CZ’s “Like” for Travala caused the price of the coin to surge. What other Binance concept coins may be worth paying attention to?

Author: Nancy, PANews

Recently, as the BNB Chain ecosystem continues to heat up, Binance concept coins have become one of the directions for the market to ambush. For example, a recent tweet by founder CZ about project investment directly pushed the token to surge several times, which also reflects the high level of market attention.

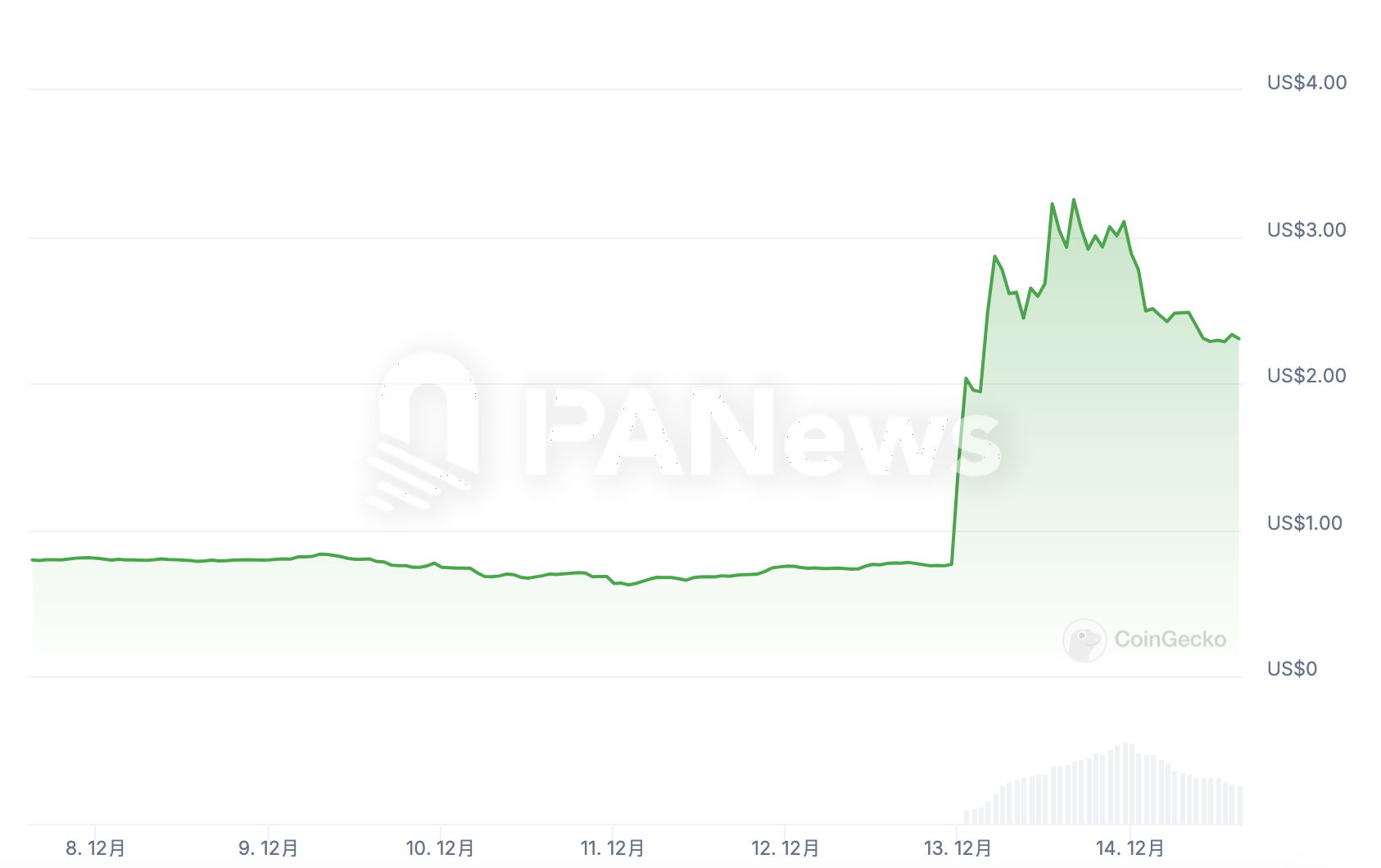

Binance investment news drives AVA price up

On December 12, CZ posted a tweet reviewing Binance’s early investment in the crypto travel platform Travala, “We invested in the crypto travel platform Travala before the COVID-19 pandemic and before the crypto winter, and we persisted.” This tweet immediately sparked heated discussions in the market, and the price of Travala’s token AVA soared, with the highest increase of about 4.3 times, becoming the focus of the market that day.

