Why Is Crypto Crashing Today? Trump Tariff Uncertainty Triggers Sharp Crypto Sell-Off

The post Why Is Crypto Crashing Today? Trump Tariff Uncertainty Triggers Sharp Crypto Sell-Off appeared first on Coinpedia Fintech News

The global cryptocurrency market lost nearly $150 billion in value over the past 24 hours as investor sentiment turned cautious. This decline pushed Bitcoin below $88,000, marking a drop of almost 3%.

Other large-cap cryptos like Ethereum fall below $3,000 after seeing a 6% decline. While XRP, Solana, TRON, and Monero also slipped from 4% to 18%.

So, what is driving this sell-off, and why is the crypto market down today?

Trump’s Tariff Warnings Shake Global Markets

One major reason for the market drop is fresh tariff worries linked to U.S. President Donald Trump. He warned eight European Union countries about possible tariffs, reportedly connected to demands related to Greenland.

European leaders quickly rejected this and hinted they may respond with their own actions.

Adding to the fear, the U.S. Supreme Court has again delayed its decision on these tariff issues. Investors were hoping for clarity, but the delay has raised concerns that the decision could support Trump.

Bitcoin ETFs See Heavy Outflows

Institutional selling has also weighed heavily on Bitcoin. Spot Bitcoin ETFs recorded outflows of nearly $874.4 million over the past two days. Fidelity led the selling with about $357.3 million in outflows, followed by Grayscale, Bitwise, and ARK Invest.

These continued withdrawals reflect growing caution among institutions amid geopolitical risks.

As a result, capital has been rotating into traditional safe-haven assets like gold and silver, both of which recently hit all-time highs.

$1 Billion in Liquidations Adds More Pressure

The sharp price drop triggered widespread liquidations across the crypto market. Data from CoinGlass shows that 183,050 traders were liquidated in the last 24 hours, with total liquidations reaching $1.02 billion.

Nearly 90% of these were long liquidations, totaling about $928.45 million, as bullish traders bet on a recovery that failed to happen. The single largest liquidation occurred on Bitget, where a BTC/USDT position worth $13.52 million was wiped out.

- Also Read :

- Gold and Silver Prices Hits New ATH As Crypto Drops: Here is Why?

- ,

Where Is Bitcoin Heading Next?

Over the past three days, Bitcoin has fallen from around $97,000 to near $88,000. Meanwhile, the Fear and Greed Index slipped to 32, firmly in the fear zone, showing traders are stepping away from risky assets amid rising uncertainty.

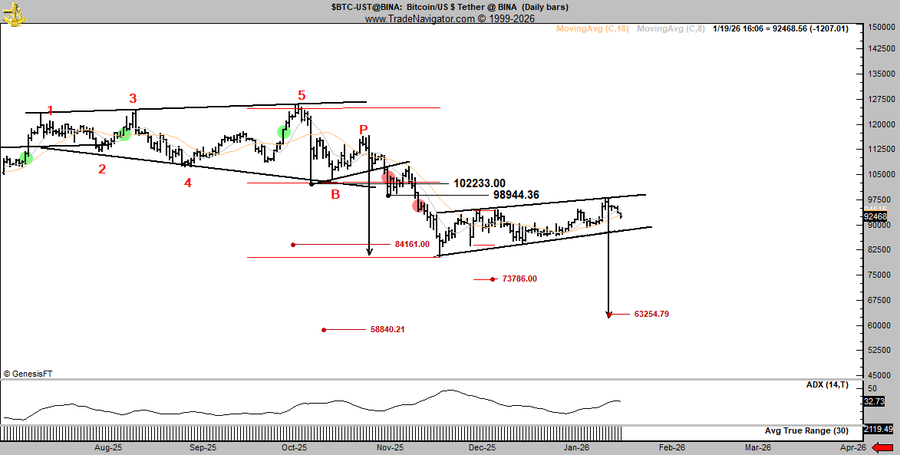

However, veteran trader Peter Brandt recently warned that Bitcoin could fall to the $58,000–$62,000 range within the next two weeks.

Despite the price decline, trading volumes have increased, suggesting strong activity as traders reposition.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Crypto prices fell due to tariff fears, ETF outflows, and heavy liquidations, pushing investors away from risk assets amid rising global uncertainty.

Major triggers include institutional selling via spot Bitcoin ETFs, which saw $874 million in outflows, and global market uncertainty sparked by new U.S. tariff threats against European allies.

Analysis suggests Bitcoin could potentially test the $58,000-$62,000 range, with market sentiment now in “fear” territory and continued geopolitical instability pressuring prices.

Over $1B in positions were liquidated in 24 hours—mostly long bets—with 90% from bullish traders caught off-guard by the sharp drop triggered by geopolitical tariff fears and risk aversion. (152 characters)

Yes, capital is rotating from cryptocurrencies into traditional safe havens like gold and silver, which recently hit record highs, as investors seek stability amid the volatility.

You May Also Like

Coinbase CEO: We will build a financial super application to replace traditional banks

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets