XRP Price Prediction If Bitcoin Price Crash to $50K: Is XRP Better Positioned Than BTC?

The post XRP Price Prediction If Bitcoin Price Crash to $50K: Is XRP Better Positioned Than BTC? appeared first on Coinpedia Fintech News

Crypto markets remain under pressure as Bitcoin struggles to regain footing, with downside risks increasingly centered around the $50,000 level. Risk appetite has thinned, ETF outflows have accelerated, and trader confidence across majors like Bitcoin and Ethereum continues to erode. XRP has not been immune to the sell-off. The price has moved lower alongside the broader market, reflecting its correlation with Bitcoin during risk-off phases. However, beneath the surface, the structure of XRP’s price decline, and the behaviour of traders around it tells a different story.

While Bitcoin appears to be grappling with sentiment capitulation, XRP’s on-chain and positioning data suggest the asset may be undergoing a controlled reset rather than a breakdown. That divergence raises a key question for the coming weeks: If Bitcoin price falls further, is XRP price better positioned to recover first?

Sentiment Divergence: Bitcoin Capitulates While XRP Holds Its Ground

Recent data highlights a growing emotional gap between Bitcoin and XRP traders. Following last week’s sharp drawdown, sentiment toward Bitcoin has turned extremely bearish, a level typically associated with fear-driven selling and loss of conviction among retail participants. Ethereum sentiment has tracked a similar path, reinforcing the idea that broader market confidence remains fragile. XRP, however, is showing a more constructive profile.

Despite price weakness, sentiment around XRP remains comparatively optimistic. This does not signal immediate bullish momentum, but it does indicate that traders are not rushing to abandon positions. Historically, this type of sentiment divergence often emerges near local bottoms, especially when broader markets are still dominated by fear. Markets tend to move against the prevailing emotional bias of retail traders. With Bitcoin sentiment approaching extremes, XRP’s relative resilience suggests it may be closer to sentiment exhaustion than escalation, a condition that often precedes stabilization or short-term relief rallies.

The ETF Story the Market Isn’t Talking About

While crypto prices remain under pressure, ETF flow data is quietly sending a message that doesn’t fully match the fear visible on Bitcoin’s chart. As Bitcoin slid lower, BTC spot ETFs saw roughly $258 million in net outflows, extending a clear pattern of institutional de-risking. Ethereum followed the same path, with around $72 million in outflows, reinforcing the view that large allocators are cutting exposure to high-beta majors rather than rotating deeper into risk.

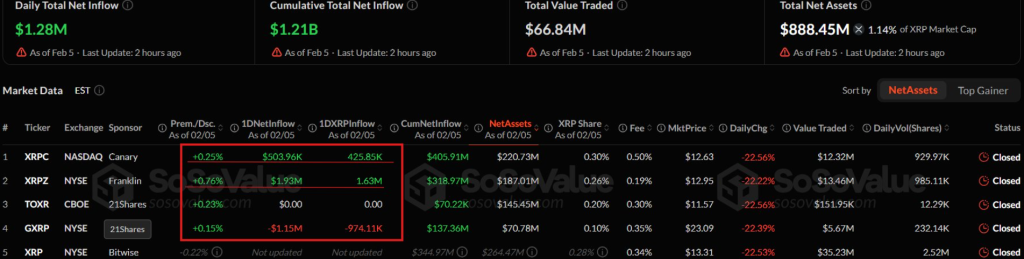

XRP, however, told a different story. Despite trading lower on the day, XRP-focused ETFs recorded net inflows of about $1.28 million, a modest figure, but notable in a market where capital was largely exiting elsewhere. More telling was activity: XRP ETF trading volume surged to nearly $79.2 million, pointing to active positioning rather than passive holding. Bitwise led the flow with roughly $40.6 million in volume, alongside participation from Franklin Templeton and Canary Capital. The takeaway isn’t outright bullishness but rotation, not abandonment. While Bitcoin and Ethereum absorb most of the selling pressure, XRP appears to be quietly holding institutional interest, even as the broader market remains cautious.

XRP Price Prediction: Can XRP Hold $1.30 and Turn the Trend Back Up?

XRP’s recent sell-off has been sharp, but it has now brought price into a zone that traders have been watching closely for weeks. The $1.30 region is not just a psychological level, it aligns with a broader demand area that previously acted as a springboard during earlier corrective phases. The current decline appears driven more by broader market weakness and Bitcoin-led risk aversion than by XRP-specific deterioration.

On the chart, XRP has unwound from its rising structure and slid into this demand pocket after a steady sequence of lower highs. If XRP manages to hold above $1.30 on a daily closing basis, the structure opens the door for a relief move back toward the $1.45–$1.50 zone, where prior breakdowns and short-term supply are stacked. A successful reclaim of that range would shift the narrative from correction to stabilization, with $2.00 coming back into focus as a medium-term objective rather than a distant upside. Meanwhile, a clean break of $1.20 would expose XRP to a deeper downside toward the $1.15–$1.20 region, where the next meaningful demand sits.

You May Also Like

DBS, Franklin Templeton, and Ripple partner to launch trading and lending solutions powered by tokenized money market funds and more

The Manchester City Donnarumma Doubters Have Missed Something Huge