6 Steps to Experience RWAs Onchain with Trust Wallet

The idea of bringing real-world assets (RWAs) onchain has been around for years. Stocks, bonds, real estate, and commodities make up most of global wealth, but access has long been locked behind brokers, paperwork, and geography. Buying shares in Apple or Tesla, for example, usually meant having a local brokerage account, linking a bank, and proving residency. Even then, fees and middlemen added friction.

Meanwhile, tokenization has been gaining momentum. Analysts estimate the market for tokenized assets could climb to $16 trillion by 2030. The pitch is simple: take assets people already trust, anchor them on blockchain, and suddenly they can move more freely — across borders, around the clock, and without as many gatekeepers.

From Bitcoin to stablecoins, Trust Wallet provides crypto access to over 200 million users. Source: Trust Wallet

The snag? Until recently, the tools for tapping into tokenized RWAs were scattered across specialist decentralized finance (DeFi) platforms with interfaces that scared off newcomers. Trust Wallet (with over 200 million downloads) is betting it can lower that barrier by weaving RWAs into the app millions already use for crypto, non-fungible tokens (NFTs) and stablecoins.

Here’s how the new feature works, step by step.

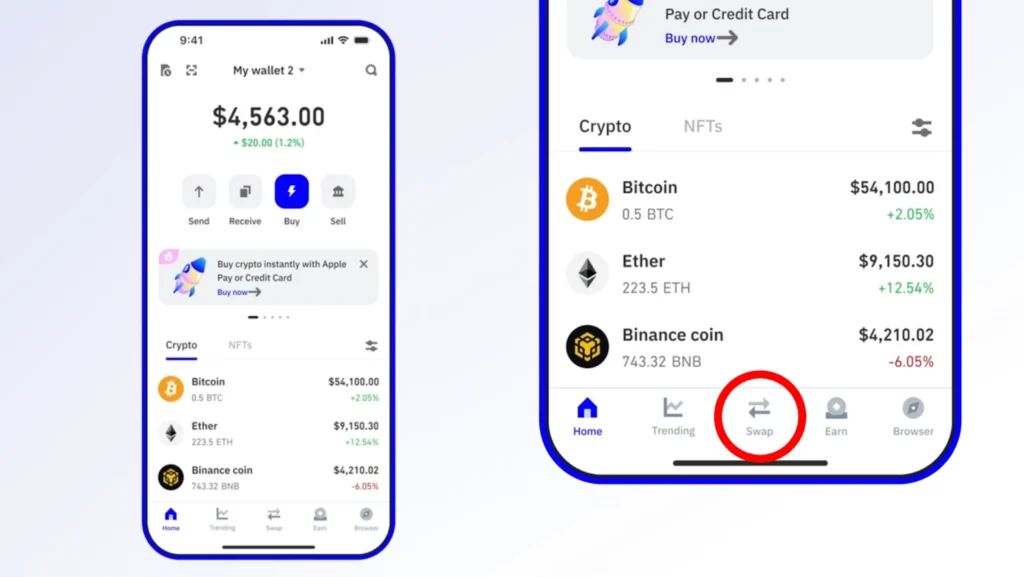

1) Open the App and Go to Swap

Everything starts in a familiar place: the Swap tab. Instead of sending users to a separate portal, Trust Wallet keeps RWAs inside the same flow people already know.

That decision matters. In Web3, the first stumbling block isn’t always regulation or liquidity — it’s complexity. If users had to learn a new app or juggle another login, many would simply give up. By slipping RWAs into the same Swap screen, Trust Wallet makes them feel like a natural extension of everyday use.

Begin by selecting the Swap tab from the home screen. Source: Trust Wallet

For newcomers, the steps are straightforward: open the app, tap Swap, and you’re in. Veterans, meanwhile, will notice the process is identical to trading ETH for USDC. That small detail, making the new feel like the old, could be what turns RWAs from a niche experiment into something mainstream.

