JasmyCoin (JASMY) Chart Signals a Potential Breakout as a Familiar Pattern Returns

Jasmy is once again back on the radar, and not because of some short-term price move, but because the chart itself is starting to look familiar.

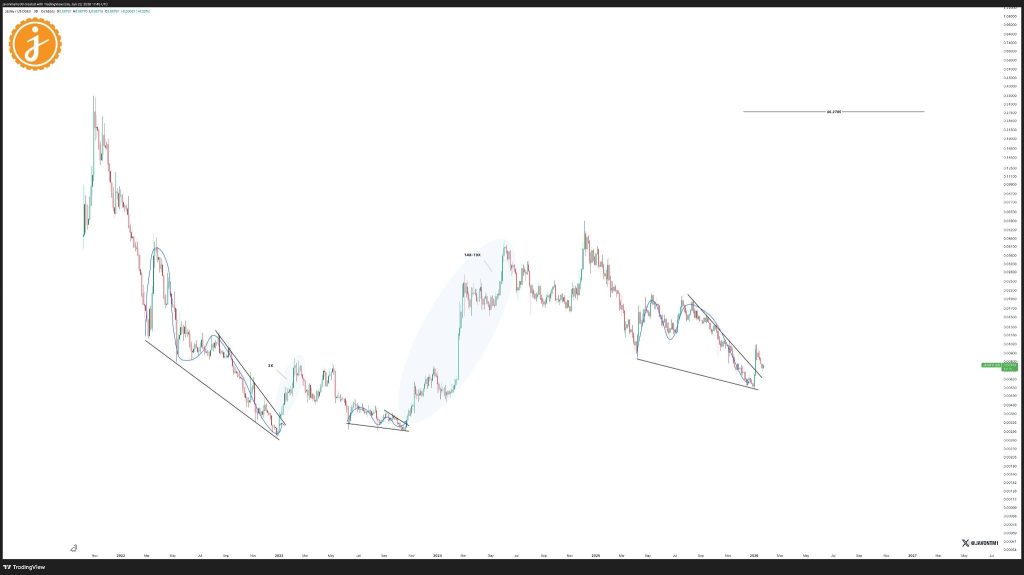

Analyst Javon Marks is pointing out that the JASMY price has broken out of a long compression phase and, more importantly, is still holding above that breakout instead of slipping back into the range. Right now, that level sits around $0.007474, and so far, price action is respecting it.

That part is what really catches attention. The last time Jasmy broke out of a similar structure, the move that followed was anything but small. Marks highlights a run in the range of 14x to 19x, which is a reminder of how crucial this market can get once momentum flips.

What The JASMY Chart Is Really Showing

Looking at the left side of the chart, you can see a long and painful downtrend, with lower highs and lower lows pressing the price lower inside a falling channel.

Throughout that phase, Jasmy kept trying to bounce, forming rounded recoveries that eventually failed and rolled back over. Those failed recoveries are important, because they show how sellers stayed in control for a long time, driving the JASMY price down from earlier peaks toward sub-cent levels.

Source: X/@JavonTm1

Source: X/@JavonTm1

Then came the shift. After months of compression and base-building, the JASMY price finally broke out and launched into a powerful impulse move, the one Javon highlights as a 14x to 19x rally. What really mattered before that move was not the breakout candle itself, but the calm that came before it. Volatility dropped, price tightened, and a clear base formed around the lower range before price expanded aggressively.

Now fast forward to the right side of the chart. The JASMY price went through another long decline inside a similar channel, printed smaller recovery arcs again, and then pushed out of that structure. The key difference this time is that price has not fallen straight back inside the channel. Instead, it is consolidating just above $0.0074, which is exactly the behavior Javon is calling “the breakout holding.”

Read Also: Why JasmyCoin (JASMY) Appears Much Stronger In 2026 Than It Did In 2025

What Traders Are Watching Next

From here, the bullish case stays simple. As long as the JASMY price remains above the breakout zone near $0.0074 and continues to form higher lows, the structure stays constructive. That is usually the kind of behavior that leads into another expansion leg, especially for a market that has already proven it can move aggressively when conditions line up.

On the flip side, there is also a clear invalidation. However, if the price of JASMY begins to close lower again from that breakout base, say below approximately $0.0070, it will alter everything again. In this case, it will be a failed breakout, meaning that the price will likely fall to the lower part of the structure again.

JASMY Price Outlook

Javon’s comparison to the previous 14x to 19x cycle is bold, but the logic behind it is pretty straightforward. Similar structure, similar behavior, and a breakout that is still being defended.

The JASMY price does not need to surge right away for this idea to stay valid. It just needs to keep holding above that breakout area around $0.0074 and continue building higher lows.

If that happens, the chart keeps pointing toward a larger trend continuation. If not, the market probably goes back into grind mode and resets before making another serious attempt.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post JasmyCoin (JASMY) Chart Signals a Potential Breakout as a Familiar Pattern Returns appeared first on CaptainAltcoin.

You May Also Like

The Manchester City Donnarumma Doubters Have Missed Something Huge

Marathon Digital BTC Transfers Highlight Miner Stress