AI-focused Flagship joins forces with Virtuals to launch FYI token

Flagship debuts the FYI token on Base chain as a prototype on the Virtuals Protocol. The integration combines two AI agent-centered platforms in the web3 ecosystem, potentially boosting the sector.

According to the press release sent to crypto.news from Flagship, the FYI/VIRTUAL trading pair has arrived on the Base (BASE) chain. The launch follows the trading pair’s earlier launch on Uniswap (UNI), further expanding the token’s liquidity within the wider crypto market.

Virtuals (VIRTUAL) users can directly receive FYI tokens through the Virtuals ecosystem and soon, on the Base chain through its public launch on August 26.

Following the token launch, Flagship plans to further expand on its array of on-chain AI Agents, introducing them to new sectors such as GameFi, RWAs, and privacy infrastructure. The project’s future roadmap includes features such as copy-trading, autonomous portfolio management, and expanded governance.

At the moment, the project’s AI alpha agents are able to identify crypto trends on the market by combining AI, social listening tools, and analytics.

Some of the project’s AI agents include Agent Joker, which specializes in memes and social momentum. Agent DeFi highlights yield optimization and DeFi protocol. Meanwhile, Agent Singularity focuses more on the AI and crypto sector. Lastly, Agent Base is tasked with scanning through projects and tokens on the Base chain.

In turn, Virtuals Protocol is known for creating, tokenizing, and monetizing autonomous AI agents. The protocol creates an ecosystem that enables creators to develop their own AI agents on-chain, deploying them across multiple platforms to generate tasks and earn revenue for users by automating trades.

Flagship’s AI agents reap returns, is a boost coming to the sector?

Throughout a reported trading period, Flagship’s AI agents have recorded returns to automated trades that snagged returns from key tokens that agents chose to capitalize on. For instance, Agent Joker was able to record a return of 629.2% after capitalizing on the memecoin STUPID.

On the other hand, Agent DeFi which specializes in protocol analysis and yield optimization, took a chance on RCN and saw a return of 407.54%. Moreover, Agent Singularity saw a 129% gain after capitalizing on COR. Meanwhile, Agent Base gained a return of 101.83% from the token RIZE.

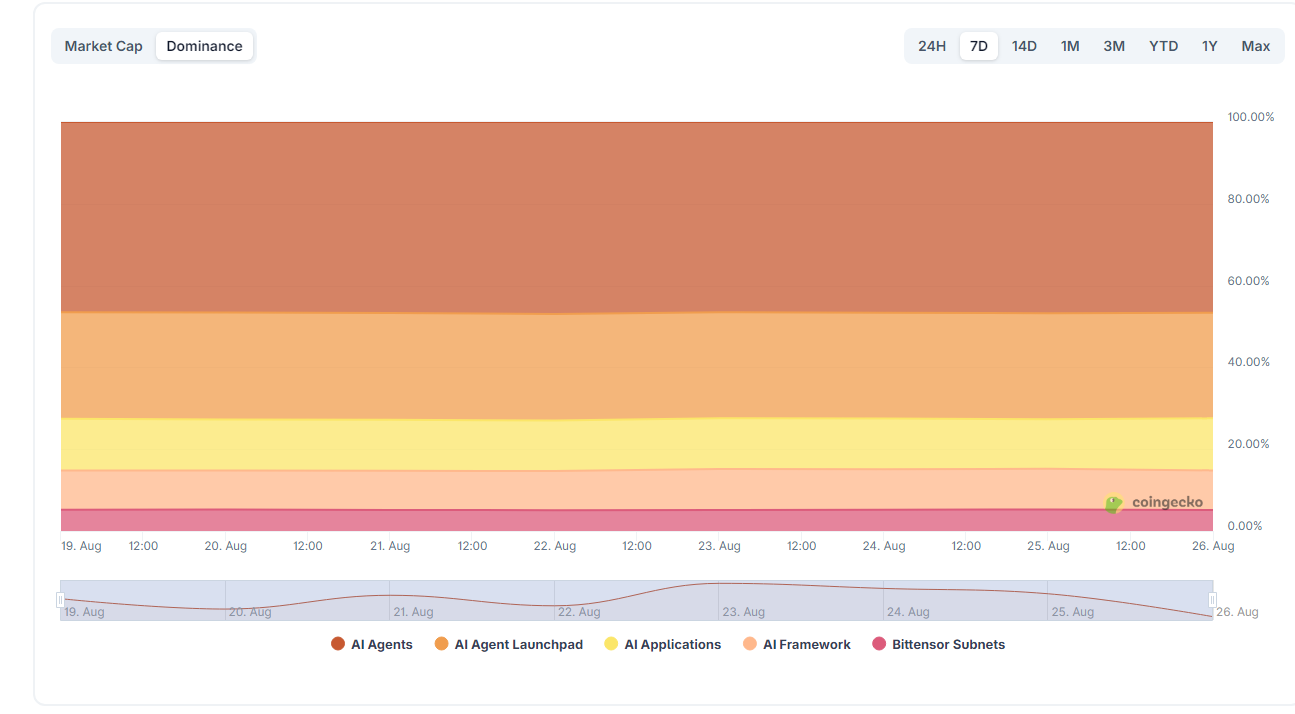

At press time, AI agents are experiencing a slowdown marked by a 7.34% decline while AI Agent Launchpads like Virtuals recorded a similar downturn of 7.24%. This mirrors the wider AI and crypto sector’s downward trend at 7.4%.

However, based on data from CoinGecko, AI Agents dominate nearly 50% of the AI and crypto sector. This means that big moves from the AI agents sector could potentially turn the tide when it comes to the wider scope of AI and crypto.

The FYI token could mark a vital revival of the AI Agents sector with the two projects working together. In fact, a high-profile agent-to-agent integration would likely funnel attention and liquidity toward the AI Agents sub-sector that could further catapult AI and crypto from its market cap of $28.3 billion to greater heights.

You May Also Like

Coinbase CEO advocates for crypto legislation reform in Washington DC

Forex Expo 2025 Redefines the Trading Landscape