Behind the Failure of Solana SIMD-0228 Proposal: Governance Difficulties Under Node Interest Game

Author: Frank, PANews

The most controversial SIMD-0228 proposal in Solana’s governance history ultimately failed with less than 66.6% of votes in favor. This vote was not only a technical debate on inflation reform, but also evolved into a war of interests among the validator class.

The top players are trying to promote the upgrade of ecological efficiency, while small and medium-sized validators are fiercely resisting for their right to survive. When the "democratic cloak" of on-chain governance is torn apart by data, Solana exposes not only the inflation problem, but also the real rift in the interests between large and small validators. How will this storm reshape the future of the ecosystem? The answer may be hidden in the game between code and the ballot box.

The interest game between large and small validators caused the proposal to fail

The main content of the SIMD-0228 proposal is to increase the network pledge rate by dynamically adjusting the inflation rate. Previously, PANew has made a detailed interpretation of the content of the proposal (Related reading: Solana Inflation Revolution: SIMD-0228 Proposal Triggers Community Controversy, 80% Reduction in Issuance Hides the Risk of a "Death Spiral" )

In general, when the proposal is passed, Solana block rewards will be reduced with high probability. When the proposer proposed this idea, he believed that it would not have much impact on the income of validators. The basis for this is that the MEV income of validators will increase significantly in the fourth quarter of 2024. Even if inflation is reduced, reducing block rewards will not affect the overall income level of validators.

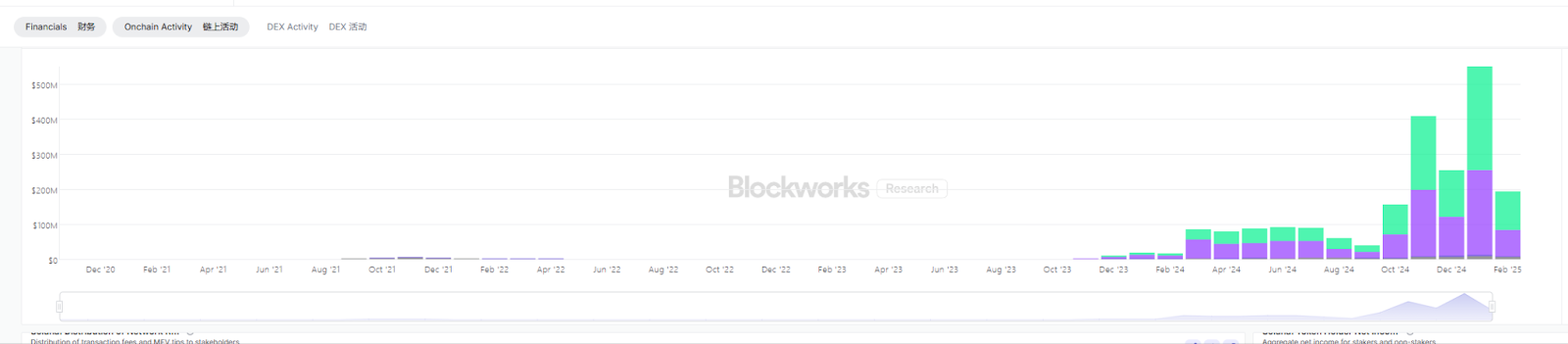

But in fact, data from February 2025 shows that the MEV revenue on the Solana chain has shrunk significantly. Compared with the overall revenue of US$550 million in January, it fell to US$195 million in February, a monthly drop of 64%. The revenue in March is expected to be lower than that in February.

That is, the prerequisites proposed by Proposal 0228 no longer exist, and the ones most affected are small and medium-sized nodes.

Therefore, in this vote, this polarized attitude can be clearly seen. The voting results show that the proportion of small nodes with a stake of less than 100,000 SOLs who voted against was 67.5%, and more than 60% of small and medium-sized nodes with a stake of less than 500,000 SOLs voted against it, while 51.6% of validators with a stake of 500,000 to 1 million SOLs voted in favor, and the proportion of nodes with a stake of more than 1 million SOLs who voted in favor was 65.8%.

It can be said that the failure of the SIMD-0228 proposal is actually a game of interests between large and small validators on the Solana network.

The survival dilemma of small and medium-sized validators, the sharp decline in MEV income, and 90% of validators are affected

The core reason for this is that large validators and small validators have different business models.

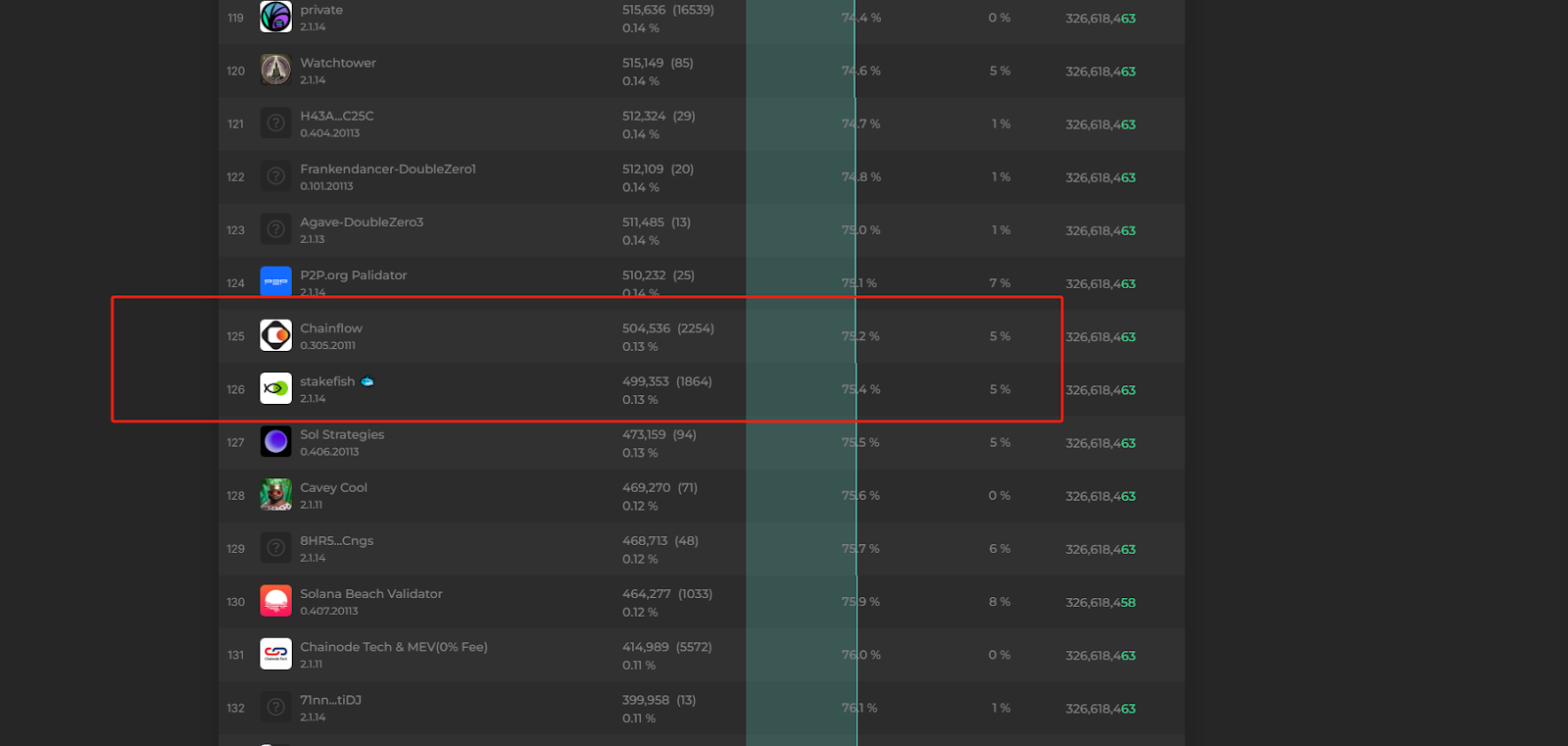

The business logic of large validators is to provide customers with better on-chain services by increasing the share of leading blocks. Therefore, it can be clearly seen in the list of validators that the top few large validators extract less MEV commissions, many of which are 0. These validator operators are either centralized exchanges or providers of RPC services such as Helius.

Small and medium-sized validators are more dependent on block rewards and MEV income. The reasonable source of income for most small and medium-sized validators is mainly based on block rewards and MEV income. Once this income drops sharply, they can only choose to withdraw from the ranks of validators or increase gray income by running sandwich attack robots and other methods.

Before analyzing the specific impact of the proposal on small and medium-sized validators, it is necessary to first clarify their operating cost structure.

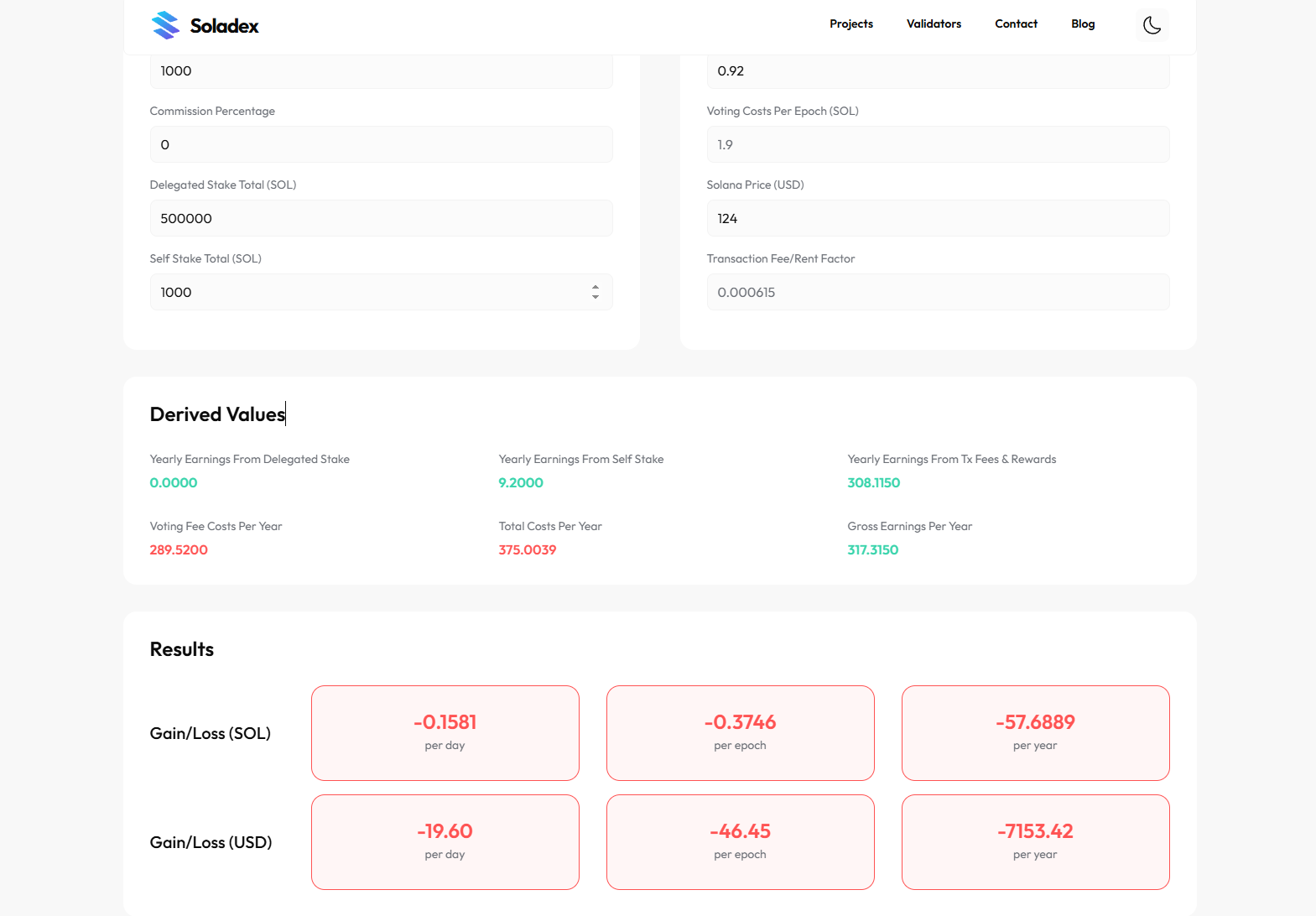

For the smallest validator, the current recommended equipment for running validators requires several important configurations, 512GB memory, 10GB bandwidth. These two items are the most expensive parts. A server with this configuration requires a minimum monthly expenditure of about $800. Add at least 1,000 SOL staked. The total investment is about $134,000. If the block reward drops to 0.92% (the expected inflation rate of the proposal), the daily net loss will reach $19.6, and there is also the risk of value loss of SOL tokens falling.

According to the current distribution of validator nodes, more than 90% of the validator nodes have less than 500,000 SOL. In order to obtain more stakes, these validators usually adopt a low commission level of 0-5%, that is, they charge very little stake commission from the client who supports the validation, and their main income basically comes from the stake of their own funds.

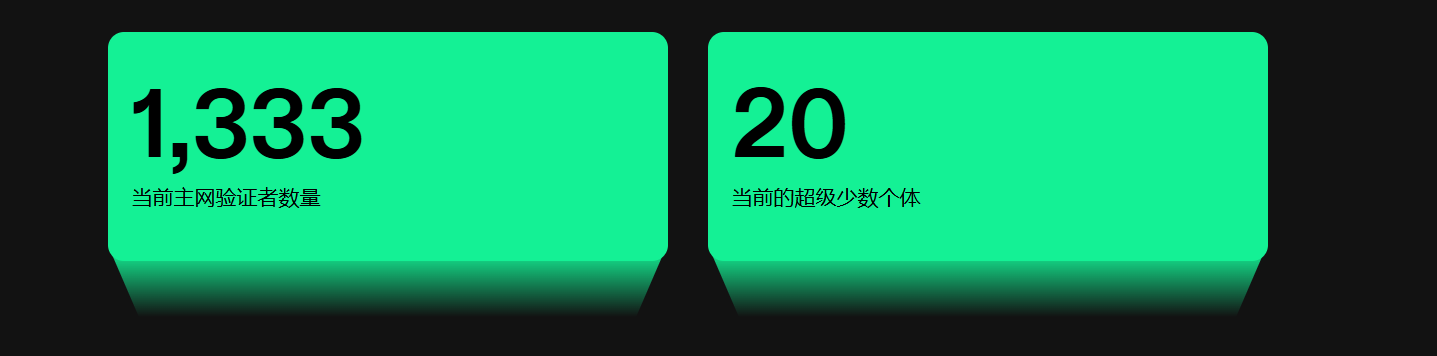

Looking at the distribution of priority fees, there are currently 1,333 validators, of which the top 125 large validators account for 75% of the market share. The remaining 1,208 small validators share about 25% of the market share. Based on the total on-chain fees of 195 million in February, these 1,208 validators can share a total of 48.75 million US dollars, and each small validator can share an average of about 40,000 US dollars in income.

Taking the median node (No. 729) as an example, based on the amount of self-staking of this node, it can get $3.67 per day, but if the inflation rate is reduced to 0.92%, this node may lose $17 per day.

Solana Co-founders Propose New Solution to Reduce Inflation

In fact, there is another SIMD-0123 proposal in progress at the same time as 0228. Similar to 0228, this proposal is also designed to limit the income of validators. It aims to automatically distribute the rewards promised by validators to delegators after each cycle through protocol upgrades. Under the current mechanism, validators issue NFTs or LSTs (liquidity pledge tokens) as settlement vouchers, but this settlement method is not public and accurate. Previously, some validators have privately adjusted the commission rate to reduce the income of delegators.

However, this proposal failed to spark as much discussion as 0228, and was eventually passed with 74.91% support. Solana co-founder Toly commented on this on X: "Simd 228 did not pass, but 123 passed. Although both proposals are aimed at reducing the income of validators. Opposing 228 is not just for their own interests."

However, the failure of Proposal 0228 does not mean the stagnation of Solana’s inflation reform plan. After the vote, Toly proposed another more moderate plan on X to increase the block CU (computing unit), double the network’s throughput, and increase the annual deflation rate to 30%.

In general, Toly advocates reducing the cost of a single transaction through engineering optimization and expansion, while improving network efficiency and reducing reliance on inflation, and gradually achieving a sustainable model of "high throughput and low inflation". This solution avoids complex governance games such as SIMD-0228 and relies more on the natural evolution of technology upgrades.

However, this proposal has not yet been formally proposed in the developer forum and is only a proposition. In any case, the inflation problem of SOL seems to be one of the key issues that the Solana ecosystem must solve next.

The failure of the SIMD-0228 proposal reflects the complex interest structure within the Solana ecosystem and the current situation where the governance model needs to be optimized. Although the proposal ultimately failed, it may be a collective participation success in Solana's governance history. Next, how to balance the interests of all parties while optimizing the token inflation model so that the ecosystem has a consistent goal and can continue to move forward may be the most difficult problem in Solana's governance.

You May Also Like

Fed Governor Lisa Cook Under Fire: DOJ Official Urges Powell to Act

Market Shifts: Altcoins Surge as Bitcoin Slows