Solana Price Breaks $209 – Can ETF Optimism Push SOL to $233?

The post Solana Price Breaks $209 – Can ETF Optimism Push SOL to $233? appeared first on Coinpedia Fintech News

Solana price now has extended its winning streak. It is currently trading at $209.77 after gaining 3.48% in the last 24 hours. The token’s market cap climbed to $113.49 billion, while 24-hour trading volume surged 35.96% to $9.08 billion. This uptick comes as positivity builds over potential U.S. approval of spot Solana ETFs, with issuers like VanEck and Franklin Templeton updating filings to include staking features. Analysts now estimate a 95% chance of approval by October 2025, which could unlock significant institutional demand.

In another positive event, Solana validators have approved the Alpenglow upgrade with 99% support. This update will reduce the transaction finality from the current 12.8 seconds to just 150 milliseconds. Thereby, placing Solana’s speed on par with Google searches, and reinforcing its case as a high-performance blockchain.

Rising DeFi Liquidity Now Solana’s Strength?

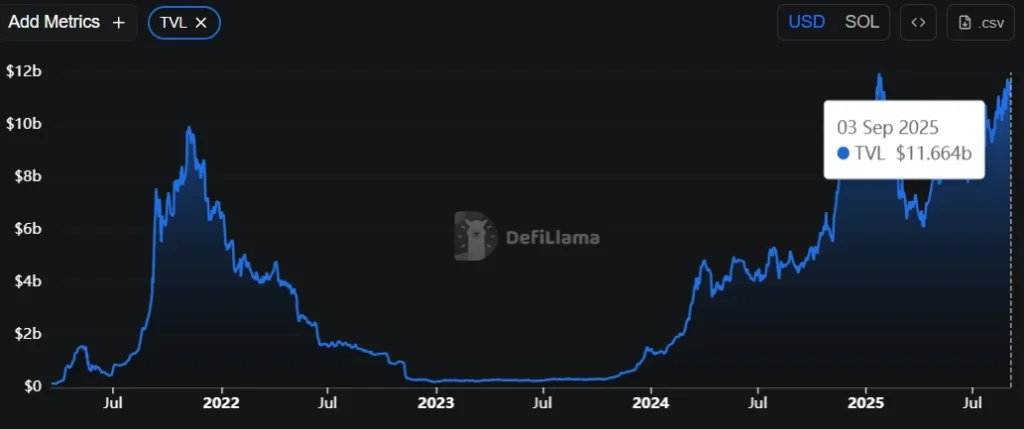

Solana’s on-chain activity continues to grow stronger, with TVL climbing to $11.66 billion as of September 3, 2025, which is the highest level in over two years. This steady growth talks about the increasing capital deployment into Solana’s DeFi ecosystem, including lending protocols, liquid staking, and decentralized exchanges.

Source: Defillama

Source: Defillama

The wave in TVL runs in tandem with the price rally, confirming that the network’s fundamentals are improving alongside market sentiment. That being said, if ETF approval materializes, institutional inflows could further push this growth, strengthening Solana’s position as a leading smart contract platform.

SOL Price Analysis

SOL price has decisively broken above its 7-day SMA at $204.69 and its 30-day EMA at $192.23. The move above $210 triggered stop-loss orders and algorithmic buying, pushing prices toward short-term resistance. However, traders need to note that the Fibonacci resistance at $204.52 may temper gains temporarily.

On the upside, a close above $217.84 would open the door for SOL to $233.19. Beyond that, the next significant resistance lies at $236, while the ATH of $294.33 remains a longer-term target if ETF approval drives institutional inflows similar to Bitcoin’s $142B ETF AUM.

Successively, the downside support lies near the lower Bollinger band at $195 and $176.69, with deeper protection at $146.52 if broader market sentiment weakens.

FAQs

ETF approval odds nearing 95% and the Alpenglow upgrade have boosted institutional and retail interest.

If Solana coin price closes above $217.84, it could target $233.19, while $195 and $176.69 provide key downside support.

If spot ETFs launch and institutional inflows mirror Bitcoin’s experience, SOL could retest or surpass $294.33 over time.

You May Also Like

The Manchester City Donnarumma Doubters Have Missed Something Huge

Marathon Digital BTC Transfers Highlight Miner Stress