NEAR Protocol Annual Progress Overview and 2025 Vision

Author: Stacy Muur , Crypto KOL

Compiled by: Felix, PANews

2024 is shaping up to be an excellent year for NEAR Protocol, both from a fundamental and sentiment perspective.

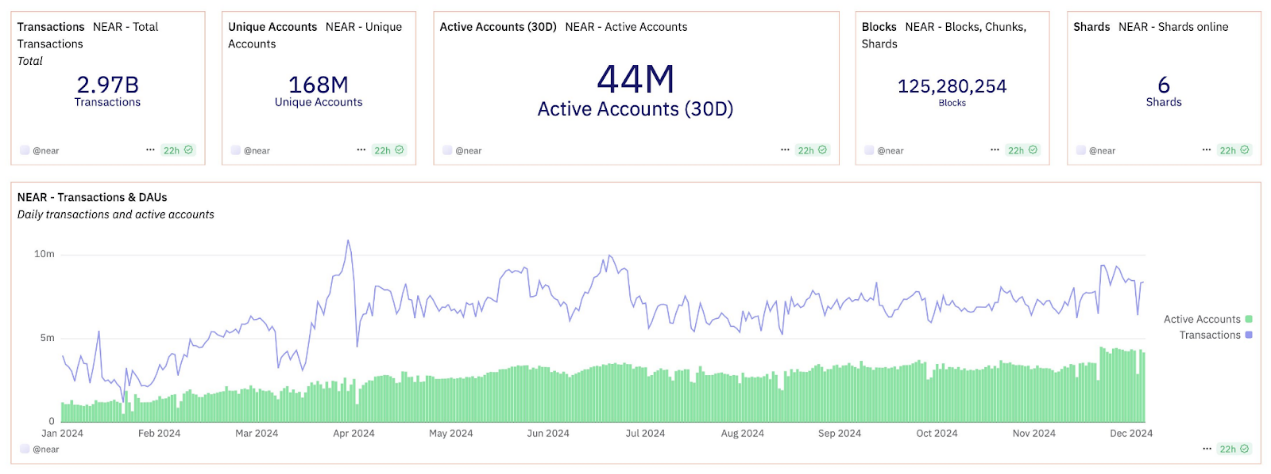

NEAR currently has:

- Monthly active accounts were 44 million, up from 7 million a year ago

- Daily transaction volume exceeds 8 million, double that of the beginning of the year (average fee is $0.002)

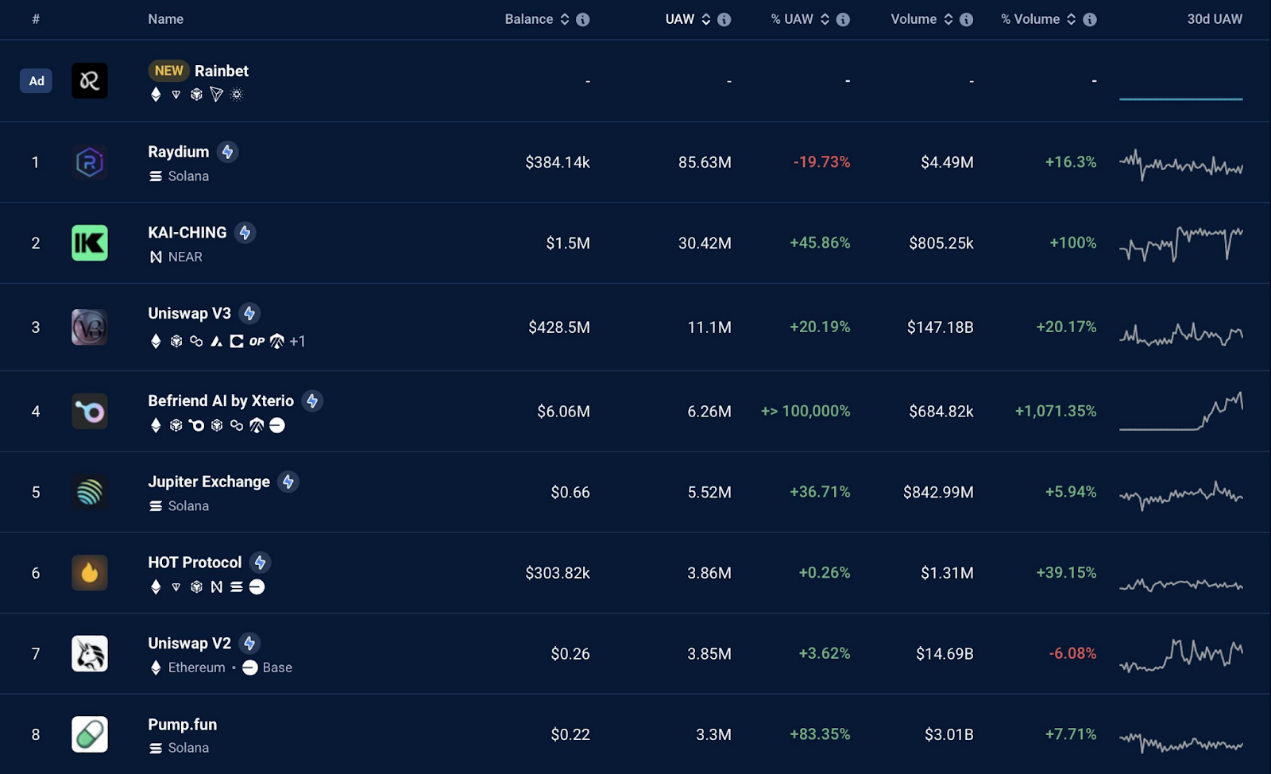

NEAR also has the top four Web3 applications in terms of monthly active users:

- KAIKAI: 31.7 million monthly active users

- Here Wallet: 4.2 million monthly active users

- Sweat Еconomy: 1.6 million monthly active users

- Playember: 500,000 monthly active users

Additionally, $700 million worth of stablecoins flowed into the NEAR ecosystem, a 20x year-over-year increase.

In May, NEAR native stablecoin issuance hit an all-time high of $760 million; at the same time, DeFi TVL increased fivefold from $88 million to $430 million.

NEAR Protocol introduced several important upgrades and releases:

Nightshade 2.0: NEAR currently runs 6 active shards, a 50% capacity increase since the beginning of the year, and plans to expand to 8 shards in the first quarter of this year.

Accelerator Programs: The Foundation has successfully run three accelerator programs, two of which focus on AI and one on Chain Abstraction. These teams have raised a total of $50.5 million in funding.

NEAR is now fully compatible with MetaMask, Phantom, and other ETH wallets.

Chain Signatures are launched on the NEAR mainnet, enabling smart contracts to sign any blockchain transaction. This solidifies NEAR’s position in the Chain Abstraction space.

Intents are launched as a new transaction type on NEAR, allowing the exchange of information, requests, assets, and actions between AI agents, services, and end users.

In May, the NEAR Foundation announced that it would focus on user-owned AI.

In November, NEAR launched NEAR AI, a research center for the public development of 1.4 trillion parameter models. The center features a user-owned AI assistant that can act on the user's behalf in Web2 and Web3 by connecting with other AI agents and services.

(Related reading: Detailed explanation of NEAR AI: Building the most powerful open source AI platform owned by users )

The NEAR AI ecosystem currently has more than 50 AI teams specializing in research, infrastructure, data and storage, models, and applications.

“AI is NEAR” momentum is building:

- Eliza is using NEAR to perform multichain swaps on ai16z

- NEAR AI and Frax Finance are collaborating to build fully autonomous brokers using NEAR infrastructure

- Sweat Еconomy is integrating an AI assistant into their wallet UI

In 2025, NEAR may focus on AI, which may earn NEAR Protocol the title of “AI Blockchain”.

Related reading: Interpreting NEAR: Following the hot narrative or becoming a market leader?

You May Also Like

Trump foe devises plan to starve him of what he 'craves' most

Why Bitcoin Is Struggling: 8 Factors Impacting Crypto Markets