Interpreting the current status of Solana’s liquidity pledge development: The top three LST protocols hold 72% of the market, and Jito’s offensive is rapid and the data is impressive

Author: Nancy, PANews

Liquidity staking is a popular topic on Ethereum, and it once presented a monopoly pattern. However, Solana's liquidity staking track has been gaining momentum recently, especially Jito's overtaking. In this article, PANews analyzes Solana's development status in the liquidity staking track from a data perspective (the data in this article are all taken as of July 30).

Liquidity staking has become the main force of TVL growth, and the market value of the top three LST tokens accounts for more than 72%

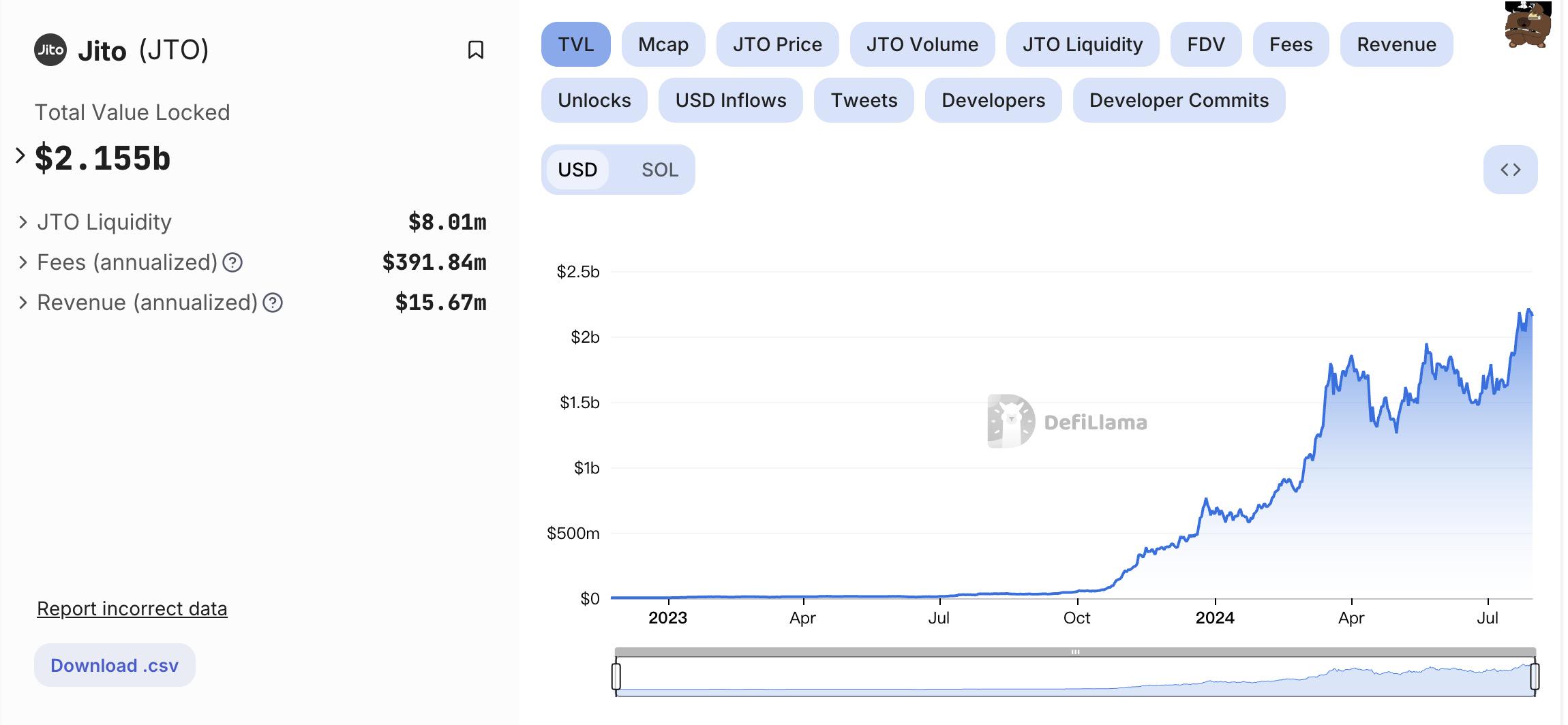

Solana has recently attracted much attention due to a number of new data records. In addition to the MEME craze, liquidity staking is also becoming a powerful narrative. DeFiLlama data shows that in the past month, Solana's TVL has jumped from US$4.84 billion to US$5.45 billion, an increase of more than 12.6%. Among them, the top three are Jito, Marinade and Kamino as the main contributors, and these protocols are all from the liquidity staking track.

