Market Sentiment Hits Rock Bottom: Why Digitap ($TAP) is the Best Crypto to Buy Now

The post Market Sentiment Hits Rock Bottom: Why Digitap ($TAP) is the Best Crypto to Buy Now appeared first on Coinpedia Fintech News

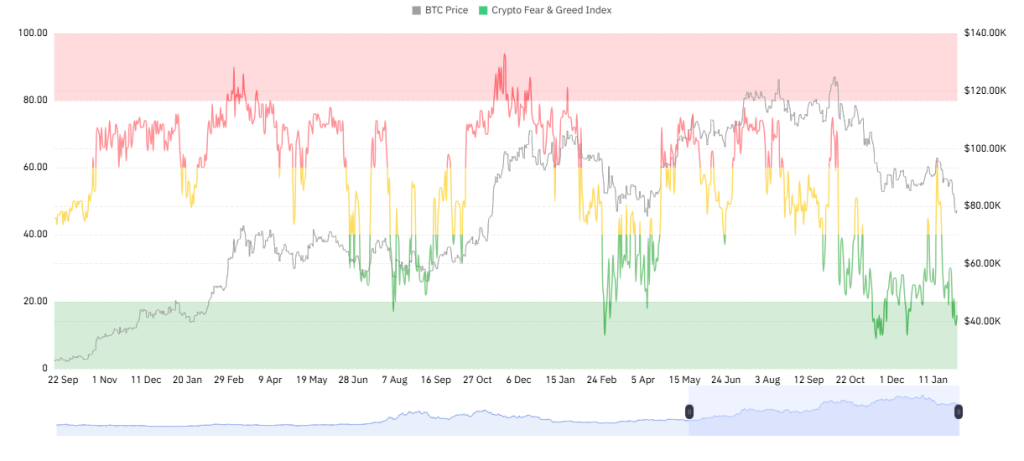

The early weeks of 2026 have delivered a harsh reality check to the crypto industry. The Fear and Greed Index sank to extreme fear levels. With Bitcoin (BTC) struggling to regain $80,000 and Ethereum (ETH) facing ongoing outflows, it is clear that a bear market has arrived.

Investors now want projects that offer real-world utility. In the current risk-off environment, investors are no longer gambling on unproven protocols. Instead, they are turning to Digitap ($TAP), an omni-bank ecosystem that has bridged the gap between decentralized finance and traditional global banking.

Digitap has built a live, downloadable app that blends crypto and fiat into one banking dashboard. This utility makes it the best crypto to buy this February. And $TAP is emerging as a favorite asset for investors looking to shield their portfolios from further losses.

Here is why over 120,000 wallets have already been connected to its dashboard.

Crypto Panic Peaks: Why Smart Money is Rotating to $TAP

Institutional capital is flowing out of traditional large caps due to increased volatility. Market sentiment has dropped to extreme fear in early February 2026, with the Fear & Greed Index reaching a yearly low of 14.

This severe drop followed a disastrous “Black Sunday” where Bitcoin collapsed below $75,000, wiping out more than $2.2 billion in leveraged positions. The macroeconomic pressures, consisting of US dollar strength and geopolitical tensions, resulted in widespread ETF outflows and institutional de-risking.

Nevertheless, smart money is always rotating elsewhere while retail panic peaks. These experienced investors are shifting their focus toward platforms that offer real-world utility like Digitap.

Its omni-bank ecosystem enables it to maintain steady utility despite the general market’s liquidity drought and technical bearish trend. This ability to thrive even during a weak market is the reason investors consider $TAP as the best altcoin to buy this February.

Why Smart Money is Betting on $TAP’s Real-World Digital Bank

The smart investors are looking for refuge in projects that generate revenue irrespective of market direction. Digitap thrives in these conditions because it is building a fully operational digital bank with its app already available on the Apple App Store and Google Play Store.

Notably, Digitap enables users to manage multi-currency accounts and virtual cards that offer near-instant transactions at near-zero fees. These components make $TAP’s crypto presale a lucrative investment opportunity.

The shift toward utility is dominating the 2026 cycle, with investors preferring projects that enable them to spend crypto like cash. They do not want assets that rely on hype and speculation to grow.

Digitap’s omni-bank offers a circular economy where transaction fees and currency swaps drive the ecosystem. In a market where sentiment has dropped considerably, the ability to spend crypto in the real world using a Visa-backed card is the largest fundamental floor for any crypto project.

Digitap’s Solana Integration Powers Instant Visa Spending

Digitap has been building an impressive infrastructure that appeals to most investors. A significant turning point happened when Solana-native deposits were officially launched on the platform. Digitap has an ecosystem that favors modern investors who want speed and cost-efficiency.

With this integration, Digitap now lets users top up their banking wallets using SOL, USDT, or USDC directly from the Solana network. Thus, it connects one of the world’s most active retail blockchains with over 80 million merchant locations that accept Visa card payments.

By leveraging Solana’s fast transactions and low fees, Digitap has eliminated the challenges that previously plagued crypto-to-fiat conversion. Users do not need to engage with a centralized exchange or wait for many hours or network confirmations.

Investors can move their Solana-based assets into the Digitap omni-bank and spend them instantly. This collaboration has resulted in increased demand and a huge influx of new users who want to enjoy the efficiency of payment finance (PayFi).

Crypto to Buy in Volatility: $TAP Presale Appeals at 66% Discount

While the prices of large altcoins swing wildly, influenced by macroeconomic news, the $TAP crypto presale provides users with a defined and predictable growth path. Currently available at $0.0467, the token is selling at a 66.64% discount from a set exchange listing price of $0.14.

For those investors who buy $TAP at its current price, they will access a built-in 200% gain before $TAP hits the open market. This predictability is a huge advantage in the current highly volatile market.

While other investors watch their portfolio decline alongside large-cap cryptos, $TAP holders have invested in an asset with a clear trajectory and a defined value floor.

With more than $5 million raised from the purchase of 213 million coins and Round 3 selling out quickly, there is huge demand for Digitap. It means the market wants projects that merge early-stage growth with a functional product.

$TAP’s Deflationary Tokenomics Give it Bear Market Resilience

The long-term growth potential of Digitap is also boosted by its exclusive deflationary mechanics and “Real Yield” staking. While most other projects use inflationary tokenomics to appeal to investors, Digitap is built with a fixed maximum supply of 2 billion tokens without any additional minting.

Furthermore, the project uses 50% of all profits to buy back and burn $TAP tokens or redistribute them to stakers, aiming to drive scarcity.

Digitap is highly appealing because it also offers a 124% APY in its current crypto presale staking program. The yield is underpinned by the revenue generated from the platform’s banking services. Therefore, as more investors use their Digitap Visa cards and transact on the platform, the rewards offered to holders increase organically.

In the current bear market conditions, this high-yield, revenue-backed staking reduces the impact of market-wide meltdowns. Also, it continuously increases the holders’ share of the total token supply.

$TAP Thrives Amid Market Fear with Live Utility

Market history shows that the most lucrative investment opportunities often arise when fear is high and the market is bleeding. Digitap offers an exclusive blend of a mature, live banking product and a high-growth crypto presale.

With its platform already serving over 120,000 wallets and its integration with Solana rails making spending easy, $TAP is the best crypto to buy in 2026. For investors who are fed up with the uncertainty of the current market, Digitap offers a defined, utility-driven path to outshine the cycle.

Discover how Digitap is unifying cash and crypto by checking out their project here:

- Presale: https://presale.digitap.app

- Website: https://digitap.app

- Social: https://linktr.ee/digitap.app

- Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise