Dogecoin (DOGE) Price: SpaceX Moon Mission in 2027 Fails to Spark Rally

TLDR

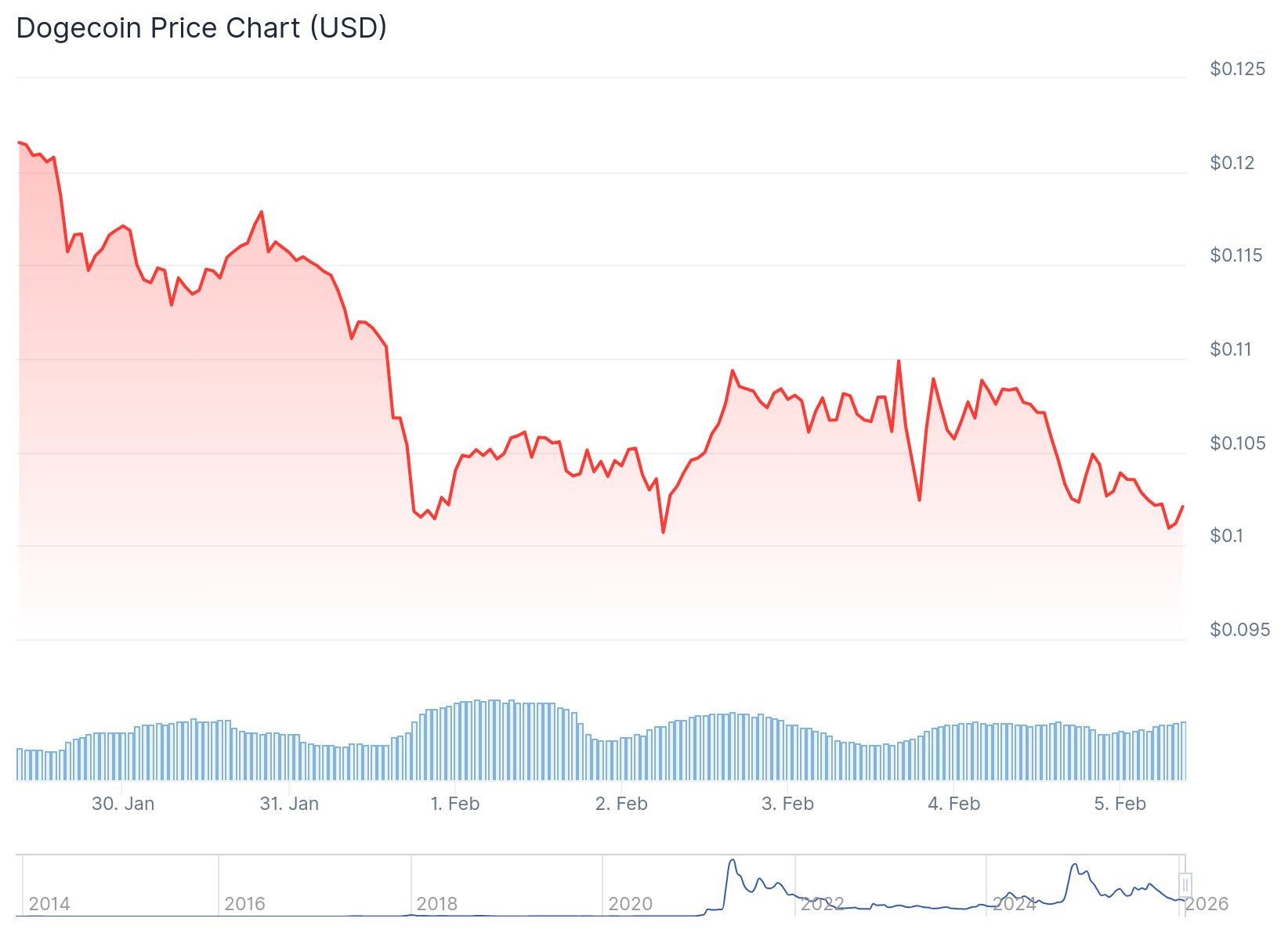

- Dogecoin price dropped 3.16% to $0.102, following a 17.8% weekly decline despite SpaceX mission announcement

- Elon Musk confirmed SpaceX plans to launch DOGE-1 mission in 2027, a Dogecoin-funded lunar satellite originally scheduled for 2022

- DOGE currently trades at $0.1016 with major support at $0.10 and resistance at $0.12

- Technical indicators show bearish momentum with MACD negative and RSI at 40.08, though some metrics suggest undervaluation

- The DOGE-1 CubeSat mission was fully financed in Dogecoin and would be the first cryptocurrency sent to space

Dogecoin price fell to $0.1016 after Elon Musk confirmed SpaceX will launch a Dogecoin-funded satellite mission in 2027. The meme cryptocurrency declined 3.16% to $0.102 in recent trading.

Dogecoin (DOGE) Price

Dogecoin (DOGE) Price

The drop comes after a difficult week that saw DOGE lose 17.8% of its value. The announcement of the SpaceX mission did not provide the price boost many investors expected.

Musk responded to a question on social media platform X about the DOGE-1 mission status. He suggested the launch could happen “maybe next year,” pointing to a 2027 timeline. The mission was originally announced in April 2021 but has faced multiple delays.

The DOGE-1 project involves a 40-kilogram CubeSat built by Geometric Energy Corporation. The satellite was fully financed using Dogecoin. It will be the first cryptocurrency physically sent to space.

SpaceX Vice President Tom Ochinero previously described the mission as a demonstration of crypto utility in space. The CubeSat is designed to gather lunar data during its mission.

The initial launch date was set for the first quarter of 2022. Geometric Energy CEO Samuel Reid later suggested a mid-2026 timeframe. Musk’s recent comments push expectations to 2027.

Market Reaction and Price Levels

Dogecoin price currently sits just above the critical $0.10 support level. The cryptocurrency briefly touched $0.108 before stabilizing around its current price.

DOGE rebounded from a Saturday low of $0.095. Traders are watching the $0.10 level closely as a key support zone. If this level fails, the next support sits at $0.09.

On the upside, resistance appears at $0.12. This level has blocked previous rally attempts. A break above $0.12 could signal a potential reversal in the downtrend.

The broader cryptocurrency market also declined by 3.89%. Bitcoin price approached the $70,000 mark during the same period. This contributed to the overall negative sentiment.

Trading volume data shows over $22.3 million in DOGE long positions were liquidated last weekend. This marked the third-largest Dogecoin liquidation event in 90 days. The liquidations came as part of $600 million in market-wide long position wipeouts.

Technical Indicators Point to Weakness

The MACD indicator shows negative momentum with the line below the signal. This suggests bearish pressure in the short term. The indicator formed a bearish crossover on January 17 that remains in effect.

The Relative Strength Index stands at 40.08. This places it slightly above oversold territory. An RSI reading near 31 on some charts suggests DOGE may be undervalued at current levels.

The Market Value to Realized Value ratio improved to -14.40% from -20.80% over the weekend. Negative MVRV values indicate traders hold unrealized losses. These levels historically attract swing traders looking for entry points.

The 7-day MVRV ratio moved to -1.16, showing some recovery. The long-to-short ratio sits at 1.02, indicating a slight bullish bias among active traders.

Some analysts point to a falling wedge pattern in DOGE price action. This pattern typically precedes bullish reversals. However, Dogecoin remains down 66% since October peaks.

If Dogecoin price breaks below $0.095, the next support level sits at $0.078.

The post Dogecoin (DOGE) Price: SpaceX Moon Mission in 2027 Fails to Spark Rally appeared first on CoinCentral.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For