Bitcoin Traders Defend $92K—How Long Can It Last?

1. Introduction

Bitcoin endured a weekend retreat as risk-off momentum resurfaced amid rising geopolitical tensions and softer-than-expected European and Chinese data. The retreat came after a failed attempt to reclaim the $98,000 level, prompting traders to reassess the balance between speculative leverage and hedging as ETFs faced renewed outflows and traditional safe havens strengthened. The pullback underscored how macro dynamics continue to shape crypto demand, even as Bitcoin traded in the upper-$90,000s for periods.

2. Key Takeaways

- The BTC futures premium hovered near 5%, suggesting leverage demand remained resilient after the failed $98,000 breakout attempt.

- Bitcoin ETFs saw $395 million outflows as gold hit fresh records, weakening hedge appeal and pushing traders to price downside risk.

- Bitcoin corrected about 3.4% over the weekend as investors cut risk amid geopolitical tensions and data showing slower growth in China.

- The BTC options delta skew jumped to 8%, indicating puts are trading at a premium and signaling cautious sentiment among large holders.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. The weekend pullback and outflows weighed on sentiment and near-term momentum.

Trading idea (Not Financial Advice): Hold. Market direction remains uncertain as macro factors drive risk-on/off dynamics and hedging demand shifts.

Market context: The crypto market remains closely tied to global macro headlines, including policy actions, geopolitical risk, and shifts in traditional assets like gold, which continue to influence crypto hedging and liquidity.

Weak BTC derivatives flag fading interest and hedge appeal

Investors sought safer havens as markets paused for a holiday and led to a flight toward cash and precious metals. The Euronext 100 declined, while gold advanced toward fresh records, reinforcing the narrative that Bitcoin is increasingly viewed as a risk-on asset rather than a reliable hedge in stressed or uncertain environments. Although Bitcoin briefly climbed back above the $93,000 mark, traders remained wary, suggesting hedging demand had not fully re-emerged despite the price rebound.

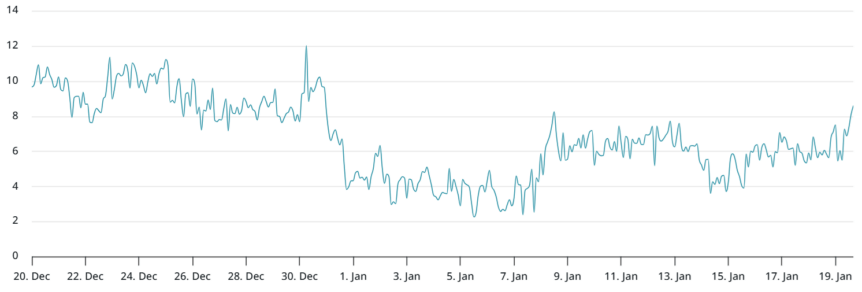

Bitcoin futures basis rate. laevitas.chThe annualized premium on Bitcoin futures—often referred to as the basis rate—held near a neutral-to-bearish 5%, implying that demand for leveraged long positions remained intact even after the failed bid to reclaim $98,000. Yet a cautious tone persisted in the derivatives market, hinting at waning institutional enthusiasm and a preference for hedges that guard against downside risk rather than chasing fresh upside.

Meanwhile, Bitcoin spot exchange-traded funds faced notable outflows—approximately $395 million on the prior Friday—while gold and silver surged to new highs. This dynamic weighs on the hedging allure of Bitcoin and reinforces the notion that traders are pricing in more downside protection as macro headwinds persist. A sense of fragility in the hedging setup may also reflect the broader diversification of risk as investors recalibrate exposure across assets that were previously viewed as uncorrelated or alternative hedges.

BTC 30-day options delta skew (put-call) at Deribit.

BTC 30-day options delta skew (put-call) at Deribit.

Derivative signals underscored a cautious mood. The Deribit delta skew—the premium on put options over calls—shifted higher, moving toward 8%. In typically balanced markets, the delta skew hovers between -6% and +6%. The move above 6% signals that investors are paying a premium to protect against downside, which aligns with a narrative of reduced conviction in a sustained rally above the $100,000 mark and a preference for hedges amid macro uncertainty.

Industry voices weighed in on the global context. Deutsche Bank’s head of FX research noted the extent of European exposure to U.S. assets, suggesting Europe could be cautious about supporting the dollar if the Western alliance faces strain. The comment highlighted how cross-border capital flows and geopolitical risk feed into crypto markets, where liquidity and hedging demand can shift rapidly in response to policy signals and currency dynamics.

China’s late-2025 data painted a mixed picture, with quarterly growth at 4.5% year-over-year and exports holding firm in part due to strong external demand. Analysts warned that stimulus measures could ease back, potentially cooling domestic momentum and pressuring global demand for risk assets, including Bitcoin. In this environment, macro catalysts continue to dominate traders’ risk appetite, reinforcing the idea that crypto markets remain sensitive to broader macro conditions rather than isolated narratives.

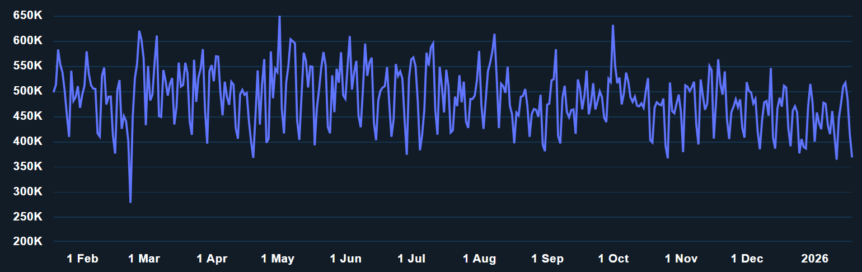

Bitcoin network daily active addresses.

Bitcoin network daily active addresses.

On-chain activity pointed to cooling demand for network participation. Daily active addresses declined to around 370,800, representing a roughly 13% drop from two weeks prior, according to Nansen. That drop matters: sustained on-chain activity is a proxy for miner revenue and network health, both of which underpin long-term investment cases for Bitcoin. In the near term, softer activity and higher regulatory or macro risk could cap upside momentum, especially if institutions reassess risk premiums in the wake of a broader market pullback.

With several macro levers in play—from global trade tensions to policy maneuvers over Greenland and geopolitical hotspots—the path for Bitcoin remains nuanced. The lack of strong bullish momentum in derivatives markets, combined with outflows from ETFs and thinning on-chain activity, suggests traders are proceeding with caution. The $92,000 level, once a focal point for a renewed breakout, now faces heightened resistance as risk sentiment remains tethered to evolving macro developments rather than purely crypto-driven catalysts.

This article was originally published as Bitcoin Traders Defend $92K—How Long Can It Last? on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

What Are the Latest Trends in Coinbase Clone Script Development?

Forward Industries Bets Big on Solana With $4B Capital Plan