From Apes to Punks, NFTs roar back with triple the buyers

The NFT market has staged a strong recovery NFTs are staging a comeback, with buyer activity nearly tripling and sales volume rising by 30.09% to $173.2 million.

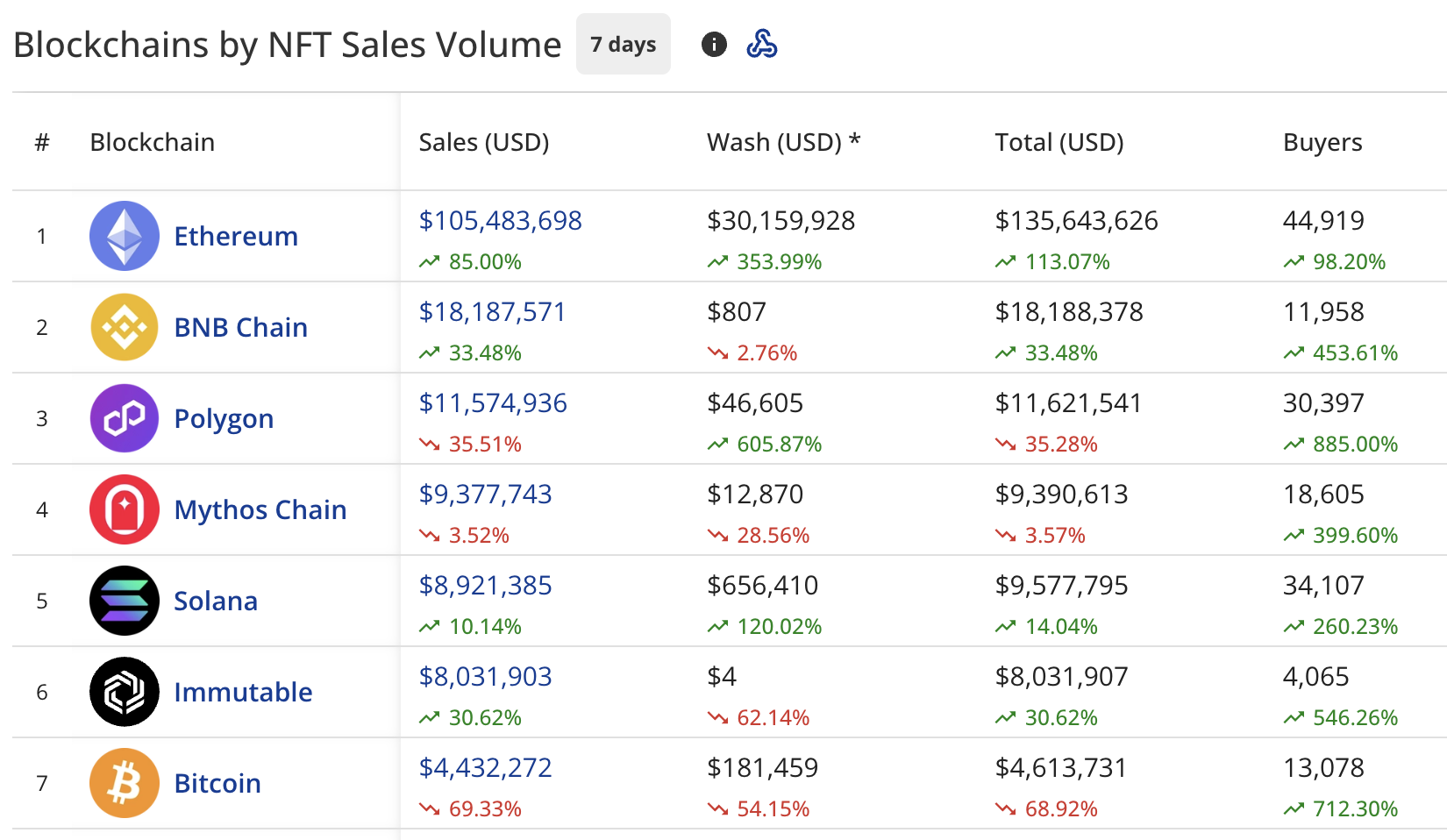

New data from CryptoSlam reveals that NFT buyers and sellers surged, while total transactions declined. This suggests renewed market participation is concentrated in higher-value trades.

Ethereum led the pack with an 85% weekly gain—though it also saw wash trading soar 354%. Collections like CryptoPunks and Bored Ape Yacht Club posted eye-catching sales spikes, underscoring how blue-chip NFTs continue to drive the market even in a turbulent crypto backdrop. Read on for more:

- NFT sales rebounded strongly with 30% growth to $173.2 million

- Bored Ape Yacht Club dominated both collection rankings and individual sales

- Market participation nearly tripled as buyers returned

According to data from CryptoSlam, market participation has rebounded with NFT buyers surging by 190.41% to 214,716 and NFT sellers increasing by 168.71% to 115,289.

However, NFT transactions have decreased by 10.65% to 1,553,949.

The sales jump is happening as Bitcoin (BTC) price has dropped to the $117,000 level after hitting a new ATH of $124,000.

At the same time, Ethereum (ETH) has dropped to $4,400 after hitting $4,700. The global crypto market cap is now $3.97 trillion.

Ethereum wash trading jumps

Ethereum has strengthened its leading position with $105.4 million in sales and jumped by 85% from the previous week.

Ethereum’s wash trading has also surged by 353.99% to $30.1 million.

BNB (BNB) Chain has climbed to second place with $18.1 million, rising 33.48%. Polygon (POL) has fallen to third position with $11.5 million, declining 35.51%.

Despite this drop, Polygon’s wash trading has surged by 605.87% to $46,605.

Mythos Chain maintains fourth place with $9.3 million, down 3.52%. Solana (SOL) holds fifth with $8.9 million, up 10.14%.

Immutable (IMX) has climbed to sixth place with $8 million, representing a 30.62% increase. Bitcoin has dropped to seventh place, with $4.4 million, a 69.33% decline.

The buyer count has increased across most blockchains, with Polygon leading at 885% growth, followed by Bitcoin at 712.30% and Immutable at 546.26%.

Bored Ape Yacht Club sales jump 500%

CryptoPunks has reclaimed the top spot in collection rankings with $21 million in sales, surging 90.95%. The collection has seen growth in transactions (121.05%) while maintaining stable buyer and seller counts.

Bored Ape Yacht Club has jumped to second place with $15.6 million, jumping by almost 500%. The collection has more than doubled its transactions (161.40%) and seen growth in both buyers (22.41%) and sellers (20%).

The Courtyard on Polygon has fallen to third place with $10.3 million, a decline of 35.22%. The collection has seen substantial drop in buyers (67.81%) and sellers (48.80%).

SpinNFTBox on BNB Chain holds the fourth position with $7.2 million, representing a 56.17% increase. Pudgy Penguins sits in fifth with $6.3 million, up 31.51%.

Notable high-value sales from this week include:

- Bored Ape Yacht Club #4795 sold for 200 ETH ($909,183)

- Bored Ape Yacht Club #2337 sold for 140 ETH ($634,809)

- Bored Ape Yacht Club #9670 sold for 140 ETH ($633,982)

- Bored Ape Yacht Club #7706 sold for 140 ETH ($633,982)

- Bored Ape Yacht Club #9670 sold for 100 ETH ($453,435)

You May Also Like

nLIGHT to Announce Fourth Quarter and Full Year 2025 Financial Results on February 26th

When silver became a meme stock, retail investors ultimately caught the falling knife.