Experts Back ZKP for 7,000x Upside While XRP and Cardano Lag

| Sponsored Post Disclaimer: This publication was produced under a paid arrangement with a third-party advertiser. It should not be relied upon as financial or investment counsel. |

Discover why experts view ZKP as a 7,000x crypto, moving ahead of XRP and Cardano, with the presale auction closing ahead of the 2027 Mainnet launch.

The digital economy has recently climbed to a $3.23 trillion valuation. At the same time, the XRP price today is holding around $1.91, while the latest Cardano news points to consolidation near $0.35. These long-standing networks offer stability, but clear limits are slowing further upside. The key question remains whether these established assets can still deliver transformational gains.

Market strategists are increasingly focusing on Zero Knowledge Proof, often described as the SSL layer for Web3. Analysts are pointing to a possible 7,000x outcome, arguing that ZKP provides the privacy foundation every modern application needs. Much like early exposure to ETH reshaped portfolios, researchers believe ZKP could become the standard privacy infrastructure supporting thousands of decentralized apps.

Presale Stage 2 pricing is moving quickly as the planned 2027 Mainnet launch approaches. Analysts suggest that securing ZKP during this phase offers exposure to long term expansion, placing it in a strong position among the top crypto gainers.

ZKP as Core Infrastructure for Private AI Growth

ZKP operates as a privacy-focused AI network built on Substrate. Unlike many early projects, the team committed $100 million in self-funded capital from the start. This funding includes $20 million dedicated to backend system development and $17 million allocated to Proof Pods that provide hardware-backed network security.

Researchers point to the Initial Coin Auction structure, where Stage 2 releases 190 million coins each day. Any coins not purchased are permanently removed from supply, tightening availability every 24 hours. Analysts believe this ongoing supply reduction places ZKP among the top crypto gainers as the network advances toward its 2027 mainnet launch.

Strategists also frame ZKP as the core privacy layer for the decentralized internet. Every application requires secure data checks without exposure, and ZKP is built to meet that need. With full EVM compatibility, developers can adopt these privacy features quickly, helping ZKP grow into a central infrastructure layer for large-scale applications.

Experts continue to point to 7,000x scenarios because ZKP is designed to support large ecosystems rather than single use cases. Analysts compare current access to ZKP with early opportunities in Ethereum, noting similar structural advantages. Researchers argue that this edge over legacy networks makes ZKP a leading candidate for investors watching the top crypto gainers in 2026.

The chance to secure infrastructure at presale auction pricing is narrowing as Stage 2 advances. Acquiring ZKP before it becomes a widely used privacy standard is viewed as a route toward high returns. With hardware already shipping and the system live, analysts say the window to gain early exposure to private AI infrastructure is closing fast.

