Trump nominates Paul Atkins as SEC Chairman, Bitcoin breaks through $100,000, cryptocurrency regulation is about to open a new chapter

Author: Weilin, PANews

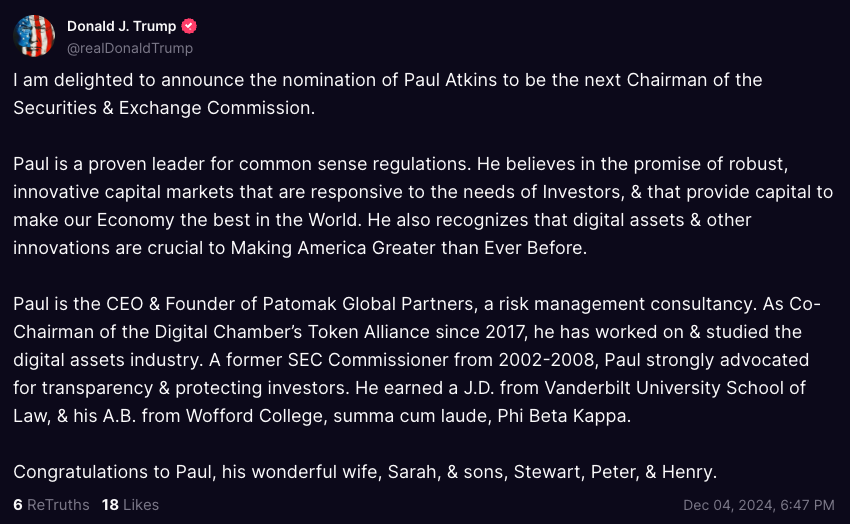

On December 5, US President-elect Trump announced that he would nominate Paul Atkins as Chairman of the US Securities and Exchange Commission (SEC). If the nomination is confirmed by the Senate, Atkins will take over the leadership of this major US regulatory agency, with a broad mission, including protecting investors, monitoring the market, and combating fraud. This nomination not only means that the US securities market will usher in a new regulatory leader, but it may also bring about a major shift in cryptocurrency regulatory policies compared to the incumbent Gary Gensler.

As the news was released, the crypto community and market reacted strongly, with CEOs of companies such as Coinbase and Ripple and US senators who support cryptocurrencies expressing their congratulations one after another. The price of Bitcoin also broke through the $100,000 mark for the first time at 10:00 Beijing time on December 5, with a 24-hour increase of 7.82%.

Crypto-friendly person nominated as SEC chairman, regulatory policy may undergo major changes

When announcing the news, Trump said on his social platform Truth Social: "Paul is a proven leader in common-sense regulation. He believes in the potential of strong and innovative capital markets that meet the needs of investors and provide capital for our economy, making it the best in the world. He also recognizes that digital assets and other innovations are critical to 'making America greater than ever'."

Atkins' experience makes him a good fit for the position. Born in North Carolina, Paul Atkins graduated from Vanderbilt University School of Law and began his career at Davis Polk & Wardwell in New York City. From 2002 to 2008, Atkins served as a Republican SEC commissioner during the Bush administration, where he gained extensive regulatory experience. After leaving the SEC in 2008, he turned to consulting for financial and cryptocurrency companies and became the CEO and founder of Patomak Global Partners.

He has also served as co-chairman of the Digital Chamber's Token Alliance since 2017, focusing on research and development in the digital asset industry. If he is successfully appointed this time, it will be his second time to hold an important position at the SEC.

Atkins has always been outspoken about his regulatory philosophy. While at the SEC, he opposed imposing large fines on companies that agreed to settle fraud charges. He believes that these fines are not only ineffective in deterring misconduct, but will affect stock prices and punish shareholders who have already been harmed by corporate behavior. Last year, Atkins said in a podcast: "If the government and the SEC can be more tolerant and deal with these (cryptocurrency) companies in a more straightforward way, I think it would be much better to let things happen in the United States than abroad."

