The super cycle begins, four predictions for the crypto market after the Trump coin incident

Author: Deebs DeFi , Crypto KOL

Compiled by: Felix, PANews

Trump has taken control of the crypto market.

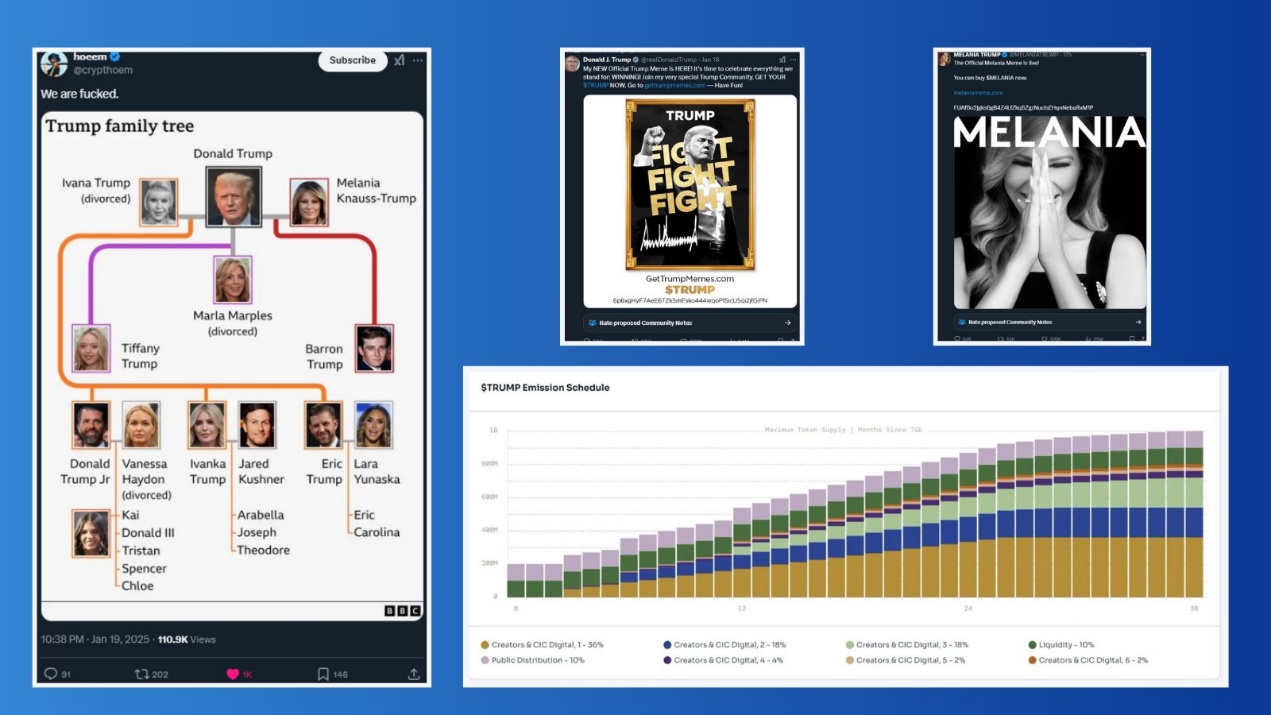

He owns the 12th largest token worth $15 billion. He has the attention of all crypto users. He dominates every token on the market and doubled his net worth in less than a day. He has complete control of the market until... his wife launches MELANIA coin and he launches a "vampire attack" on his own token, causing TRUMP coin to drop by more than 50%.

(Related reading: Trump family is making a comeback! The market value of "First Lady Coin" MELANIA has exceeded 10 billion in a short period of time, and the details of multiple tokens have caused market controversy )

It’s not that TRUMP coin is a scam. However, most people agree that the launch of MELANIA coin was a huge mistake. But this mistake does not mean the end of cryptocurrency.

In fact, it marks a new beginning, the beginning of a crazy cycle. Celebrity memes become the norm, and there is no "crime" in crypto. Here are 4 key predictions for this cycle and the tokens/ecosystems that will have the biggest impact:

Markets are smarter, Trump memes cool

It’s unclear whether the Trump family will stop issuing memes, or if all of the family will. However, one thing is clear: each new token has diminishing returns.

Launching MELANIA coin was a huge mistake, and TRUMP coin was destined to have a much higher valuation, perhaps even DOGE-level valuation. However, Trump insiders showed their cards too early.

As more and more TRUMP memes are released and underperform, traders are expected to look for broader markets and more growth opportunities.

Meanwhile, celebrities will be keeping an eye on this golden opportunity before them…

Celebrity Memes & Rugs

It’s not surprising that celebrities will launch their own memecoins. The market has been expecting this.

But what the market did not anticipate was the impact that celebrity memecoins would have on the market.

While the public is suffering from PTSD due to Hawk Tuah (HAWK token crash) and Floyd Mayweather (boxer Floyd Mayweather was involved in promoting the scam project Mayweverse, etc.), let’s review some key data from the past two days:

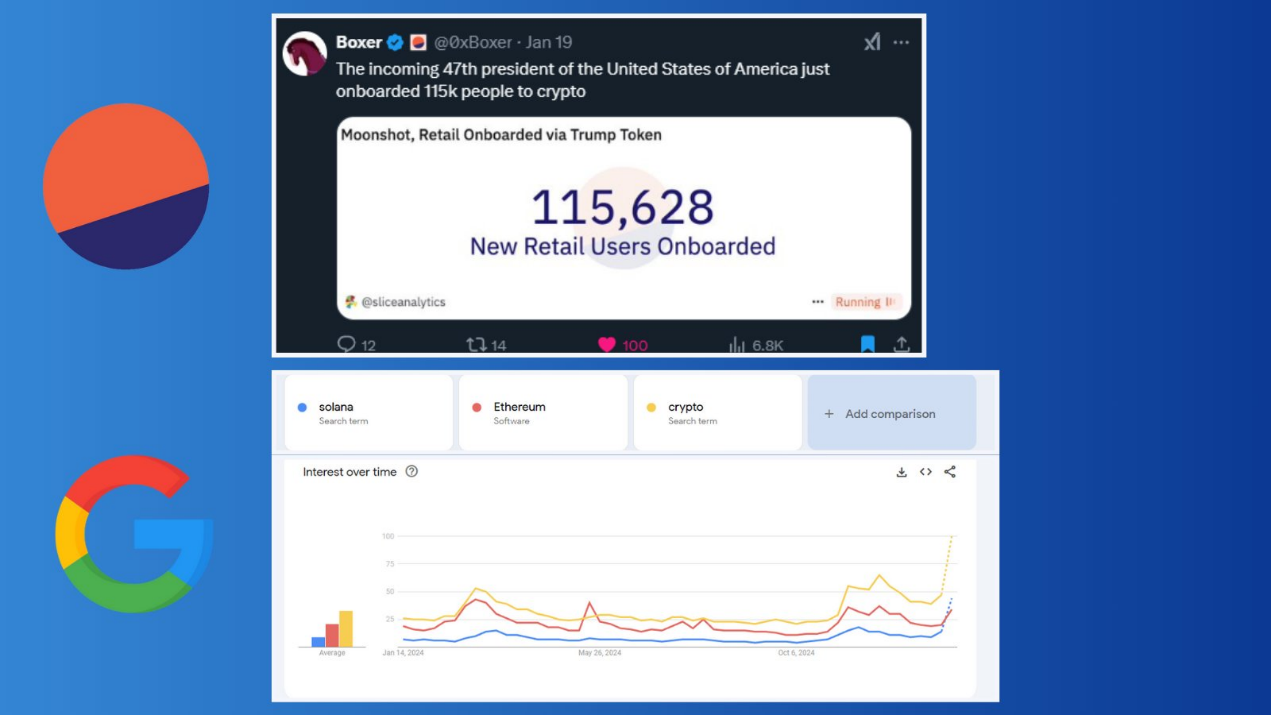

- Trump’s meme attracted over 115,000 new cryptocurrency users (see dashboard below).

- Google searches for cryptocurrency have surged in the past few days: searches for “Solana” have soared to a year-high, and searches for terms like “Crypto,” “Ethereum,” and “Coinbase” have all been on the rise this year.

Source: @0xBoxer

Why is this data so important?

115,000 users is not a small number.

- For reference, 115,000 is half of Arbitrum’s daily active users and one quarter of Ethereum’s daily active users.

Google search data indicates that there is a new user base.

- Old crypto users don’t use Google. They have a link to Coinbase, they know what Solana is, and search for information on X.

- The data also suggests that the increase in interest isn’t limited to Solana, but crypto as a whole.

Other celebrities could have a similar impact.

There are many other celebrities with cult followings who can bring hundreds of thousands of users to the chain like Trump did. For example, Elon Musk, Mr. Beast, Taylor Swift, Justin Bieber, CR7, Messi, Jeff Bezos.

Imagine Taylor Swift launches TSWIFT coin and brings 100,000-200,000 new users on the chain. This is equivalent to adding a whole new chain to cryptocurrency and a whole new planet of users to the solar system.

While all of this is optimistic, and given that celebrity memes in the past have often ended in Rug pulls, in a bull market, people quickly forget.

Hawk Tuah’s Rug incident will not affect gamblers and Taylor Swift fans from buying her future memes. Even if 9/10 of the next celebrity memes are Rug pulls, the one without the Rug will bring much-needed users and liquidity to the crypto space.

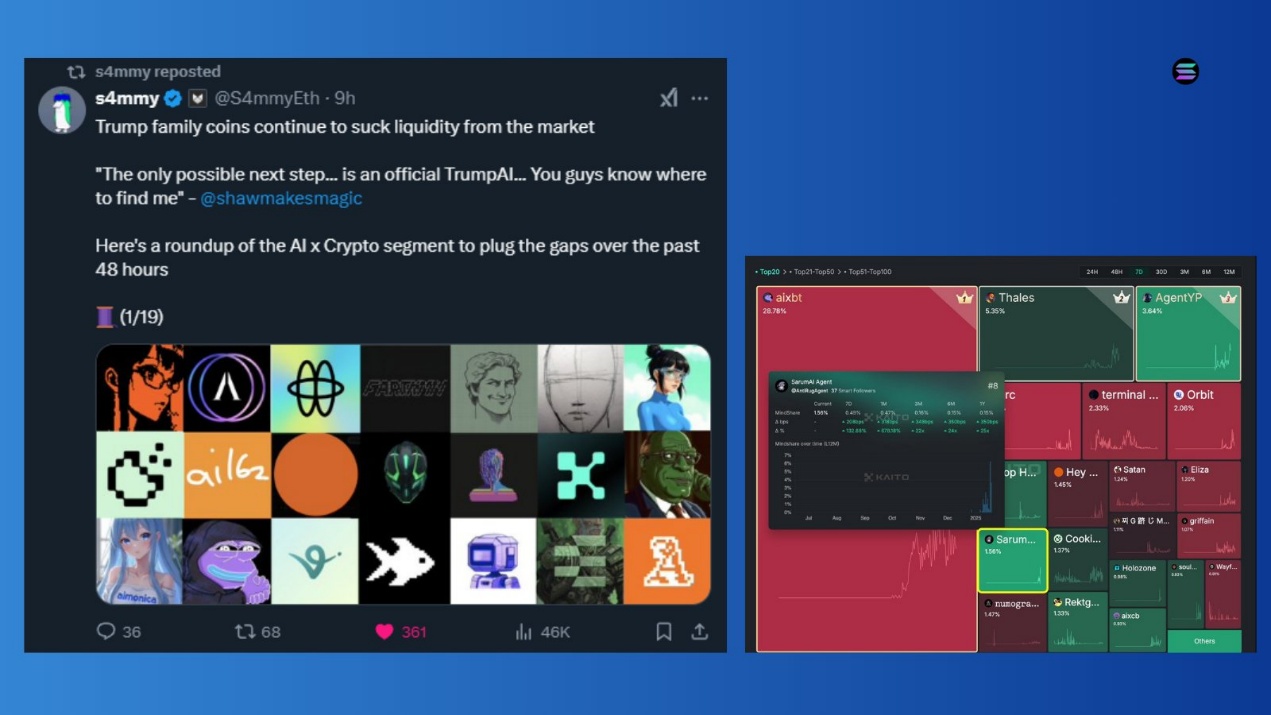

AI Tokens: Return of the King

As mentioned above, after the Trump meme cools down, traders will look for better opportunities. AI is one of the best opportunities. When thinking of AI, the acronym APE comes to mind:

- A: Abstract. AI solves UI/UX problems. It simplifies all complex DeFi processes such as trading, lending, borrowing, LPing, etc. through natural language.

- P: Profit/Protection. AI agents provide automation and superior trading strategies, providing users with additional profit returns. AI agents are also well suited to protect investors from scams. Some teams are already developing wallet protection programs that alert users to signs of possible fraud before they purchase tokens.

- E: Entertainment. Waifu, DJ, etc., need I elaborate?

When considering the impact of AI on cryptocurrencies, the profit rotation from Trump traders to DeFAI is obvious. Some of my favorite AI projects include VIRTUAL, AIXBT, AVA, FARTCOIN, and HAT.

Also keep an eye out for MCAP projects that have niche use cases that stand out (not another trading bot or launch pad):

- ANTIRUG: Predictive analysis on Project Rug

- PYTHIA: AI in the Mouse Brain

- VIRAL: An agent that learns directly from human actions on screen

SOL : Undefeated Champion

If nothing else, TRUMP coin proves that Solana is the best chain to launch a token, there is no better choice.

A market value of $15 billion in one day is impossible in any other field.

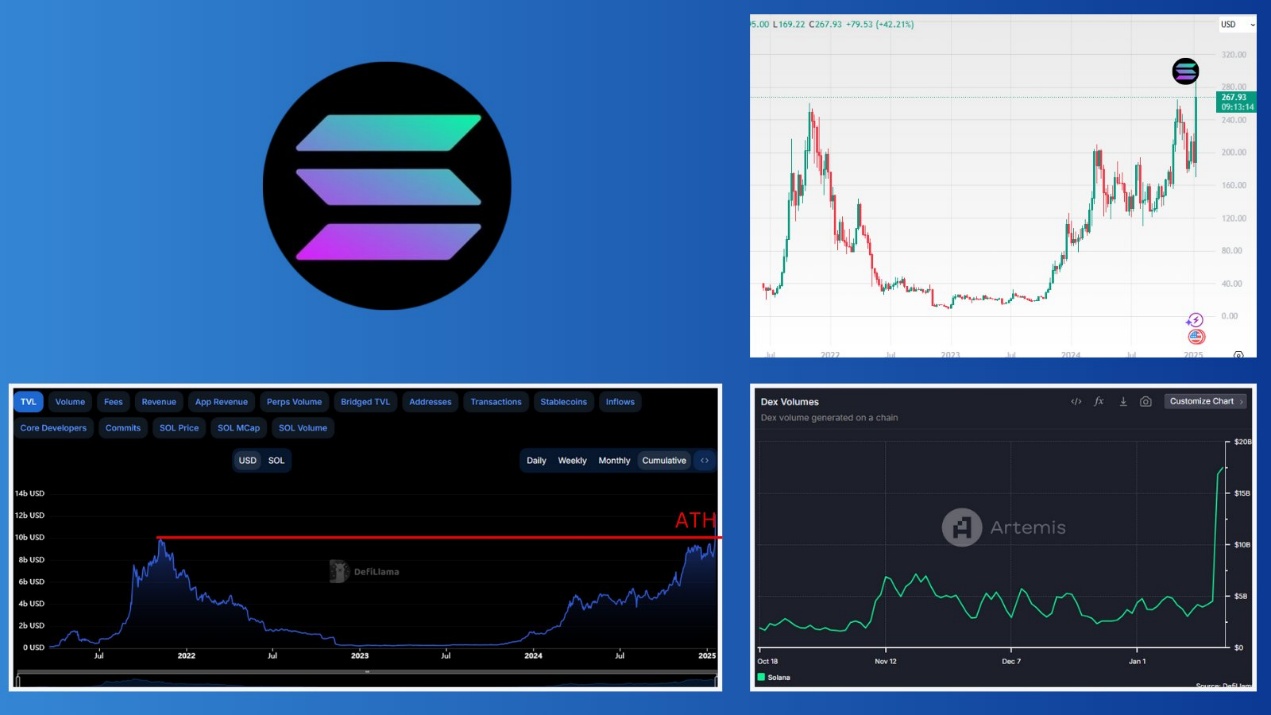

Over the past two days, Solana has hit new highs in almost every metric (Related reading: Crazy weekend: 10 charts to explain the Solana moment in the crypto market ):

- TVL surges to over $12 billion, highest level since the peak of the 2021 bull run

- The price rose by more than 25% to a new high of $290

- DEX trading volume once again hit a new high of $17.5 billion.

Solana is the “people’s” chain, and that doesn’t seem to be changing anytime soon.

Related reading: $TRUMP ignites bullish expectations in the market, which assets may usher in the "US Compliance Spring"?

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates