HFDX Liquidity Jumps $100M As Traders Seek Safer Alternatives After Recent DEX Glitches

HFDX has seen liquidity soar by over $100 million in recent weeks as traders reassess their platform choices, following a series of high-profile failures across the decentralized perpetual futures landscape. The shift comes amid growing concerns about operational reliability and genuine decentralization – reaching a breaking point when Paradex’s January database migration error triggered mass liquidations during an eight-hour outage.

Combined with Hyperliquid’s intervention in the JELLY token incident, the issues underlying decentralization marketing and centralized reality are becoming increasingly exposed – but is HFDX really ready to close the gap, and what’s bringing in the capital?

When reliable infrastructure means everything

The perpetual DEX sector processed more than $1 trillion in monthly volume by late 2025, but that scale has made infrastructure weaknesses increasingly costly. When Paradex displayed Bitcoin at $0 due to a migration error, thousands of positions liquidated automatically before engineering teams could respond 2.5 hours later. The subsequent chain rollback, while intended to restore affected users, also undermined the immutability of blockchain promises.

Hyperliquid’s $12 million loss from oracle manipulation on JELLY, followed by manual delisting and position closures, further showed similar centralized control despite its community-first branding. These incidents aren’t outliers: the first half of 2025 alone saw over $3.1 billion stolen across DeFi exploits, with access-control vulnerabilities and smart contract flaws accounting for the bulk of losses.

HFDX’s architecture goes a long way to address several of the pain points that have emerged from these failures. Built on established EVM-compatible networks rather than custom Layer-1 infrastructure, the platform benefits from the security auditing and validator distribution that comes with mature blockchain ecosystems.

This matters because Hyperliquid’s closed-source node software and team-controlled supermajority stake create concentration risk, a vulnerability highlighted when DPRK-linked wallet activity triggered $256 million in outflows within 30 hours. HFDX’s reliance on decentralized price oracles with redundant feeds reduces the single-point-of-failure risk that enabled the Paradex pricing catastrophe and the JELLY manipulation.

Sustainable economics without token gimmicks

Insurance fund backing provides a layer of protocol-level protection, though it’s worth noting that no insurance mechanism covers individual trading decisions or excessive leverage – those risks remain squarely with the user. What insurance does address is the protocol-level exploit risk that cost GMX users $42 million in July and Balancer liquidity providers $116 million in November, both through smart contract vulnerabilities in otherwise reputable platforms.

HFDX’s Liquidity Loan Note strategies offer fixed-rate returns backed by actual trading fees and borrowing costs rather than token inflation, addressing another common complaint about perpetual DEX economics.

Unlike platforms where yields depend on mercenary liquidity mining programs that evaporate post-airdrop, as Lighter demonstrated with its 70 percent volume drop after token launch, LLN returns derive from real protocol activity. Although returns naturally fluctuate with market conditions and trading volume, this creates more sustainable capital formation and better performance overall.

Credible alternative for serious traders

The platform won’t claim immunity from the risks inherent to decentralized leverage trading. Smart contract risk exists regardless of audit quality, as this year’s repeated exploits of audited protocols demonstrate. Slippage on lower-volume pairs remains a concern, and the learning curve for decentralized trading infrastructure is real.

But for traders increasingly frustrated by manual interventions disguised as decentralization, eight-hour outages during critical volatility, and centralization risks hidden behind marketing claims, HFDX’s combination of transparent architecture, proven infrastructure, and revenue-backed yields offers a credible alternative worth evaluating.

In a market where capital can flee in hours, as Balancer’s 46 percent TVL loss in 24 hours showed, infrastructure reliability and genuine decentralization are no longer optional features. With such must-have essentials among its core features, HFDX appears a strong candidate to fulfil the requirements.

Make Your Money Work Smarter And Unlock A Wealth Of Opportunities With HFDX Today!

Website: https://hfdx.xyz/

Telegram: https://t.me/HFDXTrading

X: https://x.com/HfdxProtocol

You May Also Like

Sygnum’s new bitcoin fund pulls in $65 million from investors looking for steady yield

Copy linkX (Twitter)LinkedInFacebookEmail

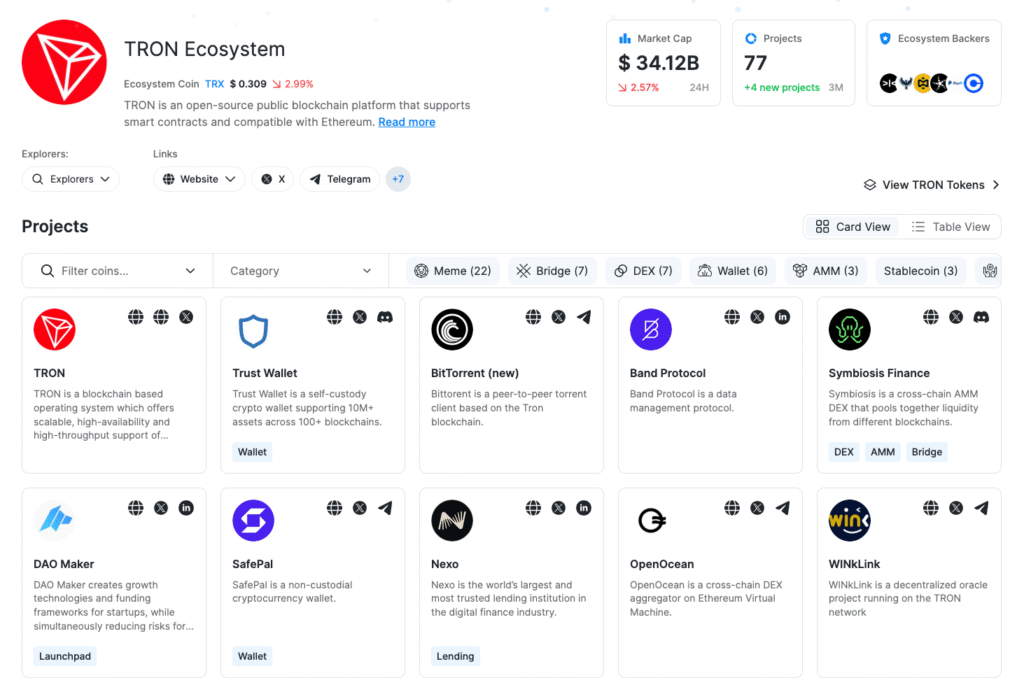

The State of TRON H2 2025: Stablecoin Settlement at Scale Amid Rising Competition