Can XYZ outshine HYPE and AAVE this cycle? Analysts say yes, if BTC holds $100k

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

With Bitcoin holding strong, XYZ is gaining momentum as analysts predict it could outshine major DeFi contenders.

Table of Contents

- Undervalued XYZ memecoin prepares for major CEX debut

- Hyperliquid

- Aave

- Conclusion

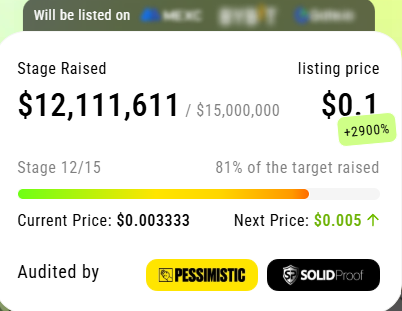

- New memecoin XYZ targets $0.1 as presale price hits $0.005 in Stage 14.

- Its presale nears $15m raise as CEX listing and token surge spark buzz.

- XYZVerse rewards fighters with airdrops, listings, and bold upside.

The spotlight has turned to XYZ as industry watchers highlight its big potential. Fresh predictions suggest XYZ could rise above HYPE and AAVE if bitcoin stays above $100,000.

Growing attention surrounds XYZ’s next moves and whether it can meet these high expectations. Curious investors are looking for clear signs that XYZ has the power to lead.

Undervalued XYZ memecoin prepares for major CEX debut

XYZVerse (XYZ) is the rising memecoin making waves in the crypto world, thanks to its bold presale trajectory, aiming to surge from $0.0001 to $0.1.

So far, it’s hit the halfway mark. Over $15 million has been raised, and XYZ is currently priced at $0.005. As the presale enters Stage 14, the price is set to climb to $0.01, giving early backers a chance to lock in greater returns before the next jump.

Following the presale, XYZ will be listed on both centralized and decentralized exchanges (CEXs & DEXs). While full details remain under wraps, the team has hinted at a major launch event.

Forged for fighters, fueled by champions

XYZVerse is more than just a memecoin — it’s a movement for those chasing outsized gains. It speaks to the ambitious, the driven, the fearless — much like athletes who fight for glory. XYZ is built for the thrill-chasers and profit-seekers.

At the heart of the project is XYZepe, the face of the fight, a symbolic meme warrior climbing the crypto ranks. Could XYZ follow in the footsteps of DOGE or SHIB? The stage is set.

Led by the community, powered by incentives

XYZVerse puts its community in the driver’s seat. Active participation earns real rewards, with 10% of the total supply — 10 billion XYZ — earmarked for one of the largest airdrops in history.

Backed by robust tokenomics, upcoming CEX and DEX listings, and regular token burns, XYZ is engineered for sustained growth and community-driven momentum.

From airdrops to rewards and exclusive perks, XYZVerse offers more than hype. It offers a shot at something legendary.

Airdrops, rewards, and more — join XYZVerse to unlock all the benefits.

Hyperliquid

Hyperliquid’s current price moves between 33.81 and 44.35. The coin slid 11.63 percent over the past week, almost flat over a month with a minus 1.23 percent, yet still up 56.14 percent since six months ago. The blend of short-term red and long-term green keeps traders alert.

The 10-day moving average at 38.72 now stands a touch above the 100-day at 38.26, hinting at steady momentum. RSI near 53 and stochastic at 65 stay in the middle zone, while MACD remains slightly positive at 0.1314. Immediate support sits at 29.41 with a deeper floor near 18.87. Resistance appears at 50.49 and higher at 61.03.

If bidding pushes past 44 and clears 50.49, a rally toward 61.03 may follow, roughly 40 percent over the current top. Failure to hold 33 could invite a slide to 29.41, near 25 percent down from today, and even 18.87 in a worst case. Given the broad six-month climb and neutral indicators, odds lean toward a slow grind higher, though last week’s weakness signals more swings ahead.

Aave

AAVE keeps grinding inside a $234-$298 pocket after a rough week. The coin fell 9.92% in 7 days and 4.89% in a month, yet its 6-month line is almost flat at +0.23%. Short-term sentiment stays cautious, with momentum gauges stuck in low gear and the 10-day average ($263.79) sitting only a touch above the 100-day line ($258.42).

Bulls point to the deep oversold read on both the stochastic (8.949) and RSI-style meter (40.10). Those levels show sellers may be tired. A push above $297 could ignite a run at the nearest ceiling at $335, a jump of roughly 25% from the current midpoint. Clearing that opens a path to the second wall at $399, adding another 19%.

Bears argue that the weak MACD and soft trend leave the door open for fresh lows. A slip under $234 drags the price toward the main floor at $207.89, slicing about 20%. Failure there risks a slide to the long-term base at $144.24, which would mean another 30% hit. For now, the chart flashes a coiled spring: break $297 and upside takes the wheel; lose $234 and gravity wins.

Conclusion

HYPE and AAVE remain strong choices, but XYZVerse stands out with its unique sports-meme blend, early growth potential, and community focus, aiming to lead the next wave of memecoins.

To learn more about XYZ, visit its website, Telegram, and Twitter.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

Solana Treasury Firm Holdings Could Double as Forward Industries Unveils $4 Billion Raise