Bitcoin (BTC) Price Today: Bitcoin Struggles as Whale Selling Overshadows Fed Rate Cut Optimism

Despite dovish remarks from Federal Reserve Chair Jerome Powell that hinted at future rate cuts, investor optimism was short-lived. Whale selling, ETF outflows, and cascading liquidations have taken center stage, overshadowing any potential relief from macroeconomic policy.

On Sunday, a massive 24,000 BTC sell-off triggered one of the sharpest moves of the month. “When one wallet dumped 24K BTC, the whole market felt it,” one analyst noted, pointing to how vulnerable Bitcoin remains to large holders. The sell-off caused over $550 million in long liquidations, with more than 160,000 traders wiped out in a single day, according to CoinGlass.

Market Overview: Bitcoin Technical Analysis and Key Levels

Bitcoin’s technical indicators are flashing caution. The cryptocurrency recently rejected its broken trendline and slipped below its 100-day Exponential Moving Average (EMA) at $110,865, raising the risk of deeper declines toward the 200-day EMA near $103,600.

Bitcoin battles to reclaim $116K resistance, with eyes on a $120K breakout if $110K–$112K support holds. Source: @NihilusBTC via X

The Relative Strength Index (RSI) now sits around 40, a level that suggests bearish momentum is gaining ground after failing to reclaim neutral territory. Meanwhile, the MACD indicator registered a bearish crossover last week, supporting the downside case.

For Bitcoin to regain strength, analysts say it must reclaim resistance at $116,000 while holding firm above the $110,800–$112,000 support zone. Failure to do so could open the door to a correction toward $108,000 or even $103,000.

Whale Activity and ETF Outflows Add Pressure

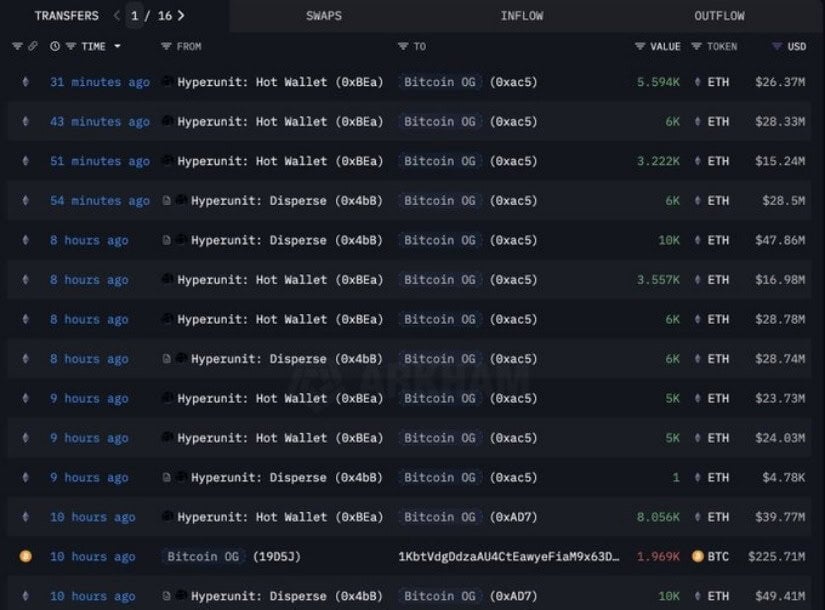

The flash crash was not an isolated event. Blockchain data shows that a so-called Bitcoin OG wallet moved more than 22,700 BTC ($2.6B) onto exchanges within days, intensifying selling pressure. To make matters worse, the wallet rotated much of its position into Ethereum, raising questions about whale sentiment toward Bitcoin in the short term.

Bitcoin OG dumps billions in BTC after moving over 22,000 coins to exchanges. Source: @lookonchain via X

Institutional flows have also turned negative. Spot Bitcoin ETFs recorded $1.17 billion in outflows last week, marking their worst week since early March. Analysts warn that if redemptions continue at this pace, Bitcoin could face further turbulence as ETF managers offload BTC into an already fragile market.

Expert Insights: Fed Optimism Meets Market Reality

Jerome Powell’s Jackson Hole speech initially sparked optimism across risk assets, including cryptocurrencies. “The framework calls for a balanced approach when the central bank’s goals are in tension,” Powell said, hinting at a pivot toward flexible inflation targeting. But traders quickly shifted their focus back to the crypto-specific headwinds dominating the market.

