Revisiting the "Grayscale Effect" of the last bull market: 14 tokens have a return rate of over 200%, and the market cycle has a significant impact

Author: Nancy, PANews

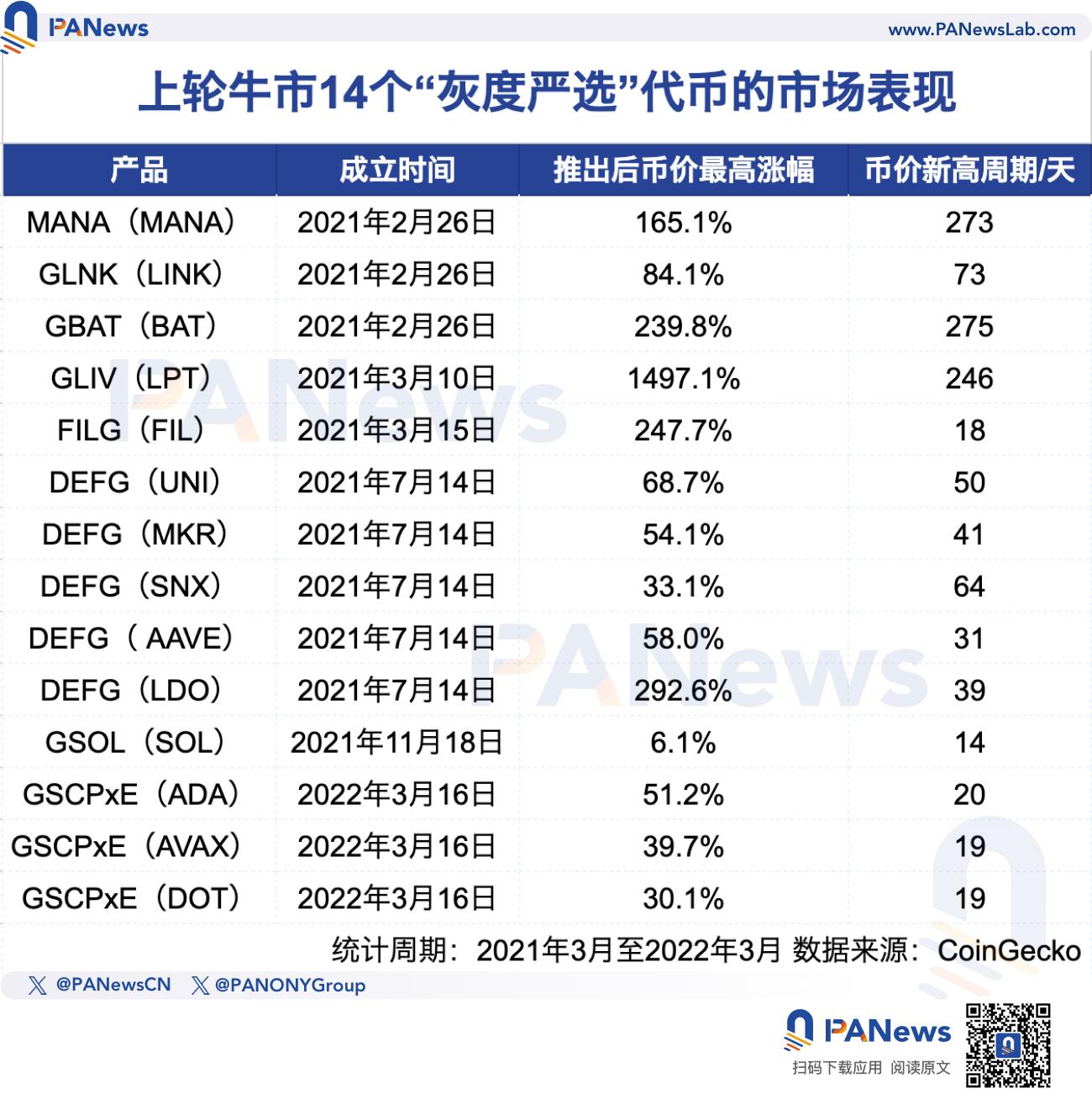

In recent times, with the soaring prices of coins such as SUI and ZEN, the "Grayscale effect" has reappeared, and Grayscale's holdings have become one of the market investment indicators. So, how do Grayscale's carefully selected crypto tokens perform in terms of return on investment? In this article, PANews reviewed the market performance of the 14 tokens involved in the crypto trust fund launched by Grayscale during the last bull market cycle, from March 2021 to March 2022.

The average rate of return exceeds 200%, and the market cycle has a significant impact

During the last bull market, Grayscale launched 14 cryptocurrency trust products through the over-the-counter market, DeFi fund DEFG and GSCPxE fund. These products were launched one after another in about a year. Judging from the time of product launch, Grayscale began to launch related token funds in the early stage of the bull market, and began to accelerate the layout frequency in the middle and late stages.

In terms of return on investment, the average maximum increase of these 14 tokens after the launch of Grayscale was 204.8%. Among them, the increases of LPT, LDO and BAT were particularly outstanding, reaching 1497.1%, 292.6% and 239.8% respectively. In contrast, the increases of SOL, DOT and SNX were far below the average.

From the perspective of the length of time required for investment to generate returns, the average period for the 14 tokens to reach a new high is 84.4 days, among which BAT, MANA and LPT require a longer period, basically exceeding 250 days, but the rate of return is also relatively high; while SOL, FIL, AVAX and DOT reached new highs in a shorter period of time, but their gains were relatively limited, and this period was in the market adjustment period after Bitcoin reached a new high. In addition to indicating that under normal circumstances, the longer the investment period during the bull market, the more advantageous the holding rate of return, this phenomenon is also related to the time of product launch. In the past, the rising cycle of the sector showed that most public chains were the first wave of rising targets in the bull market. Most of these projects launched by Grayscale achieved good gains in the early stage, resulting in limited room for later growth.

However, this difference is also affected to some extent by changes in the market cycle. Specifically, the average increase of the token funds launched by Grayscale in the early bull market in the first half of 2021 was 446.8%; in the middle of the bull market from April to November 2021, the increase dropped to 85.4%; by March 2022, when the crypto market was in a correction period, the increase of the tokens launched was only 40.3%. It can be seen that Grayscale's return on investment is greatly affected by market cycle fluctuations and shows obvious cyclical characteristics.

From this point of view, although Grayscale's cryptocurrency trust products provided considerable returns during the bull market, their performance was significantly affected by market fluctuations. Therefore, investors should fully consider the overall market trend when making investment decisions.

Participate in multiple explosive token layouts to expand the scope of investment products

Recently, the prices of multiple tokens have performed strongly, and Grayscale’s layout may play an important role in driving market trends.

For example, XRP, whose price broke through a multi-year high some time ago. In September this year, Grayscale announced that it would re-launch the first US XRP Trust Fund and officially open it to qualified investors in the near future. You should know that as early as January 2021, Grayscale withdrew from the XRP Trust and liquidated its tokens due to Ripple's legal dispute. This shift was also interpreted by the outside world as paving the way for a potential XRP spot ETF, and the price of XRP continued to rise in the following months, which may indicate the market's positive response to Grayscale's move.

The price of SUI has also performed very strongly in the past few months. A few months ago, Grayscale updated its investment strategy and announced the top 20 tokens that are expected to rise sharply by the end of 2024, including the addition of 6 new tokens such as SUI and TAO. At the same time, Grayscale also started the investment layout of SUI, announcing in August this year that it would launch GrayscaleSuiTrust, which will be officially opened to qualified investors in the near future.

Another token worth noting is ZEN, which has also seen a gratifying rise in price recently, with a 30-day increase of about 215%. After recently increasing its holdings of ZEN tokens, Grayscale also announced that it had submitted Grayscale Horizen Trust (ZEN) 8-K form to the SEC, allowing investors to gain exposure to ZEN tokens in the form of securities.

In addition to the above projects, Grayscale has also provided legitimacy and recognition for more crypto assets. On December 24, Grayscale announced that it would open private subscriptions for 22 cryptocurrency trust products to qualified investors, including mainstream tokens such as AAVE, AVAX, LINK, SOL, XRP, and fund products in subdivided tracks such as DeFi and AI. Investors can subscribe according to net asset value (NAV). The products opened this time include theme funds such as Grayscale Decentralized AI Fund and Grayscale Decentralized Finance Fund, as well as single asset trusts of emerging protocols such as Bittensor, Lido DAO, and Optimism.

In addition, Grayscale is further accelerating its business expansion and seeking more professional talents to cope with increasingly complex market demands. Earlier this month, Grayscale announced the launch of recruitment, involving positions including: tax director, ETF product senior manager, digital asset trader, portfolio manager, product manager and engineering director.

Although the specific impact of these measures on currency price changes has not yet fully emerged, Grayscale will further promote crypto assets into the mainstream market by providing investors with more diversified and professional investment products.

Related reading: A review of 21 Grayscale crypto trust funds: some have risen 10 times, while others have been bearish all the way. It is easy to step on the last train of the bull market and become a counter-indicator of the market

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates