Crypto Markets Shed Over $100B as These Alts Plunge by Double Digits: Market Watch

Following a rather untypical trading weekend in which geopolitical tensions skyrocketed, BTC’s price tumbled by several grand on Monday morning to just under $92,000.

Most larger-cap alts have followed suit with even more painful declines. ETH is down to $3,200, XRP is below $2.00, while XMR and ICP have defied the downturn with impressive gains.

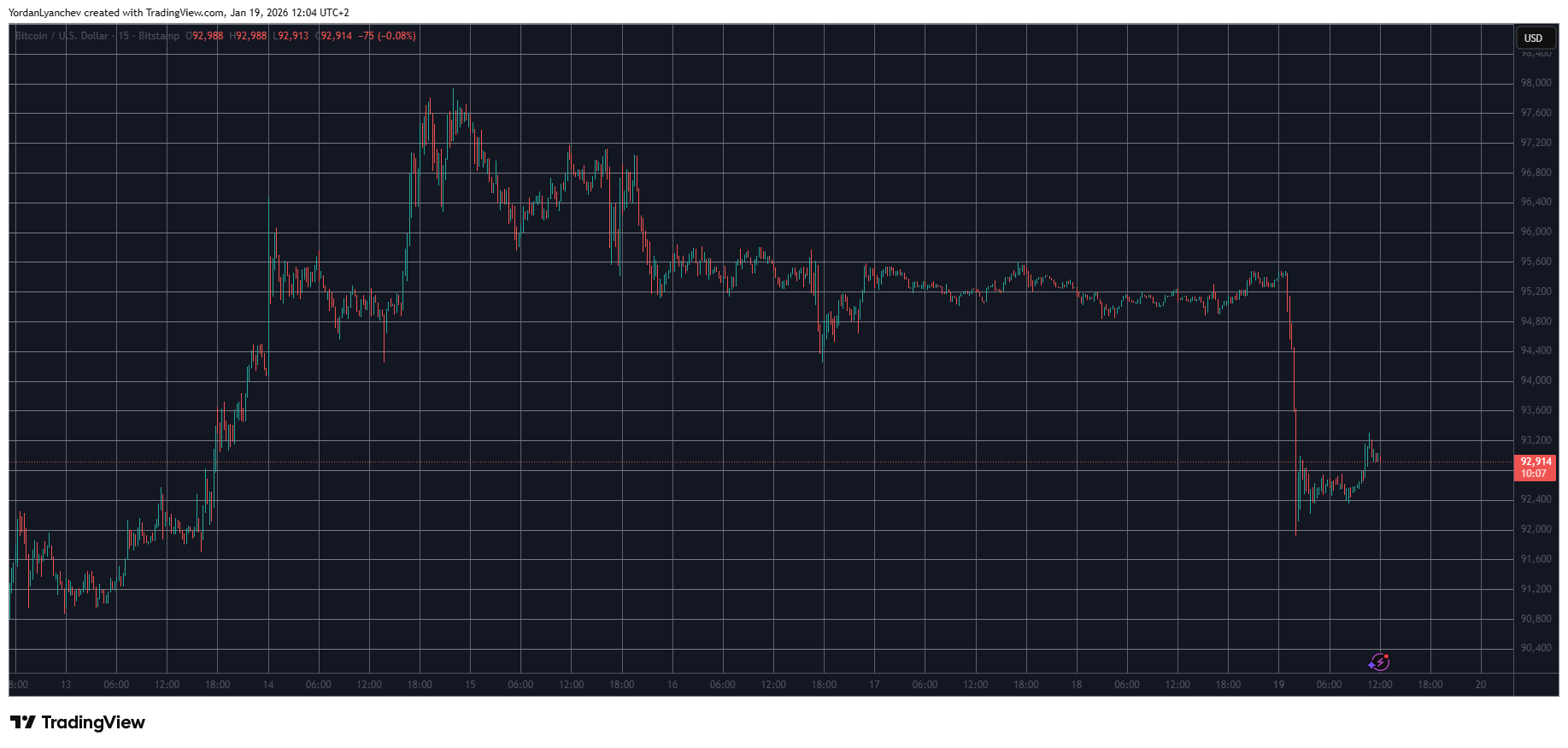

BTC Dipped Below $92K

The primary cryptocurrency rallied at the beginning of the previous business week and peaked on Wednesday when it tapped a multi-month high of $98,000. It faced an immediate sell wall at that level but remained abouve $95,000 for most of the next several days.

The weekend was uneventful as well, which was quite unexpected given the latest developments on the US-EU trade war front. At first, EU countries sent troops to Greenland after Trump claimed that the US had to acquire the island to enhance its national security. The POTUS responded with a new set of 10% tariffs, while the EU scheduled an emergency meeting and French President Macron pushed for the use of a so-called “trade bazooka” against the US.

Despite all of this uncertainty, BTC remained calm. That was until Monday morning when futures and Asian stock markets opened. Bitcoin tumbled by more than three grand and slipped to a 6-day low of just under $92,000.

Although it has recovered $1,000 since then, it’s still over 2% down daily. Its market cap has dropped below $1.860 trillion on CG, while its dominance over the alts stands tall at 57.5%.

BTCUSD Jan 19. Source: TradingView

BTCUSD Jan 19. Source: TradingView

Alts Bleed Out

Ethereum was stopped at $3,350 and now struggles to remain above $3,200. XRP has dipped below $2.00 and even fell to $1.84 earlier today. Even more painful declines come from the likes of DOGE, SOL, ADA, LINK, XLM, ZEC, AVAX, and HYPE.

The biggest losses come from the likes of ASTER, SUI, APT, ONDO, ARB, PEPE, and ENA, as all of them are down by double digits. XMR and ICP are among the few exceptions trading in the green today.

The total crypto market cap has dropped by $100 billion since this time yesterday and is down to $3.220 trillion on CG.

Cryptocurrency Market Overview Jan 19. Source: QuantifyCrypto

Cryptocurrency Market Overview Jan 19. Source: QuantifyCrypto

The post Crypto Markets Shed Over $100B as These Alts Plunge by Double Digits: Market Watch appeared first on CryptoPotato.

You May Also Like

Trend Research has liquidated its ETH holdings and currently has only 0.165 coins remaining.

FCA, crackdown on crypto