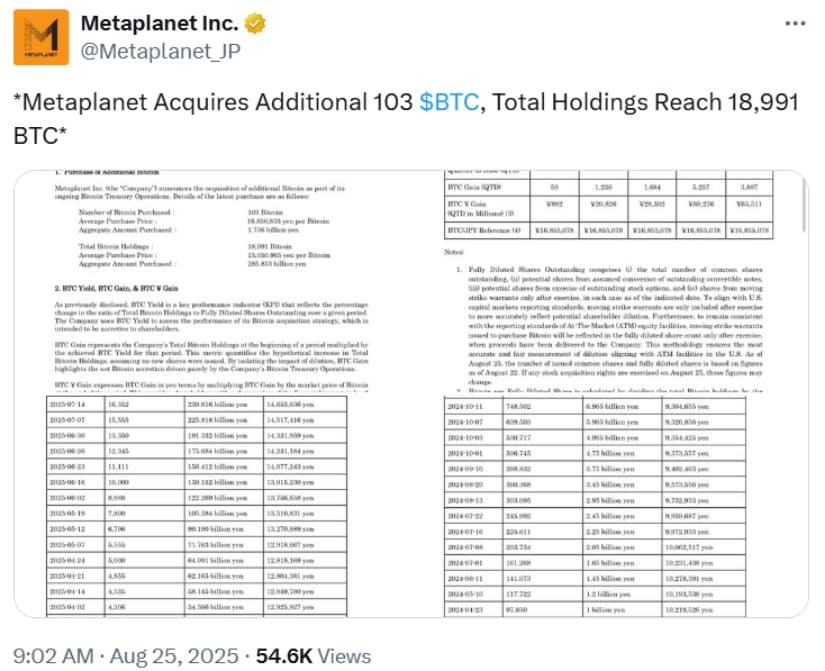

Metaplanet boosts reserves with 103 more BTC, raising total holdings to 18,991. Source: @Metaplanet_JP via X

Despite the sell-off, some analysts see opportunity. Data from Santiment shows Bitcoin’s 30-day MVRV ratio hovering around -3.37%, close to the “reversal zone” near -4%, where historical recoveries have often begun. “If all coins were sold today, most traders would realize losses. This suggests Bitcoin could be undervalued,” Santiment noted.

There are also signs of resilience from corporate buyers. Japan’s Metaplanet, often dubbed the country’s “MicroStrategy,” announced it purchased another 103 BTC, bringing its holdings to nearly 19,000 BTC. Such moves highlight the ongoing belief in Bitcoin as an inflation hedge and long-term store of value, even amid volatility.

Bitcoin’s Outlook: What’s Next for BTC Price Prediction?

The path forward for Bitcoin hinges on whether buyers can stabilize price action above the $110,800–$112,000 level. A recovery toward $116,000–$118,000 remains possible if selling pressure eases and ETF flows stabilize. However, persistent whale activity and institutional outflows could drag Bitcoin lower, with $108,000 emerging as the next key battleground.

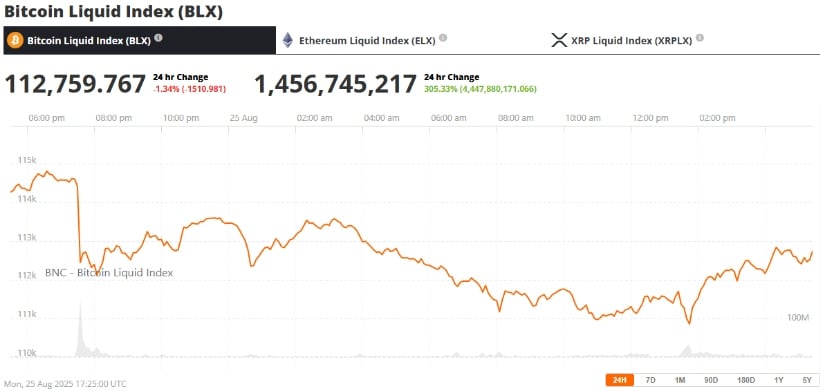

Bitcoin (BTC) was trading at around $112,759, down 1.34% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

With the Bitcoin halving in 2025 drawing closer, long-term investors remain focused on the bigger picture. Miner revenue, on-chain activity, and demand for Bitcoin ETFs will all play crucial roles in shaping whether BTC can reclaim momentum as the year progresses.

For now, the spotlight is on Bitcoin whale alerts, ETF news, and Powell’s policy direction—three factors likely to decide if Bitcoin’s latest stumble is just a bump in the road or the start of a deeper correction.

You May Also Like

Unlocking Massive Value: Curve Finance Revenue Sharing Proposal for CRV Holders

Best Crypto To Buy Now: Pepeto vs BlockDAG, Layer Brett, Remittix, Little Pepe, Compared