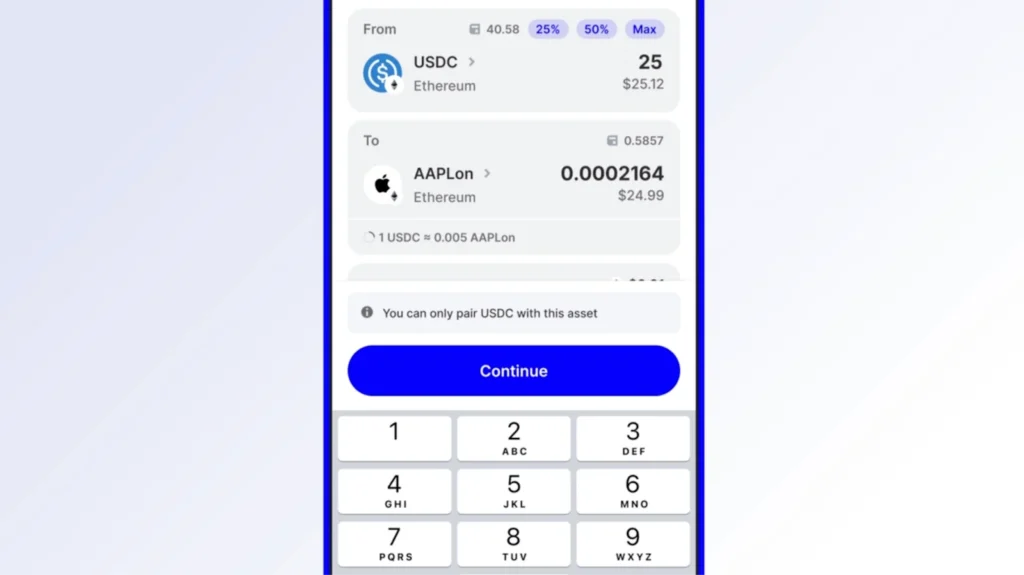

2) Pick Your Pair

Inside the Swap screen, you choose what you’re trading. At launch, RWAs are live on Ethereum and include tokens tied to names such as Apple (AAPL), Tesla (TSLA) and major U.S. exchange-traded funds (ETFs).

A user might, for example, swap USDC (Ethereum) for AAPLon, a tokenized version of Apple stock. These tokens come from providers such as Ondo Finance, which focuses on bringing assets like Treasuries and ETFs onchain. To manage the actual swap, Trust Wallet works with 1inch Fusion API, which handles execution behind the scenes.

Choose the asset pair you want to swap, such as USDC → AAPLon. Source: Trust Wallet

On the surface, it looks simple: pick what you have, decide what you want. Smart contracts and price feeds, operating under the hood, ensure the token’s alignment with its real-world counterpart. The point is that complexity is hidden away.

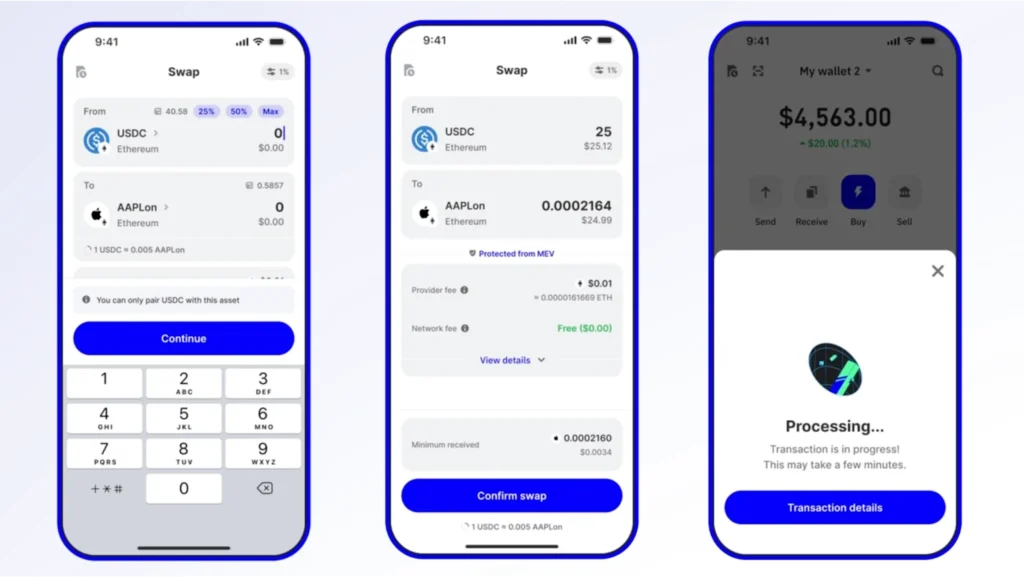

3) Enter the Amount and Confirm

Next, type how much USDC (or another stablecoin) you’d like to trade. The app previews the result: what you’ll get, the value, and the details. If it appears correct, click Confirm.

From there, Trust Wallet hands the transaction off to its RWA partners. A moment later, your portfolio refreshes, and the new token — say AAPLon — appears next to your ETH, NFTs, or stablecoins.

Enter your amount, preview the details, and tap ‘Confirm Swap’ to proceed. Source: Trust Wallet

What you don’t do is just as important: no KYC forms, no brokerage paperwork, no custodians taking your details. Trust Wallet isn’t a broker; it’s an interface where your keys stay with you and the transaction runs on decentralized rails.

For people in countries where opening a brokerage account is almost impossible, this isn’t just about convenience — it’s about finally getting a seat at the table. With only a phone and internet connection, they can hold tokens that move in value with those of globally recognized assets.

4) Trading Window

Crypto never sleeps, but the assets these tokens represent still run on banker’s hours. To stay aligned with Wall Street, Trust Wallet allows RWA swaps only during U.S. market hours.

For long-time crypto traders, that can feel like a speed bump on an open highway — odd at first, but it keeps everything from veering off course. The limit makes sure token prices move in lockstep with Wall Street instead of wandering when the exchanges are shut.

Trust Wallet connects Wall Street hours with the speed of Web3. Source: Trust Wallet

It’s a classic case of straddling two worlds. To bridge Web3 and traditional finance, you have to play by both sets of rules. Trust Wallet is trying to keep one hand on the old playbook while the other pushes into new ground.

5) Security: Keys Stay With You

One thing hasn’t changed: it’s still a self-custody wallet. Your private keys never leave your device. Trust Wallet isn’t holding your assets or acting as a middleman; it’s the doorway, not the landlord.

Security also comes from its partners. Ondo Finance handles the issuance of RWA tokens, making sure they track underlying assets. To prevent issues like slippage or unsuccessful trades, 1inch Fusion API controls the swaps. Combining self-custody with well-known brands provides some assurance in a sector where trust can quickly erode.

From real-world value to on-chain assets, the keys stay in your control. Source: Trust Wallet

In the end, storing RWAs in a Trust Wallet is comparable to storing ETH, USDC, or NFTs. You are in charge because you still have the keys.

6) What Happens Next

When the swap is complete, the new RWA token pops up in your portfolio right next to everything else you own. From then on, you can track stocks and ETFs in the very same dashboard as your crypto — all under one roof.

Trust Wallet plans to continue expanding, adding more assets and moving beyond Ethereum to other blockchain networks. That could mean deeper liquidity and more choice for users down the line.

Available on Ethereum and Solana, with BNB Chain and additional chains to follow. Source: Trust Wallet

The bigger picture, though, is ambition. CEO Eowyn Chen has described RWAs as part of building a “Web3 neo bank” — a single place to manage crypto, staking, identity, and now tokenized traditional assets.

“We’re excited to bring traditional markets onchain in a way that keeps things simple and gives users full control,” Chen said. “By partnering with Ondo and others, we’re ensuring strong price feeds and smart-contract security from the start.”

One App, One Flow

At launch, Trust Wallet’s RWA feature supports tokens that track the value of some of the world’s most recognizable equities and ETFs. Among the first available tokens are Apple (AAPL), Tesla (TSLA), Alibaba (BABA) and several major U.S. exchange-traded funds. In the app, these assets may appear with slightly different tickers — such as AAPLon for Apple — because they are smart contract–issued representations, not the actual shares themselves. The selection will expand over time as more partners and networks are added. Users can follow the rollout and new listings directly through Trust Wallet’s community channels on X and Telegram.

Trust Wallet partners with Ondo and 1inch to power on-chain RWAs. Source: Trust Wallet

Trust Wallet’s RWA feature isn’t just another technical update; it speaks to a shift in mindset. Access to global markets shouldn’t depend on where you live, which forms you’ve filled out, or which broker will take you on.

For millions, opening a brokerage account will never be an option. Downloading a mobile wallet, however, is within reach. By placing tokenized equities and ETFs inside a tool that already feels familiar, Trust Wallet turns what used to be a privilege into something closer to everyday access.

“One app, one flow” sums it up: crypto, DeFi, and tokenized traditional assets all in one place, with the user holding the keys.

Disclaimer

Tokenized RWAs in Trust Wallet are blockchain-based representations of traditional financial instruments. They are not shares, equities, or ownership rights, and they do not provide dividends. RWA features aren’t available everywhere. Currently, users in the United States, the United Kingdom, and the European Union are unable to access them, and availability may vary depending on local regulations in other regions. Content is provided for informational purposes only and does not constitute financial advice.

You May Also Like

And the Big Day Has Arrived: The Anticipated News for XRP and Dogecoin Tomorrow

Tokenized Assets Shift From Wrappers to Building Blocks in DeFi