Trump Meme Team Pulls $33M From Liquidity Again – $94M Gone in 30 Days

The wallet managing the official $TRUMP meme coin withdrew another $33 million in USDC from its liquidity pool and deposited the funds into Coinbase.

Over the past 30 days, the team has extracted a total of $94 million from the pool, according to blockchain analytics firm LookOnChain.

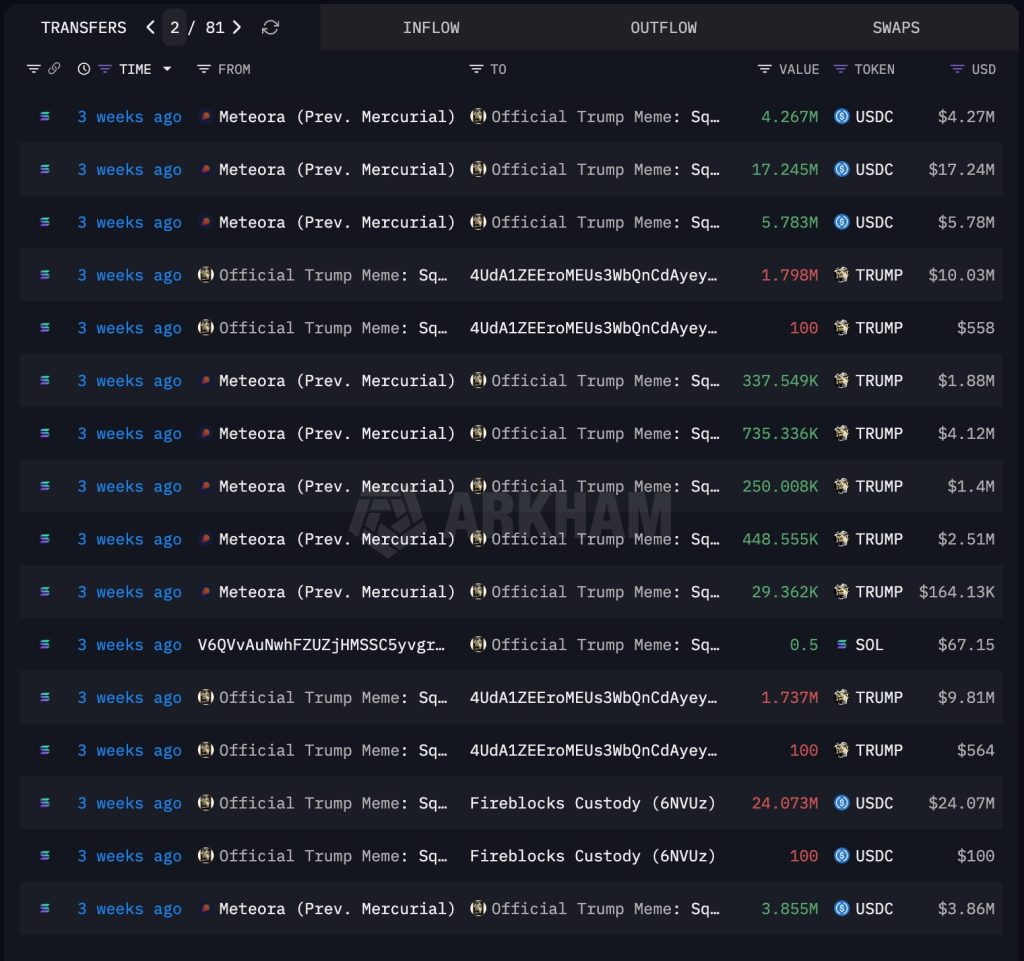

On-chain data from Arkham Intelligence shows the Official Trump Meme wallet executed multiple transactions over a 24-hour period.

The wallet pulled USDC in batches ranging from $2 million to $17.2 million from Meteora’s liquidity pools, then consolidated the funds and transferred them to Fireblocks custody addresses linked to Coinbase.

Systematic Withdrawals Follow Established Pattern

Three weeks ago, the team conducted similar operations, withdrawing $33 million in two separate transfers to Coinbase-linked custody addresses.

Those transactions followed the same pattern, multiple smaller withdrawals from Meteora pools, followed by consolidation and transfer to Fireblocks custody wallets.

Source: Arkham

Source: Arkham

The systematic removal of liquidity comes as President Trump’s crypto ventures face intensifying scrutiny.

Back in October, it was revealed that the Trump family has generated approximately $1 billion in pre-tax gains from digital asset projects over the past year, according to Financial Times analysis.

The $TRUMP and $MELANIA meme coins alone produced roughly $427 million in revenues, capitalizing on brand recognition and political influence.

World Liberty Financial, the family’s flagship DeFi venture, raised $550 million through token sales.

Trump’s official financial disclosure revealed he personally received $57.4 million in income from his association with the firm, which is primarily run by his sons.

He holds 15.75 billion WLFI tokens, representing 15.75% control of the entire project.

The venture’s governance token began trading on major exchanges in September, briefly valuing the Trump family’s stake at over $6 billion when prices touched $0.30.

At that time, trading volumes exceeded $1 billion within the first hour, though prices later retreated 16% to $0.23.

Trump Media Emerges as Major Bitcoin Holder

Trump Media & Technology Group has positioned itself among the world’s largest institutional holders of Bitcoin.

The Nasdaq-listed company currently holds approximately 11,542 BTC, valued at over $1 billion, representing roughly 20% of its total market capitalization.

The strategy places TMTG eleventh among publicly traded companies with Bitcoin treasury positions, ahead of Tesla, Block, and Galaxy Digital.

Only MicroStrategy, Marathon Digital, and Block maintain larger reserves. CEO Devin Nunes said the Bitcoin holdings “help ensure our Company’s financial freedom, help protect us against discrimination by financial institutions.“

Despite the substantial Bitcoin holdings, TMTG shares have significantly underperformed the crypto itself.

While Bitcoin declined 4.9% year to date, TMTG plunged nearly 64% the same period.

Legal Challenges Mount Across Trump Crypto Empire

The family’s crypto ventures face mounting legal pressure.

Federal prosecutors filed a class-action lawsuit against Meteora co-founder Benjamin Chow, alleging he orchestrated pump-and-dump schemes using Trump family endorsements to defraud retail investors of at least $57 million.

The lawsuit targets operations involving $MELANIA, $LIBRA, $M3M3, $ENRON, and $TRUST tokens.

Hours after the filing, three Trump-linked addresses received a $4.2 million Meteora token airdrop, which they immediately deposited into the OKX exchange.

The $MELANIA token has crashed from its peak of $13.73 to $0.118, erasing over 99% of its value.

Forensic analysis identified coordinating wallets that funded deployer accounts and financed sniper wallets capturing early supply.

Kelsier Ventures CEO Hayden Davis admitted in a YouTube interview: “We sniped our own coin to prevent snipers from sniping our own coin.“

Meanwhile, earlier this month, it was reported that ALT5 Sigma, a Nasdaq-listed company backed by World Liberty Financial, faces potential delisting after appointing an auditor currently barred from performing audits due to an expired firm license.

Shares have fallen 77% since January amid mounting compliance concerns.

The Citizens for Responsibility and Ethics in Washington described the president’s deep involvement in crypto as “unprecedented,” stating that “during Trump’s last term, CREW tracked over 3,700 conflicts of interest between his presidency and businesses.”

“With the expansion of his foreign developments and his foray into cryptocurrency, among other ventures, he seems poised to rack up more conflicts than ever, with even less transparency than last time,” they added.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

XRPR and DOJE ETFs debut on American Cboe exchange