Dogecoin (DOGE) Price: Multi-Week Decline Continues as ETF Demand Weakens

TLDR

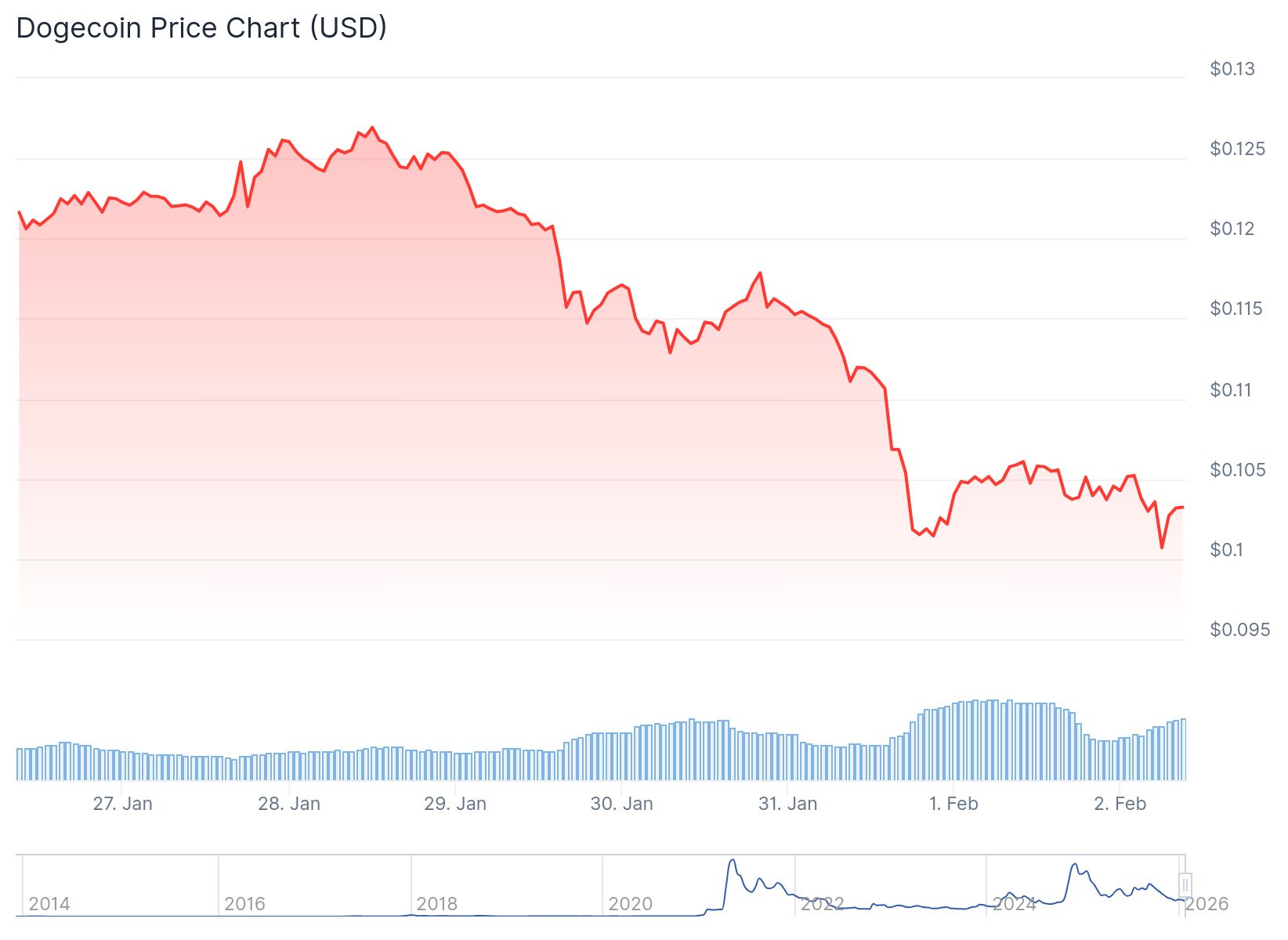

- Dogecoin dropped to its lowest level since October 2025, falling for four straight weeks to around $0.10.

