Daily Market Update: Bitcoin Crash Wipes Out $1.7 Billion in Leveraged Bets as Fed Drama Unfolds

TLDR

- More than $1.68 billion in leveraged crypto positions were liquidated in 24 hours as Bitcoin dropped to $81,000

- Long positions made up 93% of liquidations, with Bitcoin seeing $780 million and Ethereum $414 million in forced closures

- Hyperliquid exchange led with $598 million in liquidations, followed by Bybit at $339 million and Binance at $181 million

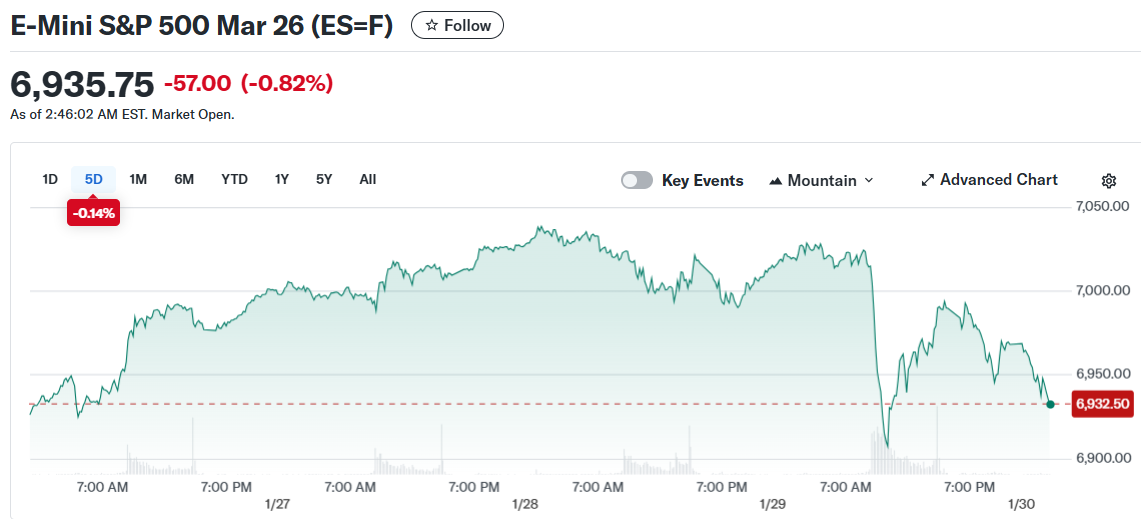

- US stock futures fell as investors await President Trump’s Friday announcement of his Fed chair pick to replace Jerome Powell

- Apple shares rose 1% after beating earnings estimates while Microsoft dropped 10% on cloud growth concerns

Bitcoin’s rapid price drop triggered a massive wave of forced selling across crypto markets. More than $1.68 billion in leveraged positions were liquidated over 24 hours as Bitcoin fell to $81,000.

Source: Coinglass

Source: Coinglass

The liquidation event forced approximately 267,370 traders out of their positions. Long positions, or bets that prices would rise, made up $1.56 billion of the total wipeout.

Short positions accounted for only $118 million in liquidations. This shows how heavily traders had positioned for rising prices before the market turned.

Bitcoin alone saw roughly $780 million in liquidations during the period. Ethereum followed with more than $414 million in forced closures.

The largest single liquidation was an $80.57 million Bitcoin-USDT position on HTX exchange. This demonstrates how even large positions can be wiped out when leverage is too high.

Exchange Breakdown Shows Concentration of Pain

Hyperliquid topped the liquidation charts with $598 million in forced closures. Over 94% of these were long positions on the exchange.

Bybit recorded $339 million in liquidations during the same period. Binance logged $181 million, with long positions dominating across all three platforms.

Liquidations happen when traders using borrowed money can’t meet margin requirements. Exchanges automatically close these positions to prevent further losses.

The forced selling creates a cascade effect in fast-moving markets. As prices fall, more positions hit liquidation thresholds, pushing prices even lower.

Analysts say the sell-off was driven by overleveraged positions unwinding rather than new bearish news. When too many traders bet in one direction, the market only needs momentum to shift.

Stock Markets Face Pressure from Fed Uncertainty

US stock futures declined as investors waited for President Trump’s Fed chair announcement. The president said he would reveal his pick Friday morning.

Futures linked to the S&P 500 fell about 0.6% in early trading. Nasdaq 100 futures dropped 0.7% while Dow Jones futures declined roughly 0.5%.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

Former Fed Governor Kevin Warsh has emerged as the leading candidate. Other names mentioned include Fed governor Chris Waller and BlackRock’s Rick Rieder.

The announcement comes days after the current Fed held interest rates steady. Traders expect roughly two quarter-point rate cuts before the end of 2026.

Tech Earnings Drive After-Hours Trading

Apple shares rose around 1% after the company beat fiscal first-quarter estimates. Stronger-than-expected iPhone demand drove the results.

Microsoft shares sank roughly 10% on Thursday, their steepest decline since March 2020. Signs of slowing growth in the company’s cloud business sparked the sell-off.

The Microsoft drop weighed heavily on both the S&P 500 and Nasdaq. Investors assessed whether AI revenue can justify the high spending needed to develop it.

Data storage company Sandisk surged 11% after issuing positive forward guidance. Despite recent volatility, major indexes remain mostly higher for the week.

Oil producers Exxon and Chevron are scheduled to report earnings before Friday’s market open. American Express and Verizon round out the week’s earnings slate.

The post Daily Market Update: Bitcoin Crash Wipes Out $1.7 Billion in Leveraged Bets as Fed Drama Unfolds appeared first on CoinCentral.

You May Also Like

Why Multicoin Capital’s Kyle Samani Is Leaving Crypto for AI and Robotics

Bitcoin Bulls Need to Reclaim This Key Level for a New Run at $125K