Is the NFT Market Making a Comeback? Here’s What Data Shows

The NFT movement appears to be gaining momentum once again, projected to grow substantially over the coming years, driven by increasing adoption levels.

Certain metrics indicate a steady rejuvenation, but we remain far from the glory years experienced not long ago.

Forecasted for Growth

According to a report from analysis platform Coinlaw.io, the non-fungible token (NFT) market is showing signs of a revival. It is projected to grow by hundreds of billions by the end of the decade, by moving away from speculative art to an interconnected ecosystem spanning fashion, gaming, and even legal matters.

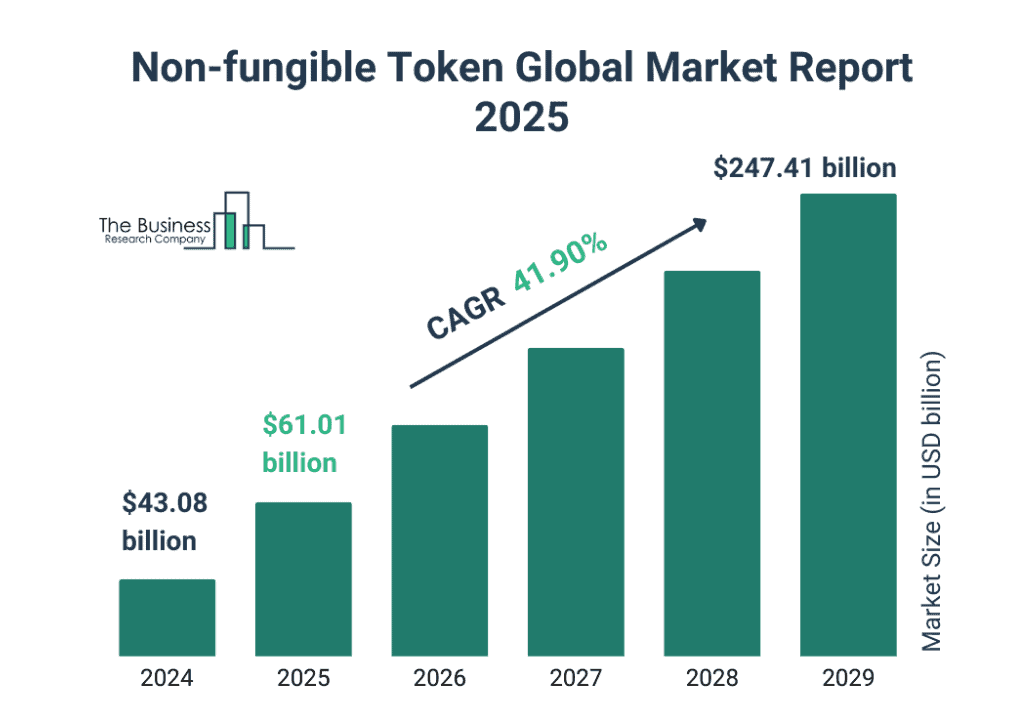

Current projections see the 2025 global NFT market to reach over $60 billion, and with a compound annual growth rate (CAGR) of almost 42%, to exceed $247 billion by 2029, of course, depending on adoption trends and market conditions.

Source: Coinlaw.io

Source: Coinlaw.io

Leading trends remain gaming and digital art, representing 38% of global NFT transactions and 21% market size, respectively. Some upcoming movements, such as real estate, surpassed $1.4 billion in volume, and phygital tokens, linked to physical goods, saw a 60% rise in transaction volume, led by luxury brands.

Institutions and venture capital (VC) firms also seem to be drawn to this market, with the latter investing $4.2 billion in NFT projects for this year alone. Financial giants like Goldman Sachs and JPMorgan have explored tokenization for digital asset collateralization, while firms like SoftBank and Sequoia Capital are expanding into tokenized digital assets.

Moreover, there has already been an application by the asset manager Canary Capital for a Pudgy Penguins ETF, which would potentially hold a mix of the PENGU meme coin and Pudgy Penguins NFT collection.