- The coin formed a head-and-shoulders pattern and technical indicators show further downside risk toward $0.05900.

- Three Dogecoin ETFs launched recently but have seen almost no inflows, holding just $10 million combined.

- Despite the 16% price drop, on-chain data shows holders accumulated more DOGE during the decline.

- The MVRV ratio entered the opportunity zone between -17% and -25%, historically a sign of potential rebounds.

Dogecoin price extended its downward movement on Monday as the broader crypto market faced selling pressure. The meme coin dropped for the fourth consecutive week. DOGE reached its lowest point since October 2025.

Dogecoin (DOGE) Price

Dogecoin (DOGE) Price

The token now trades near $0.10 after falling from $0.4885 in November 2024. This represents a decline of more than 75% from its recent peak. The price briefly touched $0.094 during intraday trading before recovering slightly.

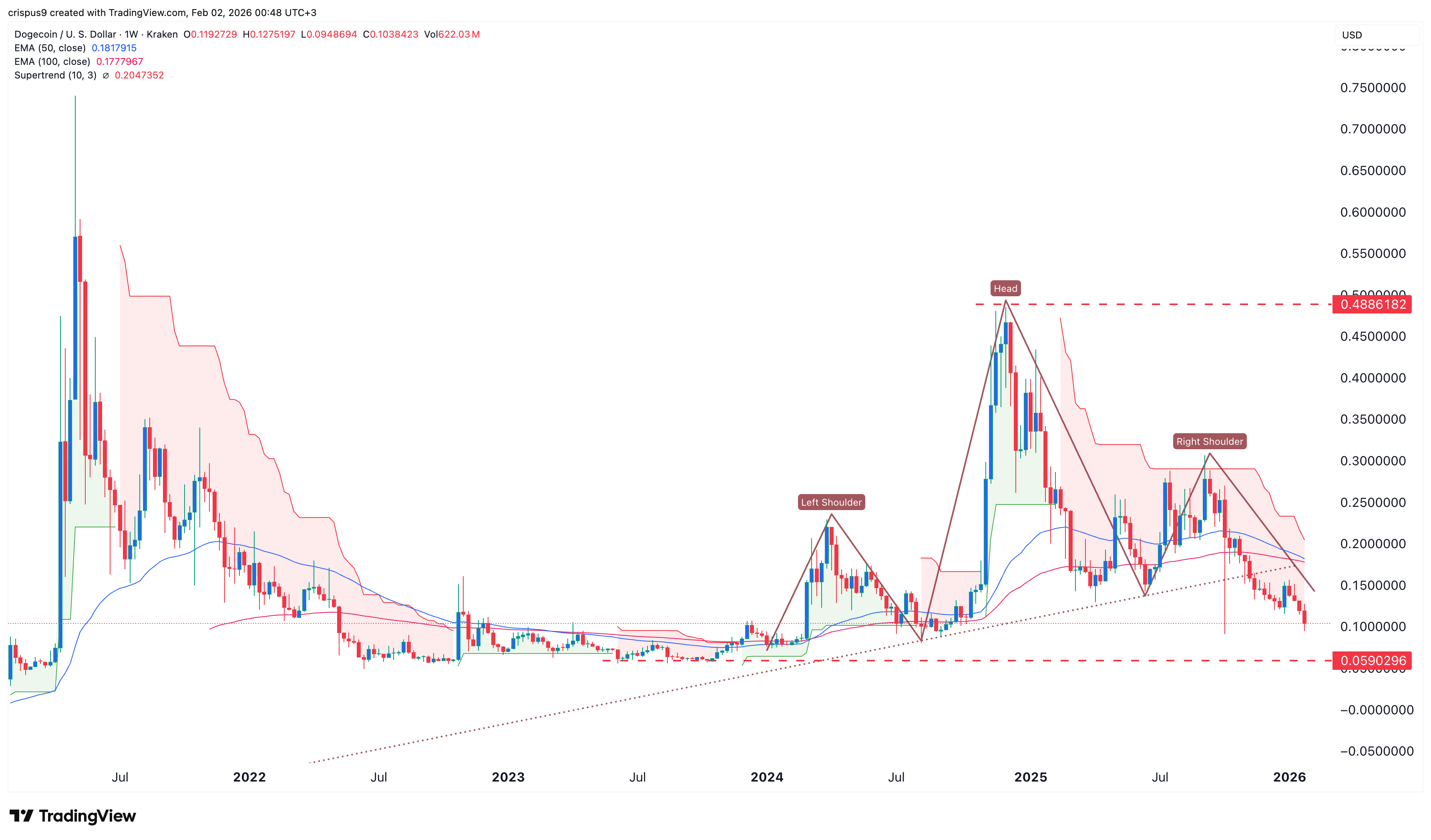

Technical analysis shows Dogecoin is forming a head-and-shoulders pattern on the weekly chart. This pattern typically signals further downside ahead. The coin has moved below an ascending trendline that previously provided support.

Source: TradingView

Source: TradingView

The 50-week and 100-week Exponential Moving Averages are approaching a crossover. This formation is known as a mini death cross. It often confirms bearish momentum in financial markets.

Dogecoin also trades below the Supertrend and Ichimoku Cloud indicators. The Relative Strength Index and MACD continue to show declining momentum. These technical signals point to a potential target of $0.05900. That level matches the lowest price seen in August 2023.

ETF Inflows Remain Weak

Three Dogecoin ETFs launched recently from Grayscale, 21Shares, and Bitwise. The funds have attracted minimal investor interest since their debut. Combined net inflows total just $6.4 million across all three products.

The ETFs currently hold $10 million in total assets under management. Inflows have dried up completely in recent days. No new money entered the funds during the past week.

The broader meme coin sector has contracted sharply. Total market capitalization for meme coins dropped from over $100 billion in 2025 to $37 billion currently. Most meme tokens posted double-digit percentage losses during this period.

The crypto market decline stems from multiple factors. Kevin Warsh received a nomination as the next Federal Reserve Chair. Geopolitical tensions added to market uncertainty. Cryptocurrencies failed to act as safe-haven assets during recent volatility.

