Ethereum in the bull market: an undervalued blue chip or a giant that is gradually losing momentum?

Author: Frank, PANews

As the bull market enters the alt season, time seems to be running out for ETH. Since the end of 2023, the performance of ETH has been attracting much attention in this round of rising cycle. But it seems that ETH has performed somewhat below expectations in the past year. The most intuitive point of view is that from October 2023 to date, the maximum increase is 170%, and it has repeatedly lingered at the $4,000 mark and failed to achieve a significant breakthrough. On the other hand, BTC's maximum increase in the same period exceeded 300%, and SOL's increase exceeded 1,300%. Many people believe that ETH represents the arrival of the alt season opportunity, but with the recent sharp rise in many old altcoins in the short term, ETH's potential is obviously insufficient.

Is Ethereum, the leading public blockchain, undervalued by the market or performing normally, judging from objective data? Lian Po is old, can he still make a living?

On-chain data has remained stagnant for a year

Judging from the on-chain data, PANews can clearly observe that Ethereum has not declined in the past year, but at least there has been no significant growth.

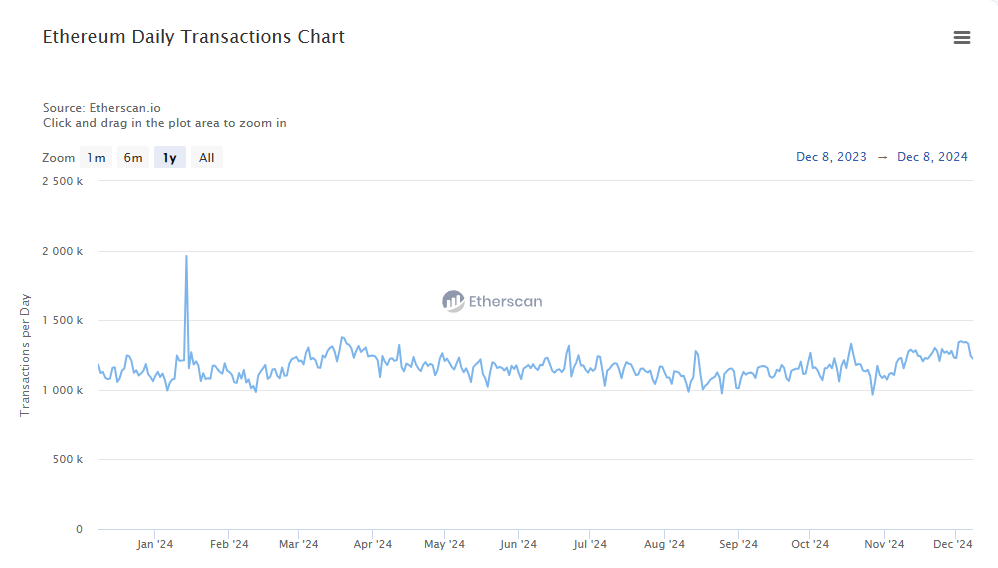

The average number of daily transactions is a very important activity indicator. If you open the average daily number of Ethereum transactions in the past year, you can see a fluctuation line that is stable and slightly fluctuating like an electrocardiogram. On December 8, 2023, the total transaction volume of the Ethereum main network was 1.18 million, and after a year, on December 8, 2024, this data was 1.22 million, almost the same. During this year, only in January 2024 did it briefly increase to 1.96 million transactions. At other times, it basically remained between 1 million and 1.3 million transactions.

The trend of Gas fees can more clearly reflect the activity on the chain. From the end of 2023 to the beginning of 2024, Ethereum's Gas fee level is still at a relatively high level, averaging above 40Gwei, and the highest can reach about 100Gwei. With the rise of new public chains such as Solana, it can be clearly seen on the chart that Ethereum's Gas fee has dropped, especially from July to September, when the lowest was only 0.3Gwei. Even though it has rebounded recently, it has generally remained below 20Gwei. At the beginning, Layer2s were advancing by leaps and bounds, and the main reason was that the Gas fee of the Ethereum mainnet was too expensive. Now, Ethereum's Gas has finally come down, but it seems that users don't know where they have gone. In other words, Ethereum has really come down as users leave.

As for active addresses, the curve pattern is basically similar to the average number of signed daily transactions. According to data from Ethereum browsers, there is no growth in the number of daily active Ethereum addresses and ERC20 addresses, and the data level is basically the same as before the bull market started.

Users flow to L2, funds remain in L1

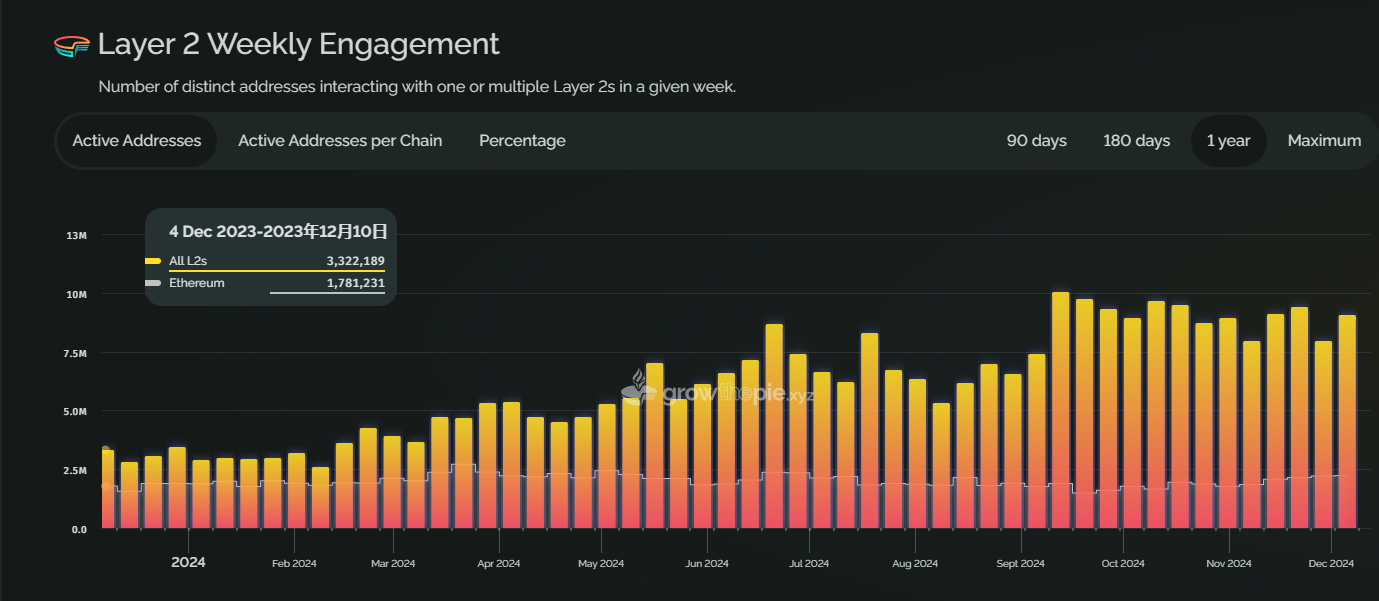

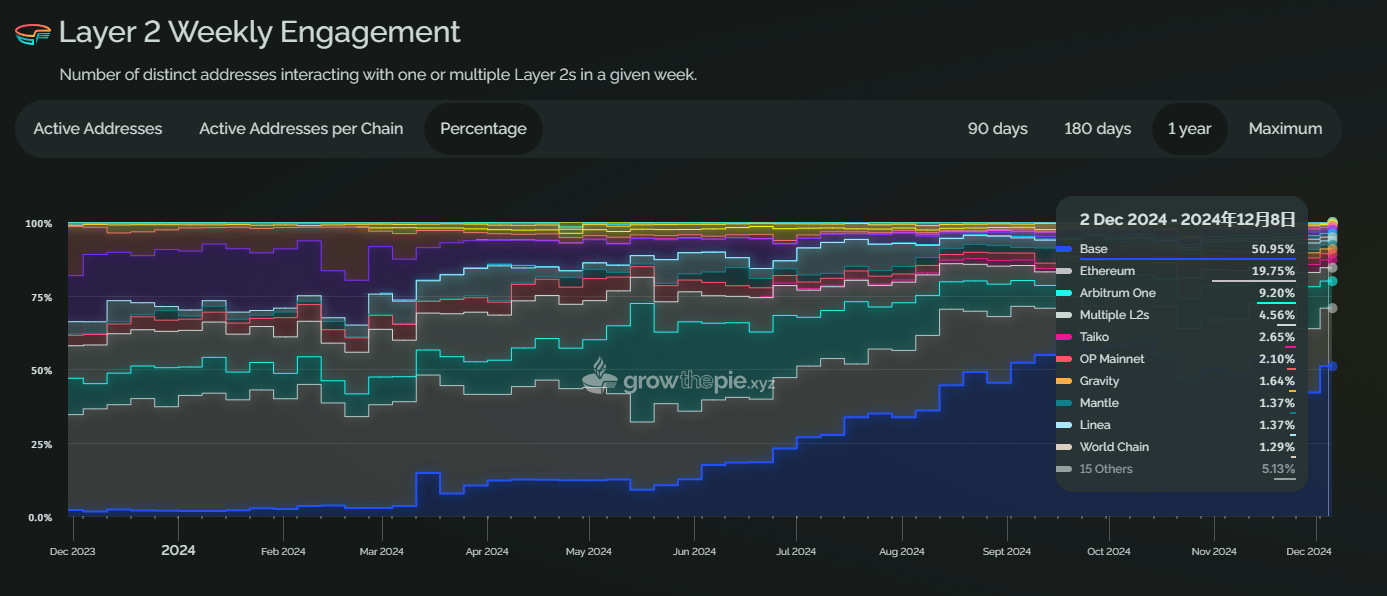

Where are Ethereum users going? According to the weekly on-chain activity data, the number of active addresses on Ethereum accounted for about 50% of all Layer2 addresses in the same period a year ago. As time goes by, the current data shows that the number of active addresses on Layer2 is on the rise overall, and the proportion of active addresses on the Ethereum mainnet accounts for about 24% of the total Layer2.

Looking at the performance of each chain individually, in December 2023, the Ethereum mainnet was the most active chain, accounting for about 32.48%. By December 2024, the most active chain had become Base, with a share rising to 50%. The Ethereum mainnet ranked second with 19%, and Arbitrum ranked third with a share of 9.2%.

But in terms of TVL, the Ethereum mainnet still seems to be the first choice for big players. Judging from the total amount of stablecoins locked on the chain, the Ethereum mainnet accounted for about 95% in December last year. The current proportion has declined slightly, but it still accounts for about 91%. Moreover, the TVL data is almost the only data that has increased significantly on the Ethereum mainnet in the past year. In December 2023, the TVL of the Ethereum mainnet was about US$28.8 billion. As of December 2024, the data rose to about US$77.5 billion. The growth rate is about 2.69 times, and the growth rate of this data also exceeds the growth rate of Ethereum prices, which is also related to the rise in asset prices in the bull market. Among Layer2, Arbitrum and Base's stablecoin TVL ranked second and third.

In terms of revenue, the Ethereum mainnet is also the most profitable chain in the Ethereum ecosystem. Over the past year, Ethereum's revenue share has remained above 80%, and as of December 8, the figure was 92%. The Base chain has become the second highest-earning Ethereum ecological chain since the beginning of this year.

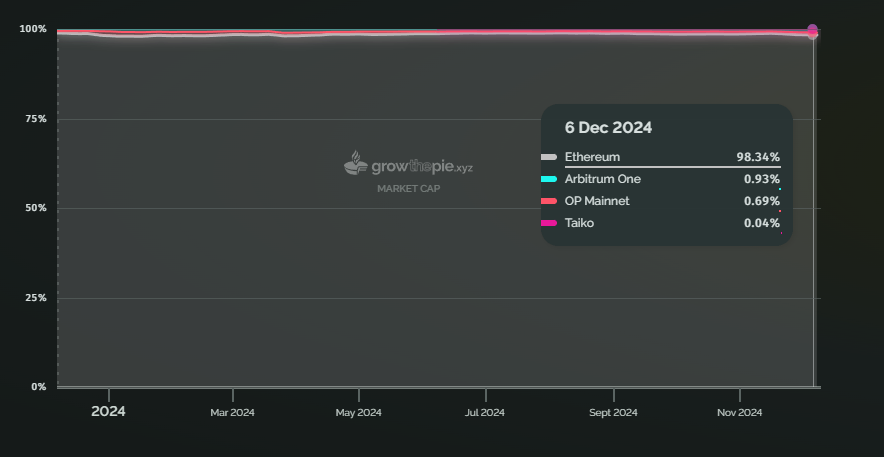

Ethereum’s market capitalization has also remained at around 98%. Although the on-chain activity has declined, the market capitalization share seems to be highly consistent with the TVL share. In addition, from the perspective of the share of the entire crypto market, Ethereum’s market capitalization share has indeed been declining over the past year, and the current share is only around 13.4%.

However, considering the growth of TVL, most large funds still choose to put their funds on the Ethereum mainnet. Comparing the ratio of total TVL to the number of active users, the data of Ethereum mainnet is 178,700 US dollars, Base is about 3,315 US dollars, and Solana is about 1,972 US dollars. From this point of view, the gold content of a single user of Ethereum still remains the highest in the entire network.

Uniswap’s departure may be a bigger concern

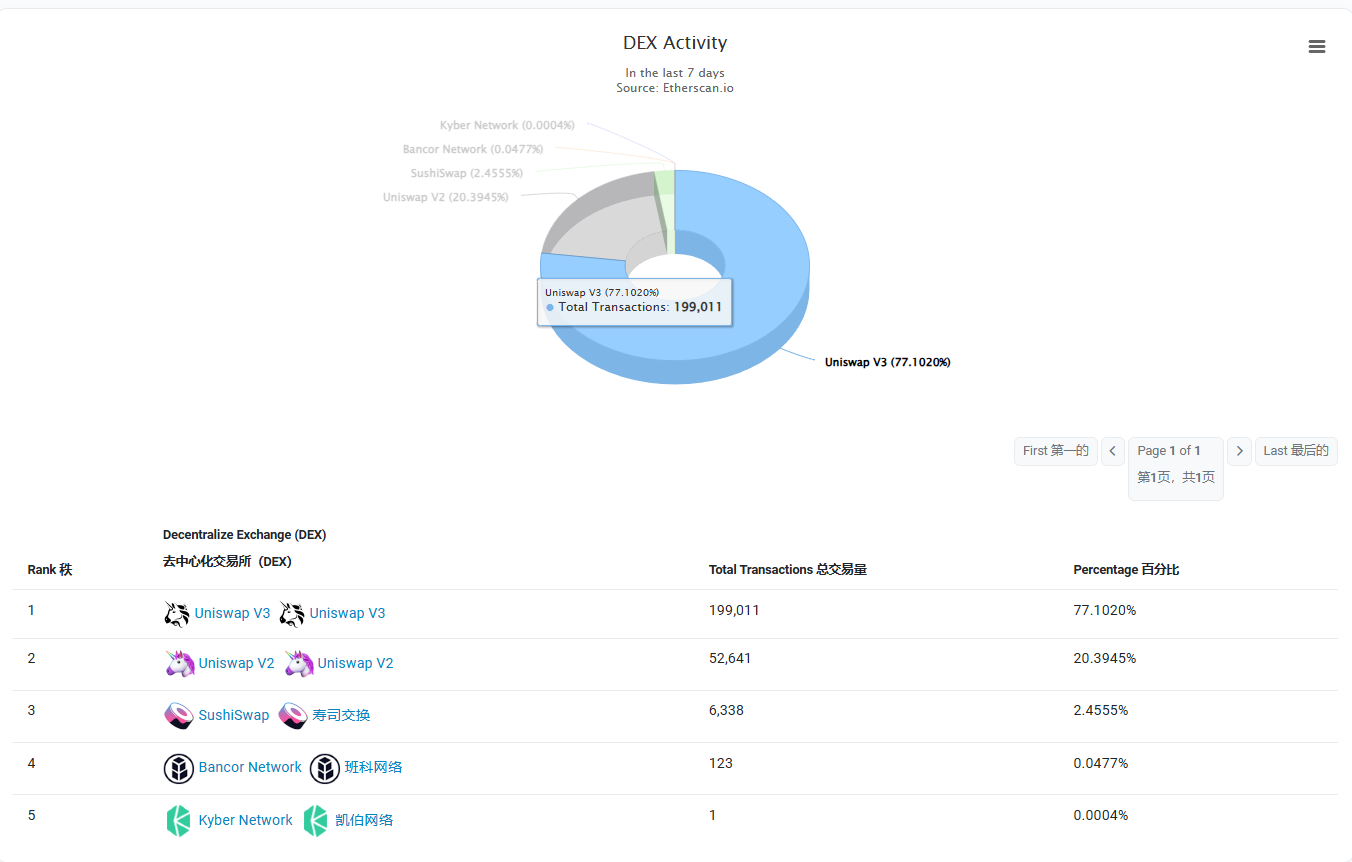

Judging from various data, Uniswap is still the undisputed largest application of Ethereum. Judging from the activity of DEX, UniswapV2 and V3 together account for more than 97% of the transaction volume of the Ethereum main network. In the Ethereum burning ranking list, Uniswap has also long occupied the top position. As of December 9, Uniswap has burned a total of 6,372 Ethereum in the past 30 days, while Ethereum transfers have only burned 4,594 Ethereum.

Once Uniswap transfers most of its trading activities to its own Unichain, the activity and burn amount of the Ethereum mainnet may drop by another order of magnitude. According to Forbes, as Uniswap transitions to its own chain, validators on the Ethereum network may lose about $400 million to $500 million in revenue each year. But more serious than this economic loss is that it threatens the basic narrative of Ethereum as a deflationary currency. Uniswap's universal router is the largest account consuming gas fees, accounting for 14.5% of Ethereum's gas fees, which is equivalent to destroying $1.6 billion worth of Ethereum.

Summarizing the above indicators, we can summarize the following characteristics. The network activity of the Ethereum mainnet has not increased in the past year, and its share in the entire Ethereum ecosystem has gradually decreased. This at least shows that new users have basically chosen other Layer2 or other public chains (after all, emerging public chains such as Solana, Sui, Aptos, etc. have maintained rapid growth in these data).

Therefore, returning to the original topic, has the fundamentals of Ethereum changed significantly? Or is the price of ETH underestimated? Based on the above data, the Ethereum mainnet seems to be transforming into a capital sedimentation pool for large and major players, and even if the gas fee has dropped significantly, it still cannot compete with Layer2 or other public chains in terms of handling fees and transaction rates. Therefore, the Ethereum mainnet is obviously no longer a club for small retail investors, and it no longer has the advantage of community numbers for the currently popular tracks such as MEME. It is more suitable for players who have low frequency requirements and higher asset security requirements. From this perspective, we can only say that the ecological role of the Ethereum mainnet is changing, and liquidity and security have become the last moat of the Ethereum mainnet.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates