Why Are BlockDAG and Bitcoin Hyper Investors Turning To LivLive Presale For Higher ROI

Crypto markets reward those who spot the shift early, and right now a clear trend is emerging. Investors from BlockDAG and Bitcoin Hyper, both tied to innovative blockchain approaches, are quietly rotating into the LivLive crypto presale. This move highlights growing interest in projects that promise stronger ROI in a landscape where established plays face maturity pressures and presale fatigue.

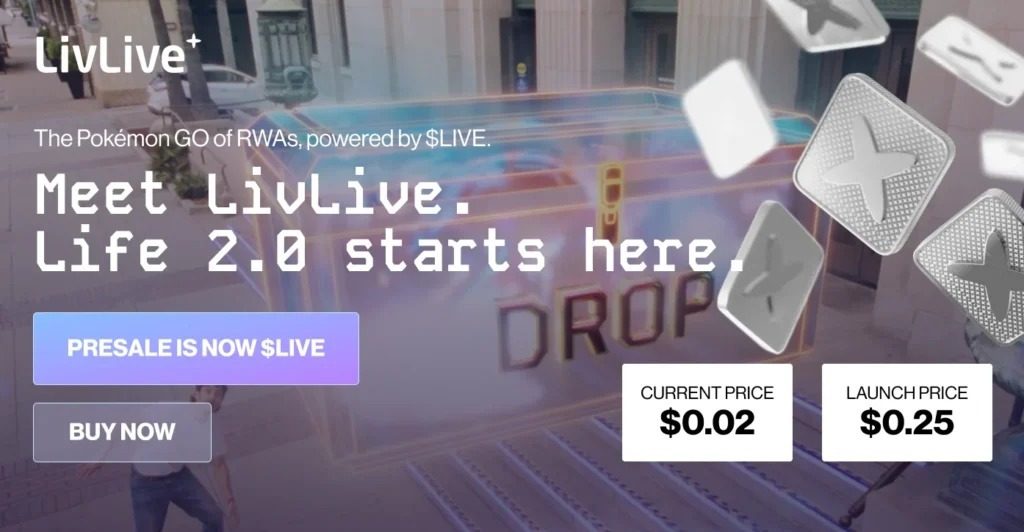

LivLive stands out as the top crypto to buy for those chasing the best crypto presale opportunities. Its AR-powered loyalty engine bridges real-world actions with blockchain rewards, turning everyday presence, quests, and reviews into $LIVE tokens. With a community-driven model and tangible utility, LivLive positions itself ahead in the crypto presale race.

LivLive Presale Gains Serious Traction

The LivLive crypto presale continues to surge, surpassing $2.2 million raised toward its $15 million softcap, all while holding steady at the current price of $0.02. This momentum draws attention from BlockDAG and Bitcoin Hyper holders seeking fresh entry points with higher ROI potential before the next stage increase.

Investors benefit from exclusive Token & NFT Packs available to early participants, which deliver long-term mining power, bonus tokens, and access to the $2.5 million Treasure Vault. This structure supports portfolio growth by enabling ongoing token accumulation through ecosystem engagement, creating layers of value that extend well beyond the initial buy-in.

A key strength lies in allocating 65% of the $LIVE supply directly to the community via presale, mining, quests, and rewards. This approach empowers active users, fosters organic adoption, and reduces concentration risks, helping maintain healthier token distribution and supporting sustained price appreciation for holders.

Path to Explosive Returns

ROI calculations underscore why the LivLive crypto presale attracts capital from BlockDAG and Bitcoin Hyper circles. A straightforward $1,000 investment at $0.02 secures 50,000 $LIVE tokens. Applying the limited-time BONUS200 code triples that to 150,000 tokens at no extra cost, amplifying exposure immediately.

At the projected launch price of $0.25, the position jumps to $37,500 for a 37.5x return. Analysts eye $1 post-launch as realistic, valuing the stake at $150,000—a 150x ROI that highlights superior upside compared to other options. This framing emphasizes how early positioning in this crypto presale maximizes compounding gains in a short window.

BlockDAG’s Current Landscape

BlockDAG’s presale has amassed over $444 million, with the final stages priced around $0.001 to $0.003 before closing soon, potentially by late January 2026. Analysts project targets up to $30 by year-end, but the project now transitions toward launch amid high expectations.

Recent updates show the presale nearing its end after extensions, with focus shifting to market entry. While the infrastructure draws interest, the closing window introduces timing considerations for participants.

Bitcoin Hyper’s Market Position

Bitcoin Hyper, a Layer 2 protocol aiming to enhance Bitcoin scalability, has raised figures reported between $10 million and $30 million in its ongoing presale, with tokens trading around $0.013 in recent rounds. Some price fluctuations have appeared across tracking sources.

The project emphasizes lower fees and faster transactions, yet it navigates typical presale volatility. Developments continue, but current dynamics reflect standard challenges in emerging Layer 2 ecosystems.

Time to Act on the Best Crypto Presale

BlockDAG and Bitcoin Hyper represent solid concepts, yet many investors now view LivLive as the best crypto presale for superior ROI in this cycle. The combination of low entry pricing, community allocation, and real-world utility creates a compelling edge.

The clock is running on the current $0.02 stage and the BONUS200 promo for 200% more tokens—this limited-time deal vanishes with the next increase. Head to the LivLive website today to join the presale and secure a position in what stands as the prime opportunity for high returns right now.

For More Information:

Website | X | Telegram Chat

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Why Are BlockDAG and Bitcoin Hyper Investors Turning To LivLive Presale For Higher ROI appeared first on CaptainAltcoin.

You May Also Like

Mystake Review 2023 – Unveil the Gaming Experience

Strategic Move Sparks Market Analysis