Bitcoin (BTC) Price Prediction: $2.7 Billion Whale Dump Triggers Massive Leverage Flush

TLDR

- Bitcoin crashed below $109,000 after a whale sold 24,000 BTC worth $2.7 billion

- All Bitcoin wallet cohorts have shifted into distribution mode, creating sell-side pressure

- The $105,000 level has emerged as the key support zone before potential deeper corrections

- Over 205,000 traders were liquidated in a $930 million liquidation event

- Bitcoin’s seasonal weakness period aligns with the current pullback

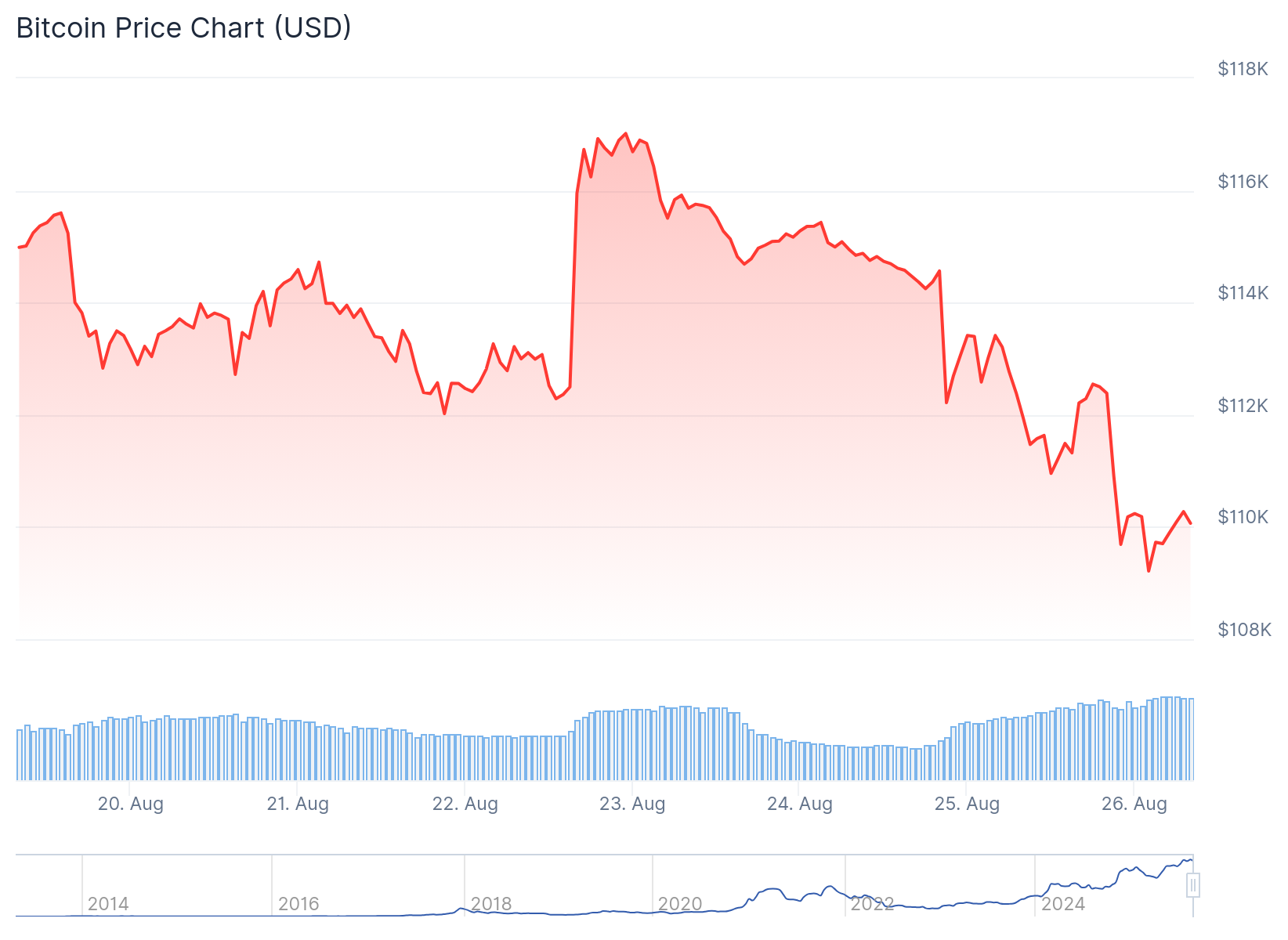

Bitcoin experienced a sharp decline below $109,000 during Asian trading hours on Tuesday. The drop marked a seven-week low for the cryptocurrency.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

A massive whale transaction triggered the selloff. One entity sold 24,000 Bitcoin worth over $2.7 billion in a single batch. This large sale caused Bitcoin to plummet $4,000 within hours.

The broader crypto market felt the impact immediately. Total market capitalization fell by $205 billion in 24 hours, dropping to $3.84 trillion. This represents the lowest level since August 6.

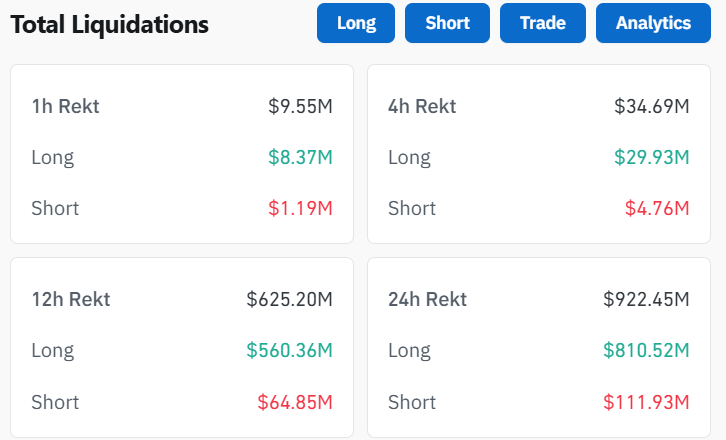

Liquidations swept across exchanges as leveraged positions unwound. Over 205,000 traders were liquidated, with total liquidations exceeding $930 million. Long Bitcoin positions faced the heaviest losses during the flush.

Source: Coinglass

Source: Coinglass

Onchain Data Shows Distribution Pattern

Data from Glassnode reveals all Bitcoin wallet cohorts have now entered distribution mode. The 10-100 BTC group leads this selling activity across different wallet sizes.

Smaller holders between 0-1 BTC continue accumulating since the recent peak. Wallets holding 1-10 BTC resumed buying below $107,000. However, the 10-100 BTC group turned into net sellers after Bitcoin crossed $118,000.

Large holders above 1,000 BTC remain consistent distributors. The 100-1,000 BTC group shows mixed behavior around the $105,000 level. This price point has emerged as the critical support zone.

Bitcoin’s realized price data supports this analysis. One to three-month holders have an average cost basis of $111,900. Longer-term holders from three to six months sit at $91,630, while 6-12 month cohorts average $89,200.

The wide gap between these levels shows heavy short-term positioning near recent highs. This contrasts with longer-term holders who accumulated closer to $90,000.

Bitcoin Price Prediction

The current pullback aligns with Bitcoin’s historical seasonal patterns. August to September typically marks a weaker period for the cryptocurrency.

Asia’s “ghost month” runs from August 23 to September 21 this year. This period often coincides with reduced risk appetite and increased profit-taking among traders.

Since 2017, Bitcoin has averaged a 21.7% decline during ghost month periods. The 2017 ghost month saw a 39.8% drop, while 2021 recorded a 23% decline.

Based on these historical patterns, a retreat toward $105,000-$100,000 remains within normal seasonal expectations.

Crypto trader Roman Trading highlighted structural concerns about Bitcoin’s recent rally. BTC/EUR has not reached new all-time highs since last year, suggesting recent gains depend more on US dollar weakness than organic demand.

Source: TradingView

Source: TradingView

Bitcoin currently trades around $110,000 after briefly touching the $109,000 support level. The 12% correction from recent highs remains shallow compared to previous bull market pullbacks.

The September 2017 and 2021 corrections during bull markets saw Bitcoin retreat 36% and 24% respectively. A similar correction this September could push prices toward $87,000 before the bull market resumes.

Glassnode warned that Bitcoin dropped below the average cost basis of recent investors who accumulated during the May to July rally period at $110,800.

The post Bitcoin (BTC) Price Prediction: $2.7 Billion Whale Dump Triggers Massive Leverage Flush appeared first on CoinCentral.

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For