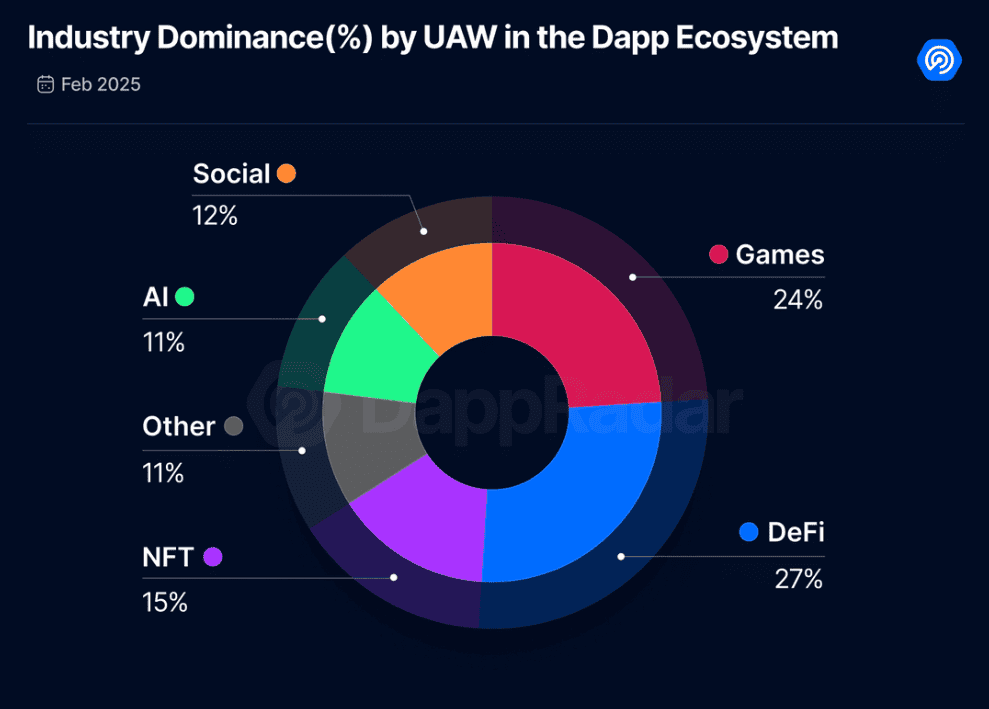

Non-fungible tokens also have a firm grasp over industry dominance, specifically concerning unique active wallets (UAW) by having a bigger share than AI and social decentralized applications (dApps).

Source: DappRadar

Source: DappRadar

Trading Volume And Sales

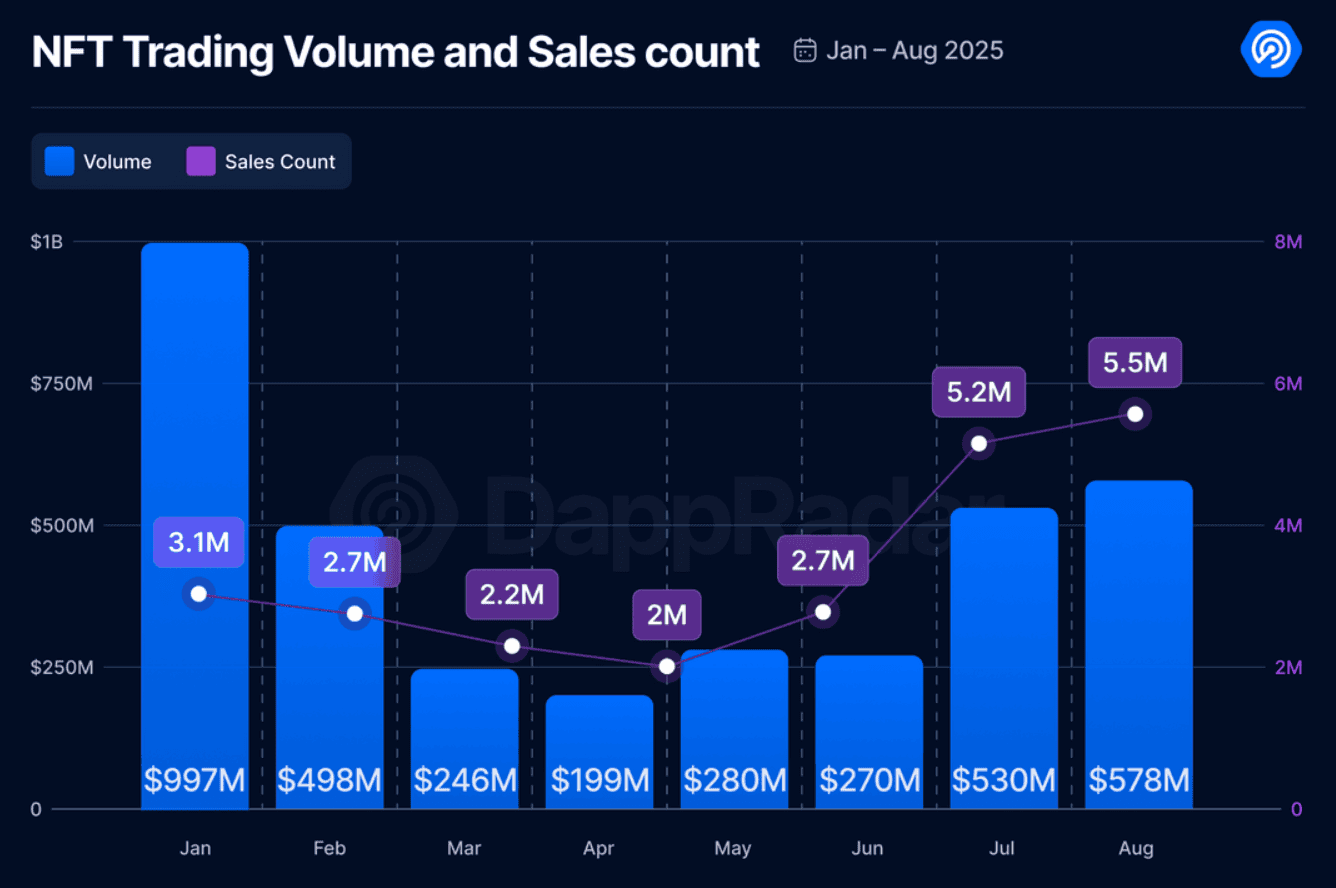

NFT sales have been gradually increasing since the start of the year, while trading volume experienced a dip, with roughly a 2M jump and $419 million drop, respectively.

Source: DappRadar

Source: DappRadar

As per the chart, July and August saw the strongest rebounds since the mid-year slump, adding roughly a billion to the NFT market cap and increasing wallet count by 90,000.

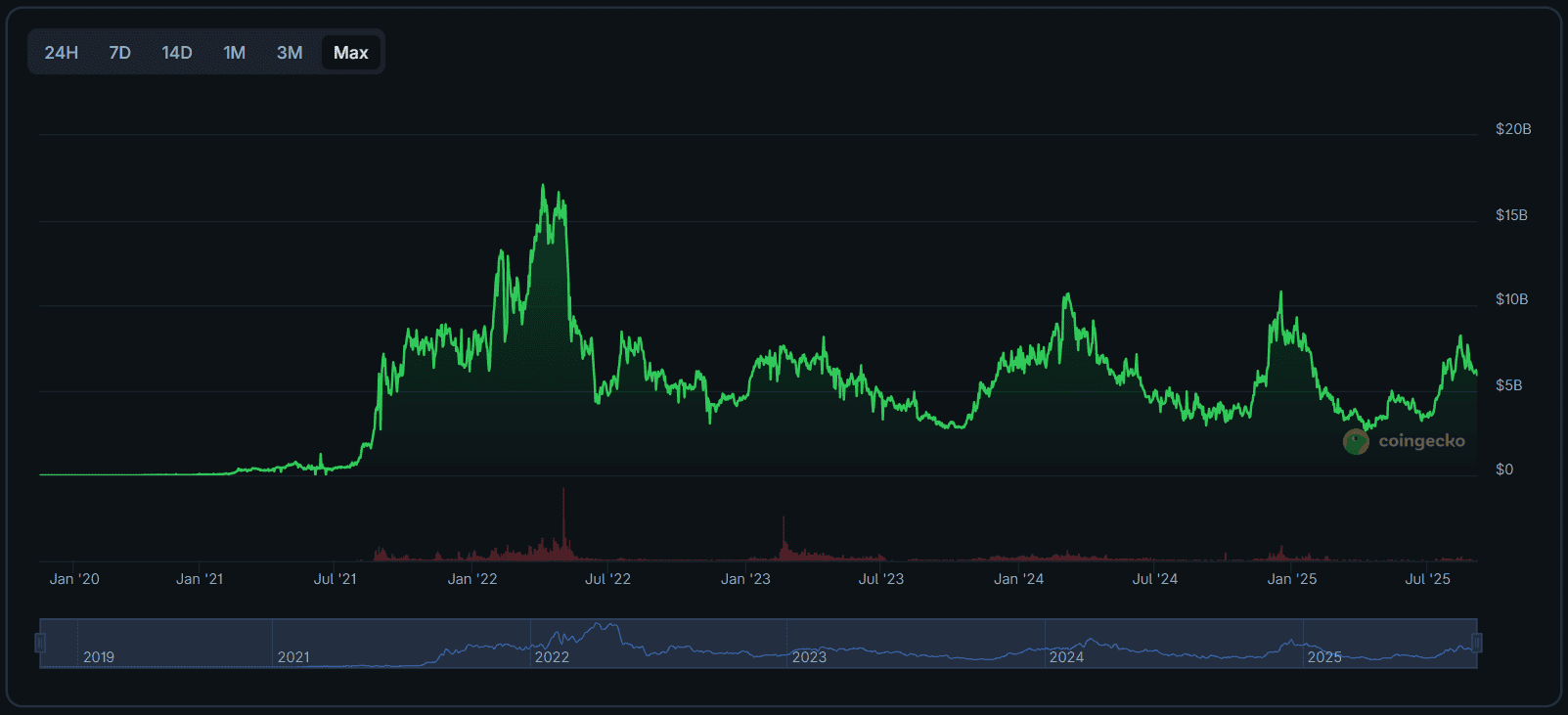

While there are signs of a recovery, this market niche is still far from the 2022 peaks it saw of roughly $24.7 billion market cap, with current levels being just shy of $6B, a substantial drop of 76%, as per data at print time from CoinGecko.

Source: CoinGecko

Source: CoinGecko

The post Is the NFT Market Making a Comeback? Here’s What Data Shows appeared first on CryptoPotato.

You May Also Like

Jump’s Firedancer Team Proposes Removing Solana Block Limit After Alpenglow Upgrade

Sushi Solana integration expands multichain DeFi reach