It is reported that Travala is a blockchain-based travel booking platform that can now accept over 100 cryptocurrencies, and its service scope has covered over 2.2 million hotels in 230 countries. As early as its establishment in 2017, Travala received multiple rounds of financing support from investors including Binance. At the same time, the platform also announced a strategic merger with the flight booking platform TravelbyBit and successfully connected to the Binance ecosystem.

In addition to Binance's long-term investment and support, Travala's solid business foundation and innovative business model also provide solid support for the surge in its tokens. As the first crypto-native travel booking platform listed by Google Hotels, it has been building its business over the past few years. For example, Travala recently announced that it has integrated with Solana, expanding to a third network in addition to Ethereum and BNB Chain.

In addition, Travala has also achieved considerable revenue. Travala recently revealed that the platform's annual revenue has reached US$100 million, and plans to launch a dedicated Bitcoin reserve to further strengthen its financial foundation and promote future growth.

15 Binance concept coins, DeFi is the key track to bet on

In addition to Travala, the Binance ecosystem has been gaining popularity recently. PANews has also previously taken stock of some potential projects in the BNB Chain ecosystem that have not yet issued tokens .

According to incomplete statistics from PANews, Binance has publicly invested in at least 110 crypto projects/enterprises. Among them, based on the information disclosed by Binance, PANews has compiled 15 projects with cumulative financing exceeding 10 million US dollars and their market performance. These projects all support the BNB Chain ecosystem and have landed on Binance.

First, in terms of financing scale, the investment of these 15 crypto projects is quite impressive, with a total of more than US$940 million in funding support, and an average financing amount of approximately US$62.873 million. Among them, the financing scale of LayerZero, 1inch and Axie Infinity all exceeded the US$100 million mark, significantly raising the average level of overall financing.

Judging from the financing lineup of these projects, Binance and Binance Labs have participated in the investment of these projects together with a series of star venture capital institutions from the crypto and traditional circles, including Galaxy Digital, Multicoin Capital, Samsung Next, Coinbase Ventures, PayPal Ventures, Galaxy Digital, Wintermute and PayPal Ventures, etc. The participation of these well-known investors not only provides strong endorsement and a large amount of resource injection for the project, but also further enhances market attention and investor confidence.

From the perspective of project types, half of the 15 projects are from the DeFi track, covering sub-tracks such as DEX, lending, LSD and cross-chain, which shows that the rapid development and innovation of DeFi are attracting the attention of Binance and other venture capital institutions. At the same time, other investment projects are mainly concentrated in emerging fields such as L2, social networking and blockchain games, showing the diversification of Binance and other venture capital in ecological layout, and will further enrich the diversity of its ecology.

In terms of market size, the total market capitalization of these 15 projects has exceeded US$6.18 billion, with an average market capitalization of approximately US$410 million, which is generally biased towards small-cap projects. It is worth noting that the market capitalizations of the three major projects, AXS, AXL, and ZRO, are respectively US$1.22 billion, US$810 million, and US$730 million, far exceeding the average. The market capitalizations of most other projects are lower, with about 50% of the projects having a market capitalization lower than the overall average. This shows that the projects in which Binance is involved are still at a stage of relatively small market capitalization as a whole, which means that they may have higher growth potential.

The circulating market value is also related to the performance of token prices. From the perspective of market performance, the average increase of the 15 tokens in the past year was about 18.6%, significantly lagging behind the performance of mainstream currencies such as Bitcoin and Ethereum during the same period. Among them, only the token prices of ID, ZRO and ANKR have achieved significant increases, far exceeding other projects, showing strong market appeal. In contrast, the prices of tokens such as RDNT, GMT and CYBER have not achieved effective increases, and their rates of return are still negative. These projects are not the hot spots of the current market and may need to be rotated by funds.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

CME Group to launch options on XRP and SOL futures