Crypto market stabilizes as US Dollar Index tumbles ahead of FOMC decision

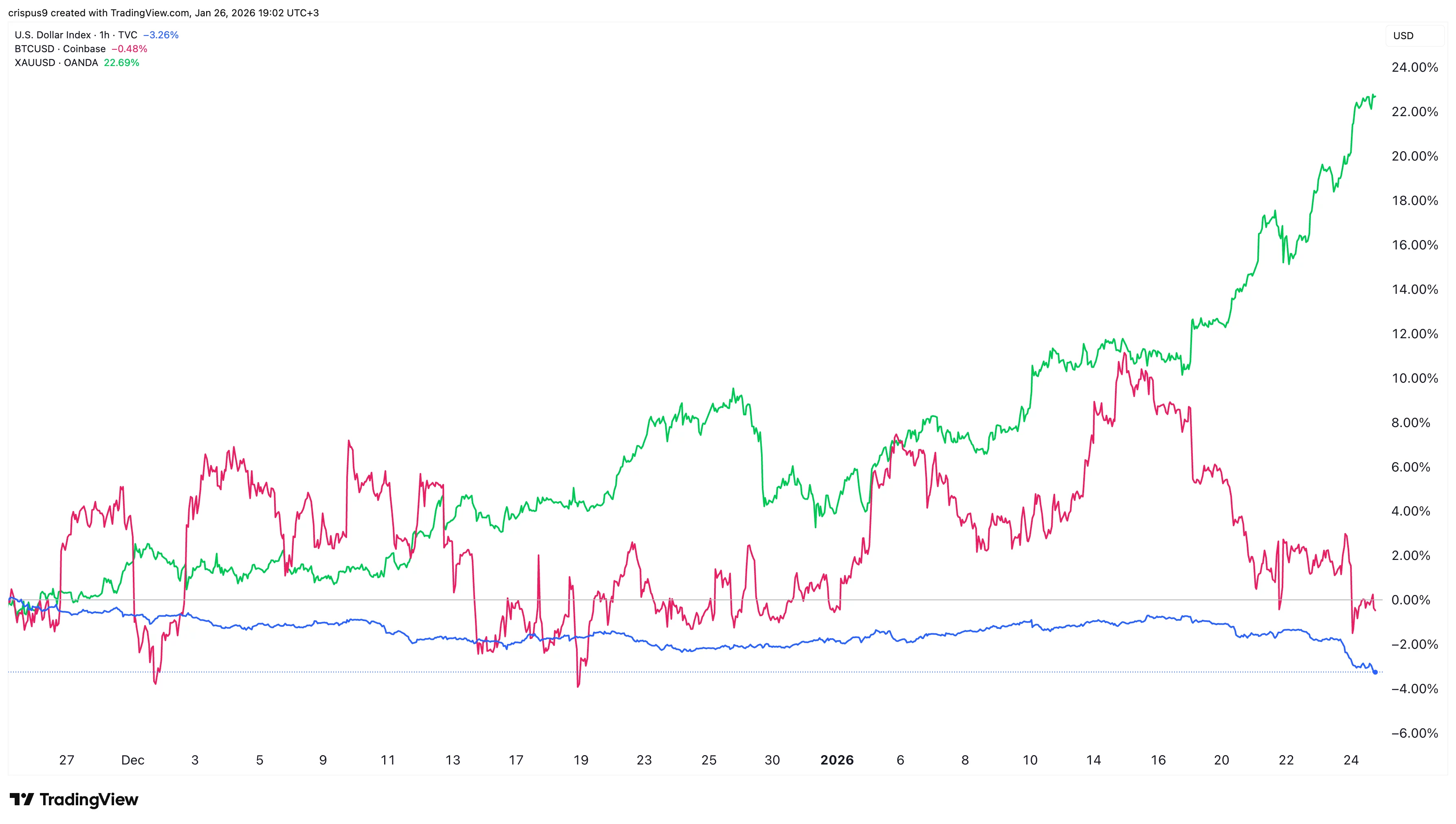

The crypto market stabilized on Monday, January 26, as gold and the stock market rose, and the US Dollar Index plunged ahead of the upcoming Federal Reserve interest rate decision.

- The crypto market pared back some of its earlier losses.

- The Bitcoin price rose to over $88,400 from the intraday low of $87,000.

- The US dollar index crashed to its lowest level since November.

Bitcoin (BTC) moved from the intraday low of $87,000 to $88,400, while Ethereum (ETH) rose and approached the key resistance at $3,000. The market capitalization of all coins moved back to $3 trillion.

Crypto market wavers as the US Dollar Index stumbles

Crypto prices stabilized as investors watched the performance of other assets. The stock market tilted upwards, with the Dow Jones and the S&P 500 Indices rising by over 0.50%. This rally happened as investors waited for the upcoming earnings season by Magnificent 7 companies like Tesla, Microsoft, Apple, and Meta Platforms.

Silver and gold prices also continued rising. Gold crossed the important resistance level at $5,000 for the first time ever, while silver remained above the key resistance at $100.

However, the US Dollar Index (DXY) stumbled to its lowest level since September last year. The greenback has tumbled by over 2.6% from its highest level this year as investors have started moving to gold.

Federal Reserve and government shutdown risks

The next main catalyst for the crypto market is the upcoming Federal Reserve interest rate decision. Most economists and Polymarket traders believe that the bank will decide to leave interest rates unchanged between 3.50% and 3.75%.

The rate pause will help officials assess the impact of the last three interest rate cuts on the economy. Also, the pause will be necessary as the economy is doing well, with the unemployment rate continuing to stabilize. Inflation has stabilized near the 2% target, and analysts believe that the economy expanded by 5% in the fourth quarter after it growing by 4.4% in Q4.

The crypto market will also react to the upcoming partial government shutdown. Polymarket data shows that the odds of a shutdown have jumped to over 70% as concerns about ICE and the Department of Homeland Security rise.

A potential macro risk is in the Middle East, where Donald Trump has sent an armada. Polymarket odds of a potential attack on Iran have continued rising. An attack would lead to higher oil prices and inflation risk.

You May Also Like

USDC Treasury mints 250 million new USDC on Solana

RFK Jr. reveals puzzling reason why he loves working for Trump