Crypto community welcomes new rulers as Bitcoin breaks $100,000 for the first time

On December 5, Coinbase CEO Brian Armstrong tweeted that he supports Paul Atkins as SEC chairman and called him a "perfect candidate." At the same time, Hester Peirce, another important figure in the digital asset field and known as the "crypto mom," also expressed her support for Atkins on Twitter, saying that he will focus on promoting free markets, capital formation, investor choice and innovation. Peirce said she was very happy that Atkins returned to lead.

Jay Clayton, who served as SEC chairman during Trump's first term, also spoke highly of Atkins. He said, "Paul knows this agency, he knows the markets, and he knows what needs to be done. I expect he will be able to get to work quickly." Clayton also mentioned that Atkins will reform the proxy-voting process, including requiring disclosure of conflicts of interest that advisors may have when advising investors to vote on various issues. In addition, Atkins also plans to reverse the climate agenda proposed by Gary Gensler, which has shifted power from shareholders to other stakeholders.

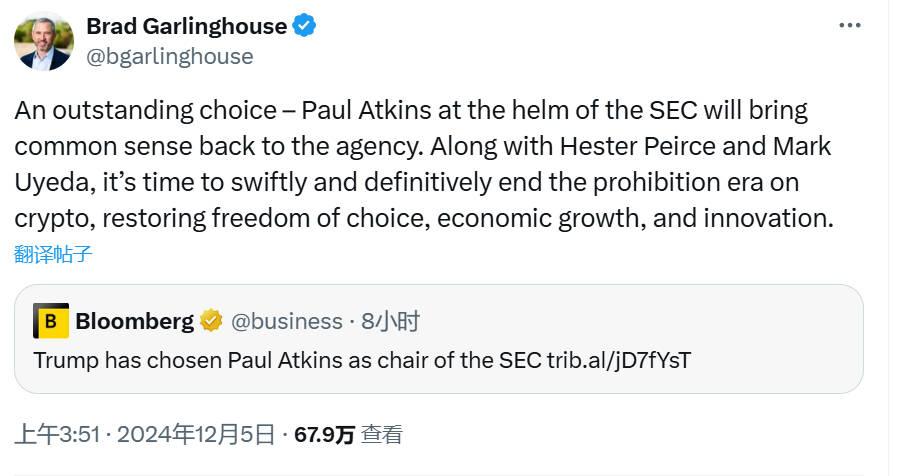

Ripple CEO Brad Garlinghouse said Atkins' nomination was an excellent choice, saying that he would be able to bring common sense back to the SEC and work with Hester Peirce and Mark Uyeda to promote fundamental changes in cryptocurrency regulation, end the "ban era" of cryptocurrency, and restore freedom of choice, economic growth and innovation.

Senator Cynthia Lummis, who proposed the Bitcoin Strategic Reserve Act, also said that Atkins' nomination as SEC Chairman is a big victory for financial innovation. She pointed out that President Trump has promised to build the most supportive government for digital assets in U.S. history, and she looks forward to working with Atkins to promote innovation and make the U.S. economy strong again.

Cameron Winklevoss, another top industry executive whose cryptocurrency exchange Gemini has also been the target of harsh crypto regulation, also gave a thumbs-up to Atkins’ nomination. He called the choice a great decision. Early last year, the SEC charged Gemini and Genesis for allegedly offering a crypto loan product through Gemini Earn, which the regulator deemed to be an unregistered security.

According to FOX Business, after Atkins was nominated as SEC Chairman, industry insiders revealed that Atkins may support Republican Commissioner Hester Peirce (known as "Crypto Mom") and another Republican Commissioner Mark Uyeda to jointly lead the formulation of cryptocurrency policies. Peirce once proposed to set up an internal cryptocurrency working group to re-evaluate the SEC's regulatory approach to digital assets and engage in dialogue with the industry.

Peirce's current term will end in June 2024, and it is unclear whether she will seek re-election, while Uyeda's term will last until 2028.

With the release of Atkins' nomination, the cryptocurrency market reacted quickly and positively. Bitcoin rose 7.82% in 24 hours, breaking the $100,000 mark for the first time, showing the market's optimistic expectations for the new regulatory policy. This milestone breakthrough marks the entry of the crypto asset market into a new stage. As the price of Bitcoin hits new highs, the attention and participation of global investors will be further enhanced.

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For