WLFI Price Jumps 25% as Mar-a-Lago Event Hype Ignites Futures Frenzy

The post WLFI Price Jumps 25% as Mar-a-Lago Event Hype Ignites Futures Frenzy appeared first on Coinpedia Fintech News

The WLFI price just ripped 25% higher intraday and no, it wasn’t random. A so-called “golden ticket” style invitation for an event at Mar-a-Lago flipped sentiment fast, and traders wasted no time piling in. Momentum didn’t just tick up. It exploded.

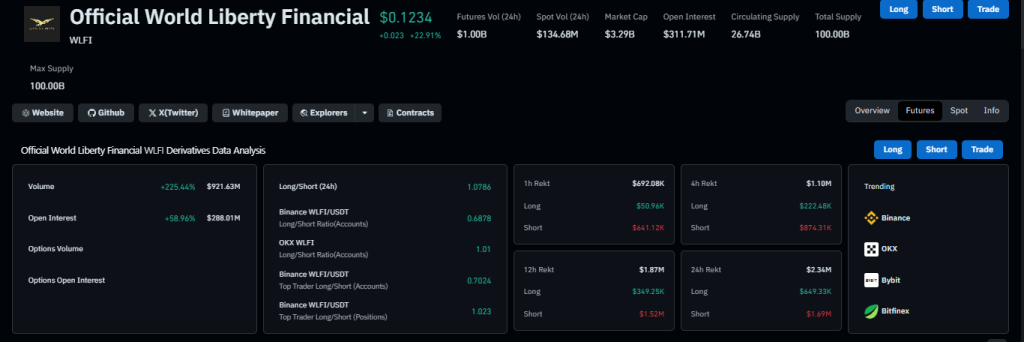

Futures Volume Goes Parabolic

Futures activity spiked 225%, with volume reaching $921.63 million. Open interest surged 58% to $288 million. That’s not subtle positioning that’s aggressive exposure.

And when leverage floods in, liquidations follow. Over the past 24 hours, total liquidations hit $2.34 million. Shorts took the bigger hit at $1.69 million, while longs saw just $649.33K wiped out. That imbalance tells you exactly who got squeezed as the WLFI price squeezed higher.

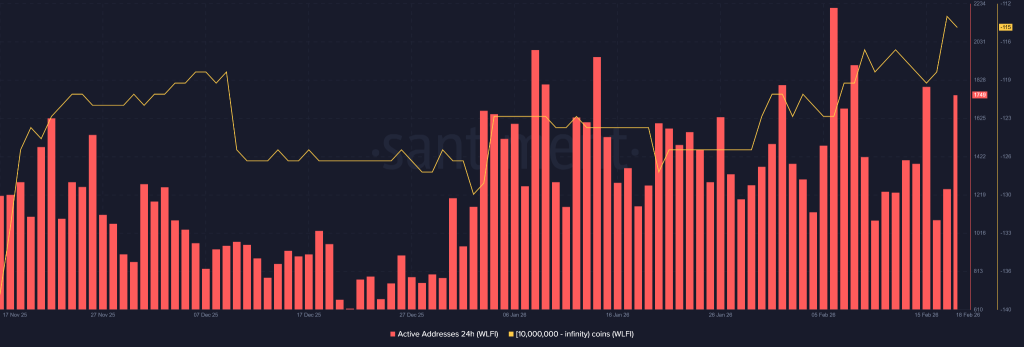

Well, here’s the kicker. On-chain data also showed a spike in daily active addresses. Most likely tied to the Mar-a-Lago event buzz, which features 38 speakers on the panel. Whether it delivers “market-shaping insights” or not, perception alone was enough to spark intraday demand.

Whales Accumulate, Exchanges Drain

Behind the scenes, bigger players appear to be stepping in. The 10 million-to-infinity holder cohort has been trending upward, suggesting whale accumulation during this surge. At the same time, exchange outflows flipped inflows which is never a neutral signal. Tokens are moving off platforms, not onto them.

That shift matters. It suggests the 25% move may not be purely speculative froth. If supply keeps tightening on exchanges while demand spikes, the WLFI price chart could reflect that imbalance quickly. But let’s be real. Intraday hype doesn’t automatically equal sustainable trend.

Key Levels on WLFI Price Chart

Technically, a wedge pattern is in play on the daily timeframe. The $0.100 zone has emerged as a key demand area, showing intraday support and reclaiming the 20-day EMA in the process.

If bullish momentum continues, clearing $0.140 becomes critical. That level dynamically aligns with the 50-day EMA band and could open the door toward $0.160 by month’s end.

So what’s next? Short term, the WLFI price prediction leans constructive as long as $0.100 holds. But zoom out, and the longer-term outlook still depends on broader demand expansion.

The event could be a catalyst or just a spark. Either way, for now, the WLFI price isn’t moving quietly.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Institute of Museum and Library Services Awards $4.1 Million to Support the Trump AI Action Plan