Holders Accumulate During Decline

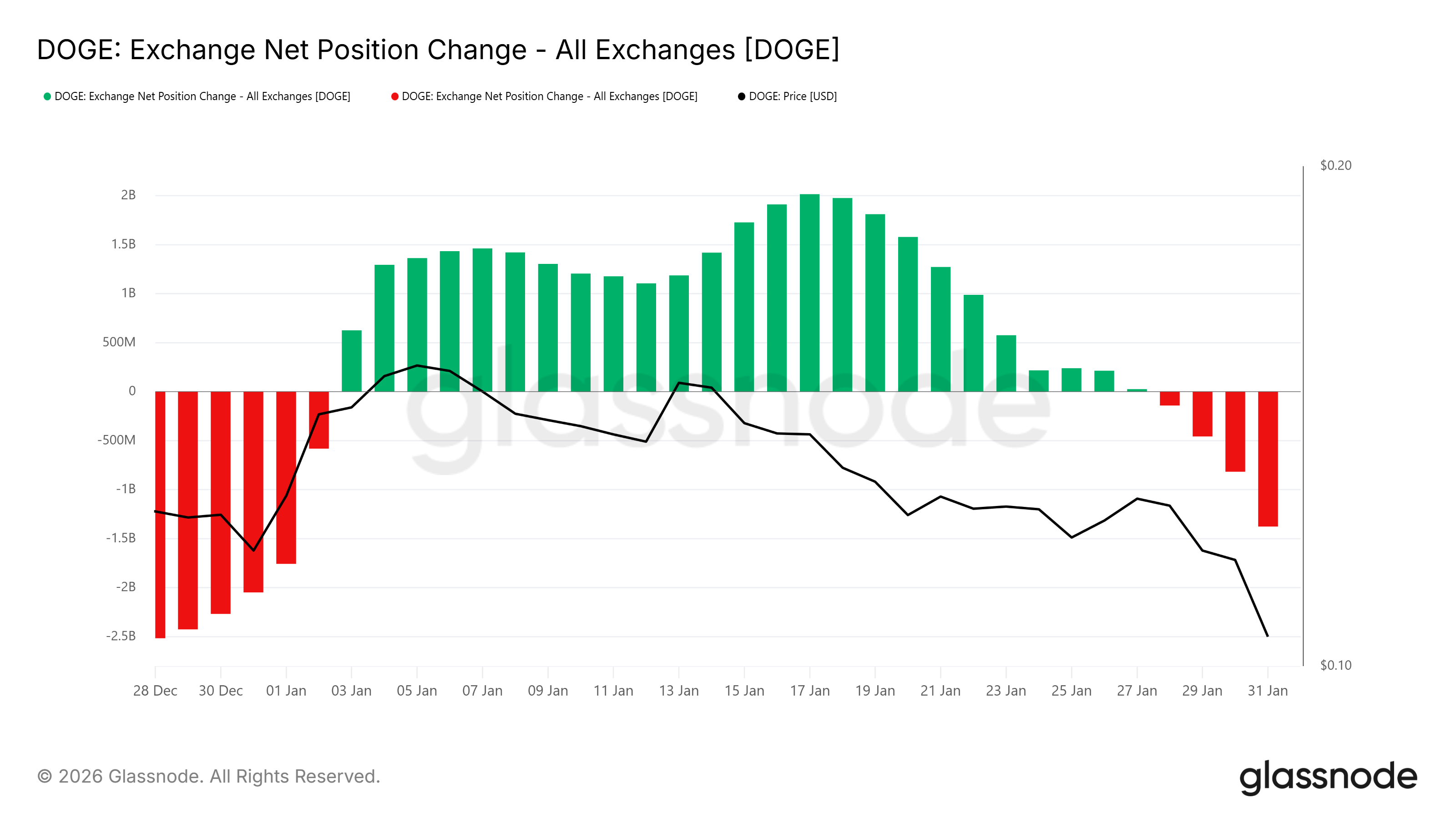

On-chain data reveals a different story about Dogecoin holder behavior. Exchange net position change showed rising accumulation as prices fell. Buyers stepped in as DOGE dropped 16% over four days.

Source: Glassnode

Source: Glassnode

This buying activity suggests investors viewed the price decline as an entry opportunity. Informed participants increased their exposure at lower levels. The accumulation helped stabilize the price around $0.10.

The Market Value to Realized Value ratio entered the opportunity zone. DOGE’s MVRV currently sits between -17% and -25%. This range indicates unrealized losses across the network.

Historical patterns show Dogecoin often rebounds when MVRV reaches this zone. Holders typically avoid selling at a loss. Accumulation tends to increase during these phases.

Dogecoin must hold above $0.100 to maintain its recovery potential. A break above $0.110 would strengthen short-term momentum. That move could push prices toward $0.117.

Failure to hold $0.100 would expose DOGE to renewed selling pressure. The price could revisit $0.094 or decline further in that scenario.

The post Dogecoin (DOGE) Price: Multi-Week Decline Continues as ETF Demand Weakens appeared first on CoinCentral.

You May Also Like

Water150 Unveils Historical Satra Brunn Well: The Original Source of 150 Years of Premium Quality Spring Water Hydration

Amazon signs AI and cloud partnership to accelerate growth