Pump.fun flips Hyperliquid in 24-hour revenue

Pump.fun is building serious momentum. The Solana-based launchpad has now outpaced Hyperliquid in daily revenue, another milestone in its latest comeback.

- Pump.fun generated $2.55 million in 24-hour revenue, surpassing Hyperliquid’s $2.21milion.

- The growth comes after the protocol launched Project Ascend, which introduces dynamic, market cap-based fees to reward long-term token growth.

- The PUMP token has risen 10.39% on the day, outperforming Hyperliquid’s HYPE token.

Solana memecoin creation tool Pump.fun surpassed Hyperliquid, a decentralized exchange and Layer 1 blockchain, in 24-hour revenue on Sept 4, according to data from DefiLlama.

Pump.fun has generated approximately $2.55 million in the past 24 hours, outpacing Hyperliquid, which recorded $2.21 million over the same period. In addition, the memecoin launchpad’s cumulative revenue has hit $784.56 million, outpacing Hyperliquid’s $650.85 million.

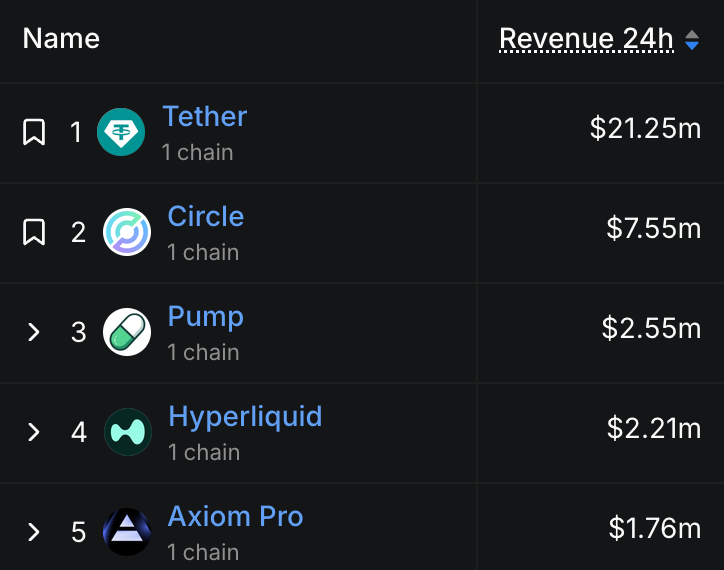

The achievement makes the launchpad the highest-earning dApp in crypto, trailing only behind stablecoin issuers, Tether and Circle. Earlier in February, Hyperliquid had overtaken Pump.fun as the third-highest revenue generator. Now, the platform is again climbing the leaderboard, fueled by aggressive buyback and a new project which could attract more creators.

Project Ascend targets Pump.fun long-term growth

Much of the platform’s recent resurgence can be tied to its strategic update known as Project Ascend, which was unveiled on Sept 2. This creator-centric overhaul is designed to 100x the pump fun ecosystem and boost long-term sustainability for memecoins launched on the platform.

At the center of this initiative is Dynamic Fees V1, a tiered model that links creator fees to a token’s market capitalization. As a token’s market cap grows, the associated fees decrease. This design discourages the pump-and-dump behavior the platform has been criticised for, and rewards developers who build community-backed, sustainable tokens.

The protocol describes the system as a way to make launching a token 10x more rewarding, while still reducing excessive costs for projects that achieve scale.

In addition to structural changes, buybacks and user activity are reinforcing positive momentum. Total buybacks have now reached $69.5 million, demonstrating the platform’s ongoing effort to reduce token supply and stabilize price action.

These buybacks are funded by revenue generated from token launches and platform fees, a feedback loop that supports value appreciation for PUMP (PUMP) holders. Also, retail participation is rising. According to on-chain data, the number of the token’s unique holders has grown to 72,082, a sign of increased adoption.

Meanwhile, the platform also recently reclaimed its spot as the top memecoin launchpad on Solana. Nearly 28,000 tokens have been deployed on Pump.fun in the past 24 hours, according to Dune Analytics, a notable jump from the 18,446 reported just days ago.

PUMP outperforms HYPE on the charts

Alongside revenue dominance and ecosystem growth, Pump.fun’s native token is also outperforming Hyperliquid’s HYPE. At the time of writing, PUMP is up 12% in 24 hours and roughly 32% over the past 7 days, per market data from crypto.news.

In contrast, HYPE (HYPE) is up 2.48% on the daily chart but down 6.40% over the same 7-day period. Pump.fun’s revenue milestone highlights its growing influence in the crypto ecosystem. With strategic upgrades like Project Ascend, rising user adoption, and strong token performance, the platform is positioning itself for more growth.

You May Also Like

Marathon Digital BTC Transfers Highlight Miner Stress

This U.S. politician’s suspicious stock trade just returned over 200% in weeks