Bitcoin Price in Extreme Fear Zone, But Is This Time Different?

The post Bitcoin Price in Extreme Fear Zone, But Is This Time Different? appeared first on Coinpedia Fintech News

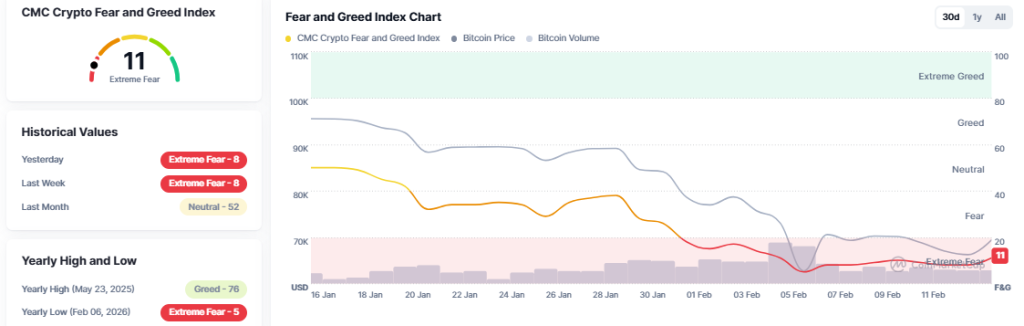

The Bitcoin price is once again sitting in “Extreme Fear.” Historically, that label has marked some of the best accumulation zones the market has ever seen. But 2026 isn’t seeing one particular event based crash. And the structure behind current selloff looks very different.

Let’s rewind. Back in 2012, price collapsed to $7.10. During the Mt. Gox crisis, it dropped to $421.55. The 2017–2018 crash bottomed at $3,129.39. The COVID panic low came in at $3,852.65. Then the FTX-driven washout pushed price to $15,642.12. Each of those moments coincided with extreme fear readings. Each time, institutional interest was minimal, and government support was nonexistent, and retail capitulation defined the mood. And eventually, rallies followed.

Extreme Fear Then and Now

Fast forward to the 2026 crash. A low of $60,001.01 on Coinbase has printed in February while sentiment sits in the same “Extreme Fear” zone.

On paper, that sounds familiar. Historically, fear extremes have aligned with major bottoms on the Bitcoin price chart. But here’s the complication: the market today is saturated with institutional flows, ETF structures, and macro-driven liquidity cycles.

This isn’t just retail panic anymore. The fear and greed index may reflect retail sentiment, but in a market increasingly influenced by ETF sponsors and large capital allocators, that dial might not be accurate this time.

ETFs and Macro Pressure

Well, here’s the reason why a dip has more odds. If institutions tend to scale in at discounted levels, the indicator could simply be lagging liquidation events rather than signaling recovery. In other words, extreme fear might just be a snapshot of damage already done and its not confirmation that selling pressure has ended.

Macro-driven selloffs also muddy the picture. BTC/USD doesn’t move in isolation when broader markets tighten. Risk-off environments can override sentiment-based signals, especially if forced liquidations are still unfolding.

Historically, the most powerful accumulation phases began when even dip-buyers went quiet. We’re approaching that disbelief phase, but whether it’s fully played out is another question.

Whale Activity Adds Pressure

And then there’s whale activity. A prominent known whale wallet recently deposited another 5,000 $BTC thats worth $348.82 million into Binance. Large inflows to exchanges often precede potential distribution. That doesn’t guarantee selling, but it adds supply-side uncertainty at a fragile moment.

So what does this mean for Bitcoin price prediction narrative?

Extreme fear alone isn’t a timing tool. Until forced liquidations ease and spot demand absorbs supply without heavy reliance on sentiment gauges, the Bitcoin price remains vulnerable to another leg lower beneath $60K even if history suggests these zones eventually become accumulation opportunities.

You May Also Like

X Üst Düzey Yetkilisi, Platformda Kripto Paralar İçin Müjdeyi Verdi! Ancak Bazı Altcoinler İçin Kötü Haber Olabilir

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise