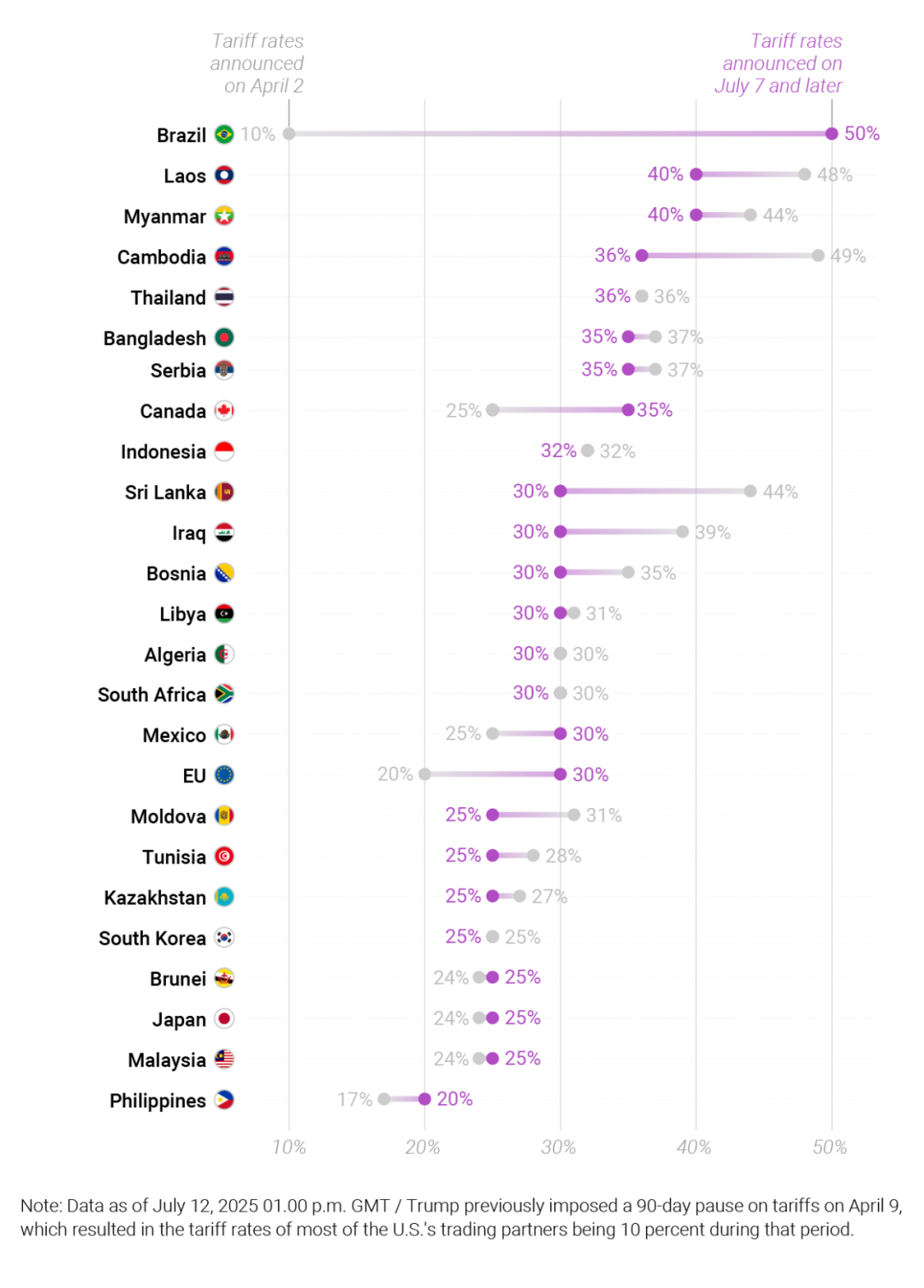

To make matters worse, the United States recently imposed a 40% tariff on exports from Laos, the second-highest level among Washington's trading partners.

As of July 12, US President Donald Trump announced new tariff rates on dozens of economies and extended the tariff deadline to August 1, 2025.

Many environmental advocates see the shift to cryptocurrency mining as a symptom of flawed energy policies that have saddled Laos with debt and left it unable to absorb its excess electricity.

“Allowing electricity to be used for cryptocurrency mining is clearly not driven by domestic conditions,” said Witoon Permpongsacharoen, director of the Mekong Energy and Ecology Network. “It stems from the fact that Laos is heavily indebted and unable to repay.”

Paradoxically, Laos generates excess electricity during the rainy season, but is forced to purchase electricity from neighboring countries when hydropower output drops during the dry season.

"Most of Laos' hydropower supply is seasonal; during the dry season, Laos buys back electricity from Thailand," said Pianporn Deetes of International Rivers.

Diters said that for the communities relocated to build the reservoir and dam, the promised improvements in life have largely not been fulfilled; instead of prosperity, many people face greater difficulties.

She said Laos risks "taking its rich natural resources away from its people and making their situation worse rather than better."

Still, the government’s foray into cryptocurrency mining has drawn widespread attention in the region as it seeks new sources of growth at a time of shifting global trade winds.

Laos aims to become a mature digital economy by 2030 and is expected to be removed from the United Nations' list of "least developed countries" next year.

Although China — Laos’ powerful northern neighbor — banned cryptocurrency mining and trading in 2021 due to concerns about financial stability, Laos has become a magnet for Chinese miners due to its low electricity prices, some of which are engaged in illegal activities.

The Lao government’s latest move aims to bring related activities under official supervision and collect industry taxes through the issuance of licenses.

The International Monetary Fund believes that there is economic logic in monetizing excess electricity, but challenges remain.

The IMF warned in November last year that Laos’ “significant public debt levels pose challenges to its medium-term economic outlook” and that under current policies, “inflation and debt revaluation are likely to intensify, meaning a significant drag on growth over the longer term.”

You May Also Like

Tether Gold Breaks $2 Billion, Fueling Tokenized Asset Momentum

MetaMask Launches $30M Rewards Program on Mobile