Seeker (SKR) Price: Solana Mobile Token Drops to $0.04 After Airdrop Launch

TLDR

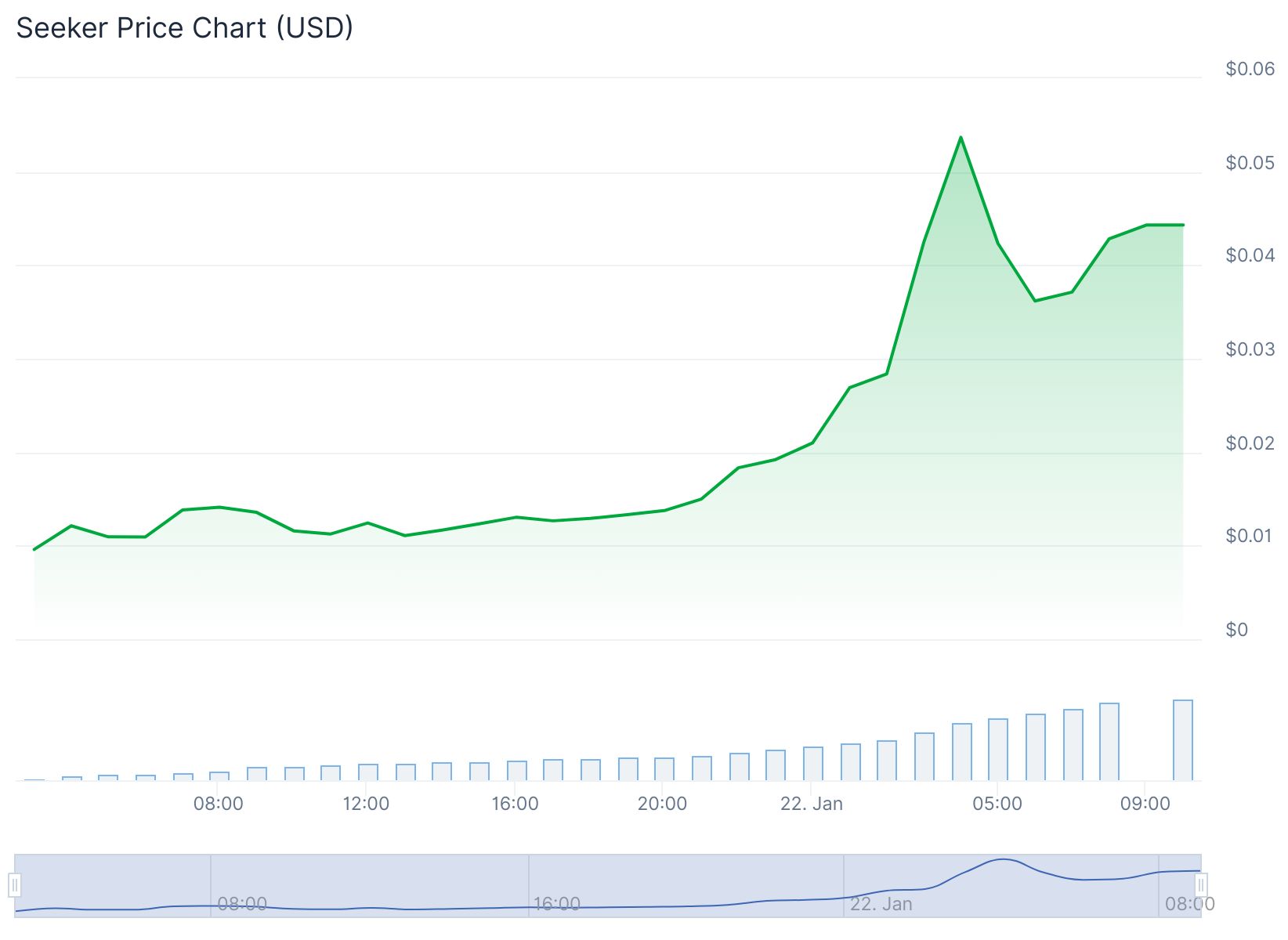

- Seeker token launched on January 21, 2026 at $0.06 but dropped to $0.04 as airdrop recipients sold their tokens for profit.

- Nearly 2 billion SKR tokens were distributed to over 100,000 verified Seeker smartphone owners, representing 20% of total supply.

- Trading volume jumped 6,500% to $41.81 million with the token briefly surging 55% to $0.0128 before pulling back.

- SKR is used for staking with 28% APY, governance voting, and accessing the Seeker mobile dApp store.

- Season 1 activity showed 9 million transactions, $2.6 billion in volume, and 265 active dApps on the platform.

Seeker launched its native token on January 21, 2026, distributing 1.82 billion SKR to Seeker smartphone owners. The token opened at $0.06 before dropping to $0.04 as early recipients took profits.

Seeker (SKR) Price

Seeker (SKR) Price

The airdrop represented approximately 20% of the total 10 billion SKR supply. Over 100,000 verified Seeker device owners became eligible to claim tokens through the built-in Seed Vault Wallet.

Trading volume surged over 6,500% to reach $41.81 million in the hours following the launch. The price briefly jumped 55% to $0.0128 before retreating to current levels around $0.04.

Multiple exchanges including Kraken, Bybit, Gate, and MEXC listed the token for trading. The 24-hour price change shows a decline of 4.58% from the opening price.

The token’s market cap sits at approximately $400 million with 3 billion tokens in circulation. This represents 30% of the total 10 billion token supply.

SKR serves three main functions within the Solana Mobile ecosystem. Users can stake tokens with an initial annual percentage yield of 28%. The token also grants governance rights over app curation and ecosystem decisions.

Access to the Seeker mobile dApp store requires SKR tokens. The platform currently hosts 265 active dApps according to Season 1 data.

Guardian System And Governance

The Guardian system differentiates SKR from typical governance structures. Established Solana infrastructure firms including Anza, Helius Labs, and Jito serve as Guardians. Token holders delegate voting power to these entities rather than voting directly.

Staking rewards follow a declining schedule starting at 10% annual inflation. The reward rate drops 25% each year until reaching a minimum of 2%. Early stakers receive higher yields while later participants face dilution through 2027.

Season 1 Performance Metrics

Season 1 metrics showed strong platform activity before the token launch. The platform processed 9 million transactions with $2.6 billion in total volume. The 265 active dApps demonstrate existing developer adoption.

Some analysts project SKR could reach $0.10 by mid-2026 if ecosystem adoption continues. Others suggest a base case near $0.12 with a bull scenario toward $0.22 depending on device sales and dApp growth.

Short-term price action may face selling pressure as airdrop recipients continue liquidating holdings. Trading volume and market stabilization will determine the token’s next directional move.

The current circulating supply of 3 billion tokens leaves 7 billion tokens yet to enter circulation. Token distribution schedule and unlock timelines will affect future price dynamics.

The post Seeker (SKR) Price: Solana Mobile Token Drops to $0.04 After Airdrop Launch appeared first on CoinCentral.

You May Also Like

XRP Enters ‘Washout Zone,’ Then Targets $30, Crypto Analyst Says

Republicans are 'very concerned about Texas' turning blue: GOP senator