XRP Market Update as Buyers Hold Key Levels

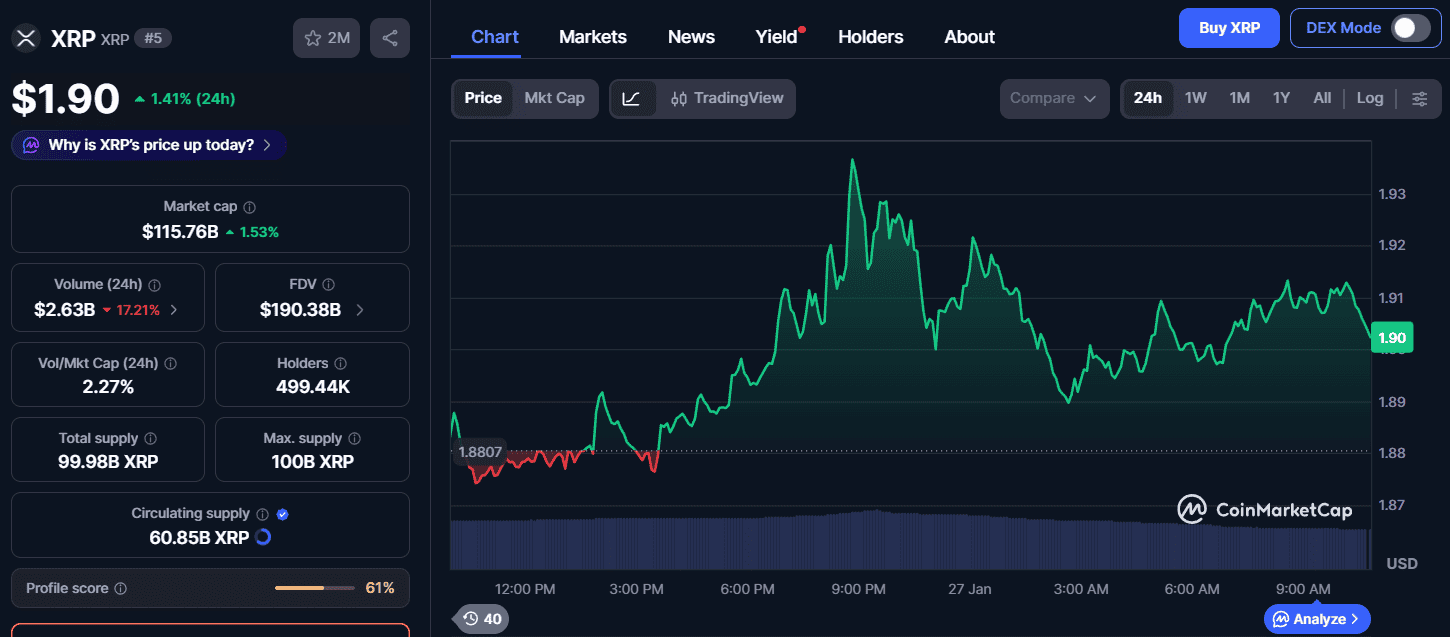

The XRP price today remains firm, trading in the $1.90 to $1.97 range. With a large $120 billion market cap and about $3.6 billion in daily trading volume, liquidity stays very strong. Buyers continue to protect the $1.80 level while watching closely for a move above $2.00. Institutional interest remains intense, with spot ETFs recently adding $1.37 billion. Standard Chartered has outlined an $8.00 target by year-end, reflecting strong long-term confidence in the asset.

Source: CoinMarketCap

Source: CoinMarketCap

Recent developments continue to support the XRP price today and its real-world role. Ripple has partnered with Jeel to upgrade systems in Saudi Arabia. DXC Technology has also integrated Ripple into banking platforms that manage nearly $5 trillion in deposits. The launch of RLUSD on Binance adds further momentum to the network. These global partnerships show that adoption is expanding quickly. The longer-term outlook remains positive as use cases grow across international markets and financial systems.

Cardano Shifts Power as Community Takes Control

Fresh Cardano news points to a major move toward user-led governance. This week, the first on-chain Constitution was approved with a strong 79% vote. The Foundation also delegated 220 million ADA to representatives, lifting the total to 360 million ADA. The network carries a market value of about $13.1 billion, with price holding near $0.35. This structure is viewed as supportive for future growth as control shifts more toward the community.

Further Cardano news shows progress on the Midnight sidechain, which has entered the stable Kūkolu phase. This update allows developers to release applications with built-in privacy tools. A new partnership with AlphaTON Capital aims to bring these features to Telegram users. At the same time, work continues on the Leios upgrade to improve transaction speed. With CME Group planning ADA futures for February, activity across the ecosystem is picking up. Development is moving quickly, and rising utility keeps interest strong.

Final Say

The XRP price today remains supported by banking use cases and institutional trust, while ongoing Cardano news highlights governance progress and privacy-focused expansion. Both networks offer stability and scale, but their size also limits how far returns can stretch for investors seeking aggressive upside.

Attention is now turning to ZKP, which analysts often describe as the SSL layer for decentralized applications. Researchers believe this infrastructure could become a privacy standard, placing ZKP among the top presale crypto gainers. Experts point to possible 7,000x outcomes as thousands of applications adopt this core layer.

Stage 2 is advancing quickly, and analysts caution that presale auction supply is shrinking. Securing exposure ahead of the planned 2027 Mainnet launch is seen as critical for those aiming to capture potential long-term generational gains.

Find Out More about ZKP:

Website: https://zkp.com/

Buy: https://buy.zkp.com

Telegram: https://t.me/ZKPofficial

X: https://x.com/ZKPofficial

| Disclaimer: The text above is an advertorial article that is not part of CoinLineup editorial content. |

You May Also Like

Crucial Fed Rate Cut: October Probability Surges to 94%

FCA, crackdown on crypto