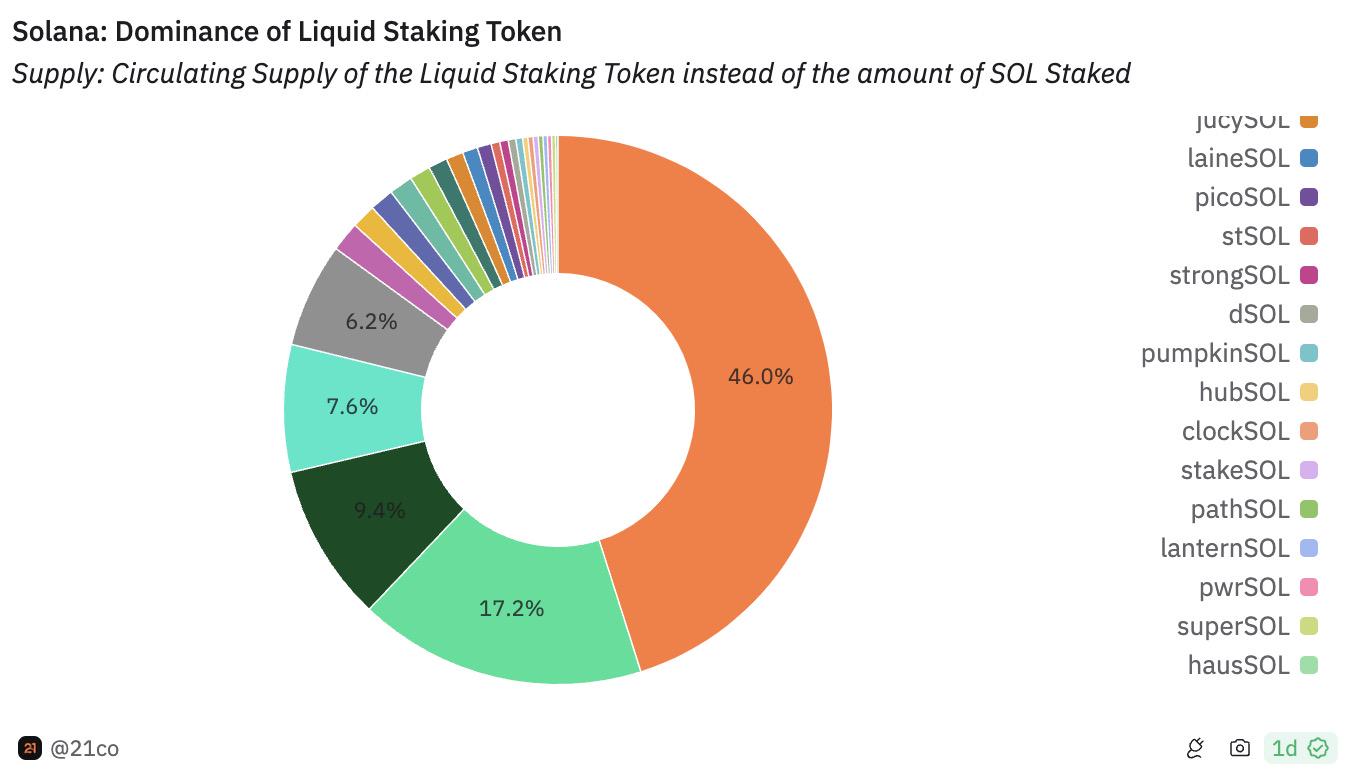

Currently, the market structure of Solana's liquidity staking tokens has changed. Dune data shows that in the early stages of development, the market was mainly dominated by Marinade's mSOL, Lido's stSOL, and Sanctum's scnSOL (now renamed infSOL). Today, Solana's liquidity staking track has 27 related agreements, and the top three Jito, Marinade, and Jupiter are the "traffic leaders", with a total market share of nearly 72.1%.

Among them, Jito's LST token jitoSOL has a market value of up to 2.2 billion US dollars, accounting for 46% of the total, ranking first. The official website shows that jitoSOL's APR is 7.68%, the number of pledgers exceeds 105,000, and the number of validators is 218.

Jito's other data performances are also quite impressive. According to DeFiLlama data, Jito's TVL exceeds US$2.17 billion, with an increase of more than 36.6% in the past 30 days. It is the only protocol on Solana with a total locked volume exceeding US$2 billion. In terms of fee income performance, Jito's transaction fees reached US$32.12 million and its revenue reached US$12.8 million, both ranking second only to Raydium; and Jito's daily fee income once surpassed Lido to rank first, ranking third among all protocols, surpassing Uniswap, Ethereum, etc. Artemis data shows that in terms of transaction activity, Jito's total number of transactions exceeded 54.78 million, ranking fourth among all Solana DeFi protocols, but Jito's daily active addresses are only 1,347, which is far from Solana's overall 2.4 million daily active addresses.

In the past few months, Jito has also made frequent moves in the market, including the Jito Foundation announcing the launch of a new infrastructure platform, Jito Restaking, which supports hybrid staking, re-staking, LRT modules and active verification services (AVS); Jito DAO's new proposal plans to use 7.5 million JTO tokens for liquidity mining, which accounts for 3.1% of the 240 million JTOs held in the DAO JTO treasury and 0.75% of the total supply of JTO;

Following closely behind is Marinade's LST token mSOL, which has a market value of over $800 million and a market share of 17.2%. Official website data shows that mSOL's APR is 7.33%, and the number of pledgers exceeds 147,000. At the same time, DeFiLlama data shows that Marinade's TVL reached $1.45 billion, up about 26.2% in the past month. Artemis data shows that Marinade's total number of transactions exceeded 2.544 million, with a fee of $329,000 and 12,573 daily active addresses. In the past few months, Marinade has taken multiple initiatives to improve the liquidity of its tokens, including Marinade DAO's proposal to allocate 50 million MNDE to Marinade Earn Season 3 to make the mSOL pool and other SOL LST more profitable, thereby deepening the liquidity of mSOL in DeFi, Marinade's launch of the equity auction market to increase yields and promote Solana's decentralization, and Marinade's proposal to "provide a budget of 26 million MNDE tokens to three market makers" to increase the liquidity of MNDE on CEX.

Jupiter's jupSOL was launched in April this year, with a market value of nearly $450 million and a market share of 9.39%. The LST token allows staking income and 100% MEV rebates to be earned from Jupiter validators, and the Jupiter team also entrusted 100,000 SOL to provide high returns. DeFiLlama data shows that Jupiter's TVL is $500 million, up 40.4% in the past month. Artemis data shows that Jupiter has 195,000 daily active users and more than 110 million transactions, both ranking first in DeFi protocols, and gas income is $7.38 million.

Ethereum accounts for more than 80% of the staking market share, and Solana's market structure becomes more diversified

From the development history of Ethereum, staking is one of the important driving forces for opening up the on-chain economy. According to multiple data, Ethereum currently has a stronger leading advantage than Solana in terms of liquidity staking scale and ecological richness, but Solana is showing great growth potential due to the gradual improvement of related infrastructure and more flexible and lower participation threshold. Both of them show a significant head effect.

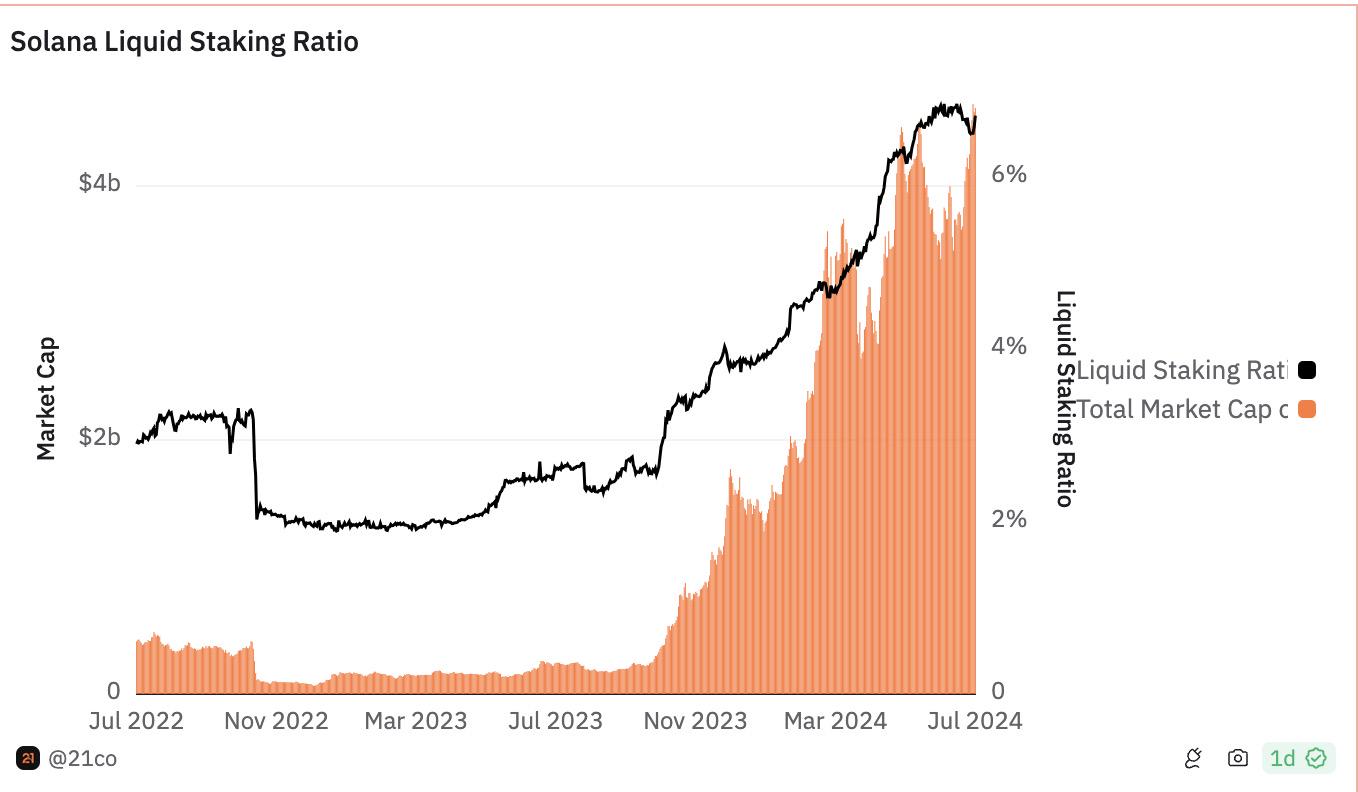

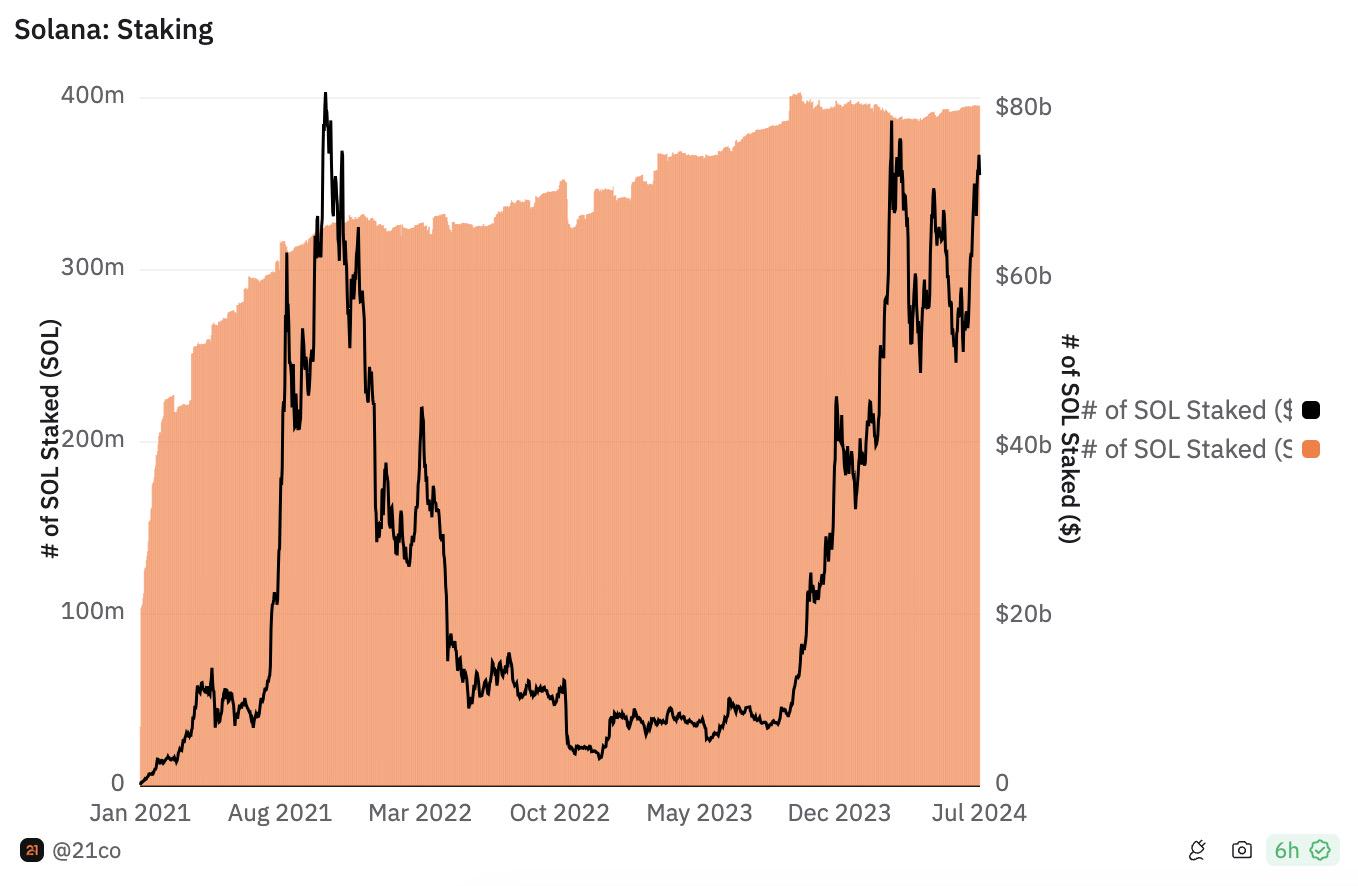

As the foundation of the liquidity pledge track, first of all, from the perspective of liquidity pledge TVL, DeFiLlama data shows that the current network liquidity pledge TVL exceeds 52.81 billion US dollars, of which Ethereum accounts for nearly 84.8% of the market share with 44.78 billion US dollars, and Solana follows closely with 4.51 billion US dollars, accounting for only 8.5%. In terms of growth rate, from the beginning of this year to date, Ethereum's growth rate is 55.1%, while Solana has increased significantly by nearly 159.2%.

At the same time, from the perspective of the number of liquidity pledge tokens, Solana has about 27 LST tokens, while Ethereum has more than 80. Among them, Dune data shows that the market share of the top three LST tokens on Solana is 72.6%, and the top five is 86.4%; while the top 3 LST tokens on Ethereum account for 80.9%, of which STETH alone accounts for 73% of the overall market. From this point of view, although both Ethereum and Solana show a relatively obvious head effect, the latter is relatively more diversified.

The number of LST pledged and the pledge rate are also important indicators that reflect market growth. Among them, Solana's LST pledged this year has increased from the initial 126,000 to the current 807,000, which means that the total amount has increased by more than 6.4 times; and according to Dune data, the current number of tokens SOL pledged exceeds 390 million, the current value exceeds US$72.85 billion, and the pledge rate exceeds 68.1%. The number of ETH pledged exceeds 33.881 million, the current value exceeds US$112.89 billion, and the pledge rate is nearly 28.3%. This may be related to the lower pledge threshold compared to Solana; although Solana has a higher pledge rate, from the perspective of liquidity pledge rate performance, Solana is only 6.7%, while Ethereum is as high as 32.7%.

In general, Solana's liquidity staking ecosystem has ushered in good development, but it mainly relies on leading projects and there is still a clear gap with Ethereum. In the future, only more innovative products and more competitive returns can attract more users to participate.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates