Oil Crashes 8.7% From Last Week’s Peak as Middle East Tensions Rattle Markets

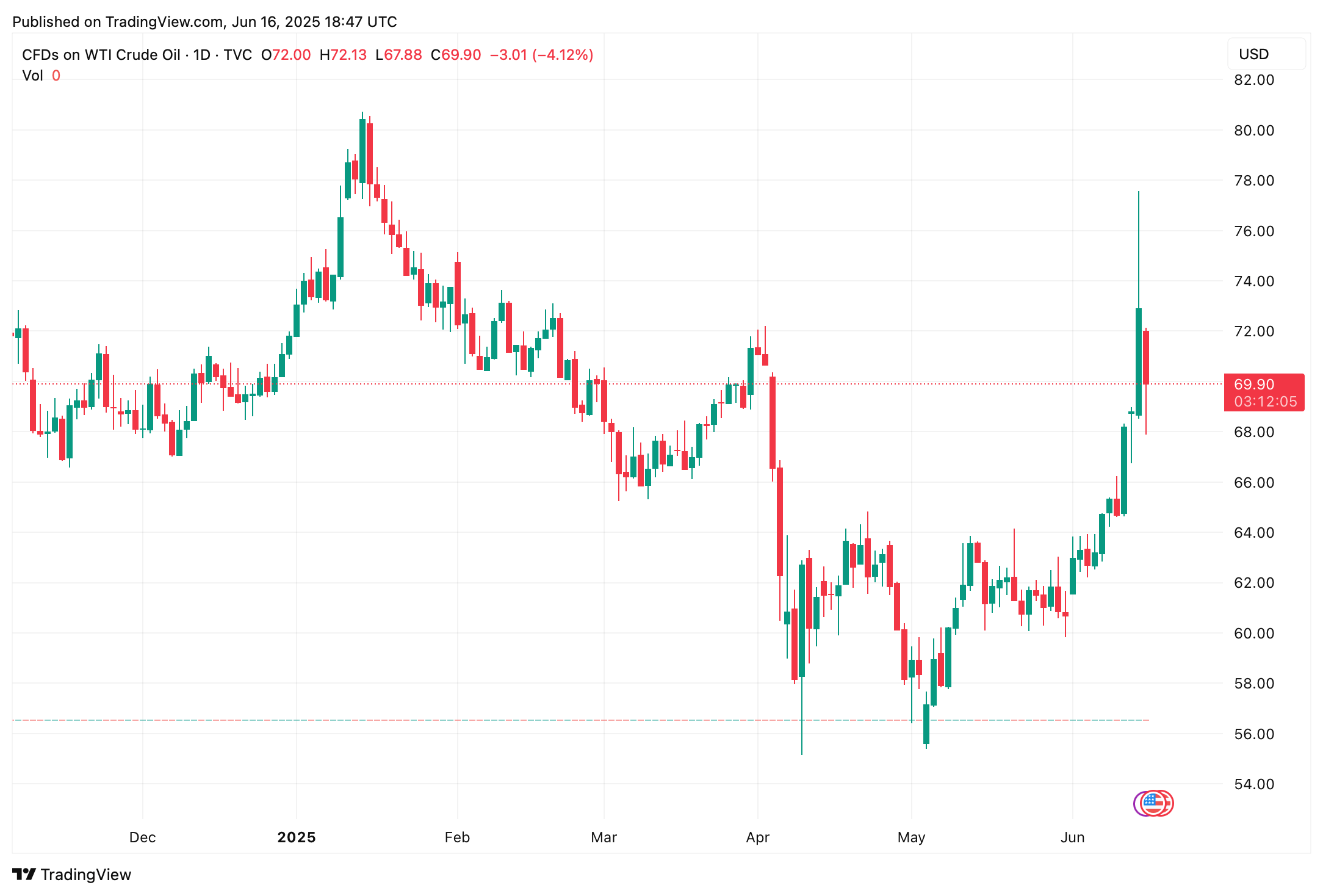

U.S. stocks bounced back into positive territory as crude prices plunged more than 4% in the past 24 hours and have now slid 8.74% since June 12. Analysts at Deutsche Bank note that oil’s trajectory could oscillate unpredictably in the months ahead.

$76 to $70: Crude Collapses as Nuclear Talks Stall

While much attention remains fixed on equities, precious metals, and digital assets, traders and analysts are equally fixated on bond yields and the fluctuating price of crude. Last week, tensions escalated between Israel and Iran, with Israeli forces striking what they claimed were nuclear sites in Tehran. In response, Iran launched a barrage of missiles targeting Tel Aviv and Jerusalem.

Now, emerging reports suggest Iran may be looking to revive diplomatic dialogue concerning its nuclear ambitions. The recent tensions have caused earlier nuclear negotiations between Iran and the United States to be paused on June 15. When the military attacks first started, the price of crude oil swelled to $76.76 per barrel but today it is down 8.74% lower and trading at $70.05. The drop came even as Israel’s Haifa Oil Refinery was partly damaged.

An editorial from the New York Times (NYT) highlights insights from Deutsche Bank analysts, who suggest crude oil prices may fluctuate unpredictably from this point forward. The analysts outline a broad spectrum of potential scenarios, with extremes ranging from prices exceeding $120 per barrel to a slide toward $50 by next year. NYT journalist Stanley Reed, based in London, also spoke with an executive from the commodities research firm Argus Media.

The senior energy markets analyst at Argus Media, Bachar El-Halabi, told Reed:

According to prediction market Polymarket, the probability of Iran shutting the Strait of Hormuz in 2025 stands at 25%, down from the 40% range observed last week. Even a brief closure of the strait could jolt global oil prices upward almost instantly. As a strategic artery, it channels around 20% of the world’s seaborne oil—carrying exports from Saudi Arabia, the UAE, Kuwait, and Iraq. Any blockage would rattle energy markets, provoking a scramble as traders and governments brace for potential shortages and logistical snarls.

Brent crude and West Texas Intermediate (WTI) futures would likely leap as investors bake in geopolitical risk premiums. The magnitude of the price response would depend entirely on how long and how extensively the flow is interrupted. At present, equities continue their upward drift, while the crypto economy has advanced 2.62% over the past 24 hours. Meanwhile, gold slipped 1.26% on Monday, stabilizing around $3,389 per troy ounce.

Longer-term U.S. bond yields remain elevated relative to historical norms, a reflection of persistent economic and fiscal ambiguity in the air. During the session, the yield on the 10-year Treasury note fluctuated between roughly 4.42% and 4.55%. Recent benchmarks and comparable durations for the 30-year yield indicate it’s been hovering near 4.90% to 4.93%, with the latest 30-year issuance carrying a 4.75% coupon as of June 16.

The financial pulse now hinges not only on volatility in the oil trade but on a delicate geopolitical détente that could recalibrate risk sentiment overnight. Investors are navigating a matrix of uncertainty—sensitive to even whispers of escalation or diplomacy. Whether calm or conflict prevails, the balance of power in energy, equities, and fixed income will likely reflect every subtle shift on the global stage.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Solana Price Prediction from Standard Chartered