“Selling a kidney to keep Bitcoin”: Strategy’s long bet faces liquidation concerns

Author: Nancy, PANews

"Sell a kidney if necessary, but keep your Bitcoin." This seemingly humorous joke in the latest tweet by Michael Saylor, founder of Strategy (formerly MicroStrategy), actually expresses his strong belief in the long-term value of Bitcoin.

In recent times, Bitcoin has led the crypto market to fall across the board, and the pessimistic liquidity outlook has exacerbated the market's selling sentiment. In this market environment, investors can't help but worry that MicroStrategy, a veteran Bitcoin leverager, will encounter a "turnover."

The long bet encounters a cold snap, what is the risk of liquidation?

The Bitcoin super-bullish strategy is facing the dual pressures of profit withdrawal and falling stock prices.

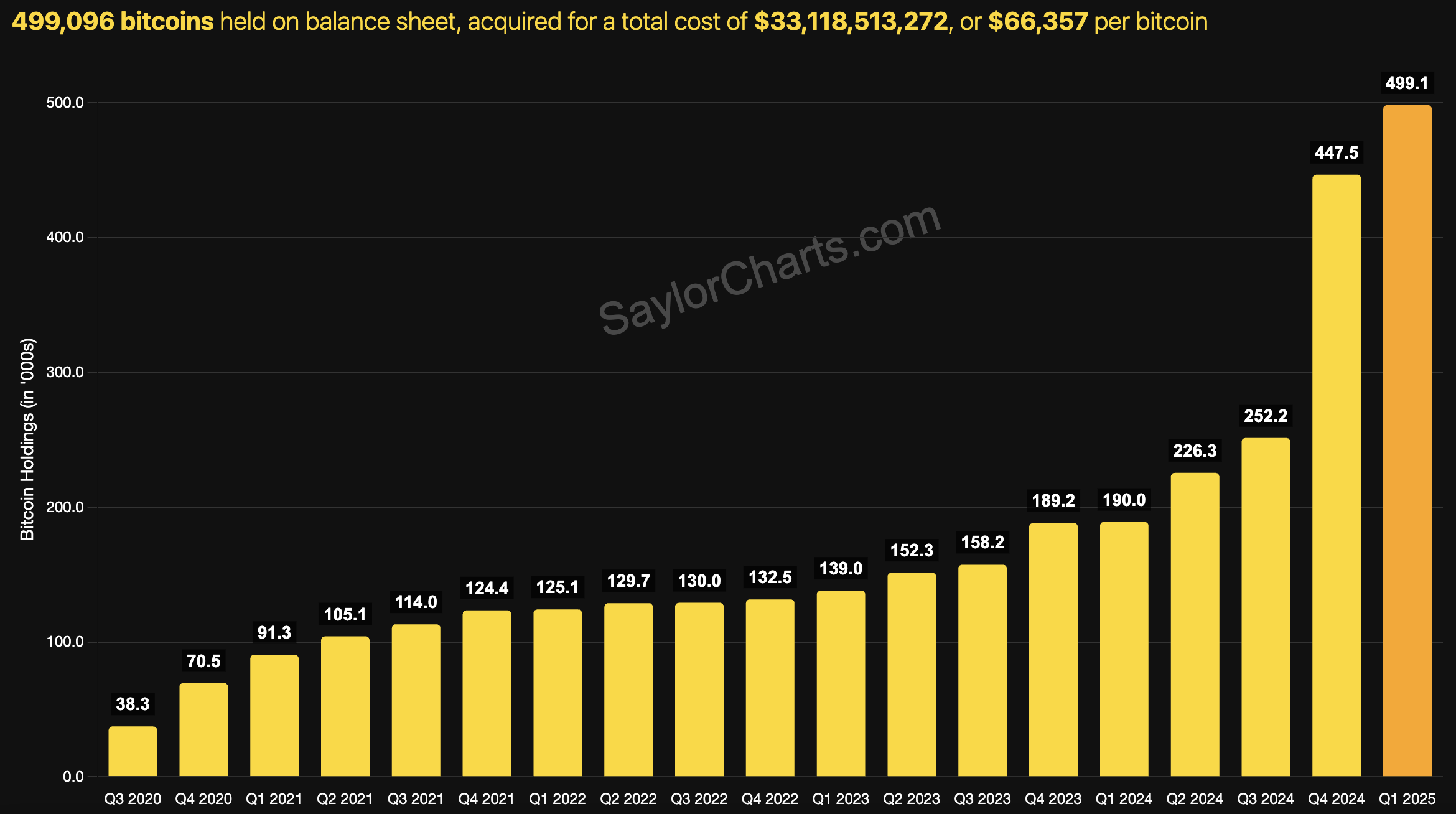

MSTR-tracker data shows that as of February 28, Strategy holds a total of 499,096 bitcoins, with a total purchase cost of nearly $33.12 billion and an average purchase price of about $66,357. The current total value of bitcoin holdings is $39.57 billion. Compared with Strategy's highest bitcoin holding profit of nearly $20 billion in previous months, it has now dropped to $6.45 billion.

As the floating profit retracement was significant, Strategy's stock price continued to fall. Google Finance shows that as of February 28, Strategy's stock price has fallen by more than 39.4% from its high of $396.5 this year. The market has also raised concerns that the "Bitcoin Treasury" company may be forced to liquidate its Bitcoin holdings. As crypto analyst Miles Deutscher pointed out, the premium rate of Strategy's market value relative to its Bitcoin assets has dropped from 3.4 times in November last year to 1.6 times at present. The lower this value is, the more difficult it will be for Michael Saylor to raise more funds to buy Bitcoin, which means that his pace of buying Bitcoin may slow down.

However, the analysis agency The Kobeissi Letter believes that this situation is "almost impossible to happen". The reason is that the structural design of Strategy's convertible notes, the company's ability to raise $1.8 billion in equity during the decline of Bitcoin, and Michael Saylor's 46.8% voting rights together constitute a strong guarantee to prevent forced liquidation. Even if the price of Bitcoin falls by 50% to $33,000, Strategy's assets will still exceed its debt by more than 100%.

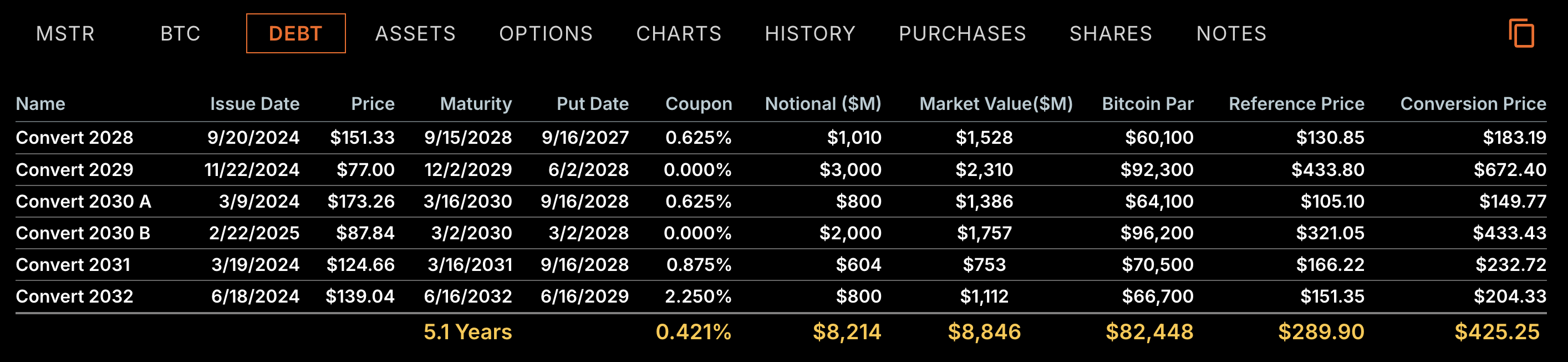

At present, Strategy has a total of $9.26 billion in unsecured debt. According to Strategy's official website, the company has six outstanding convertible bonds, most of which were issued at extremely low interest rates and have maturity dates after 2028, with the latest debt due in June 2032. Even though the two largest bonds total $5 billion, accounting for more than half of the total debt, and the market price of their convertible bonds is lower than the issue price, which may increase market concerns about these debts, these debts will not mature until after the end of 2029, and Strategy has enough time to respond and adjust. What's more, the bitcoins held by Strategy are not directly pledged as collateral for loans, and their funds mainly come from external investors. To some extent, Strategy's convertible bond structure and financing capabilities reduce the possibility of its bitcoins being forcibly pledged or liquidated.

In addition, the stock holdings of Strategy not only show the high recognition and confidence of large institutional investors in Strategy, but also bring it stronger market credibility and capital support. Fintel data shows that Strategy has 1,403 institutional owners and shareholders, such as Susquehanna International Group, Vanguard Group, IMC-Chicago, Citadel Advisors, Jane Street Group, Capital International and BlackRock.

Continue to be bullish against the market trend, and set a target of 10 billion yuan in revenue in 2025

Despite the cold snap in the crypto market, Michael Saylor remained firmly bullish and even continued to increase his holdings when Bitcoin fell.

In a recent public occasion, Michael Saylor reiterated that Bitcoin is becoming the "world's reserve capital network", superior to real estate and stocks, and is a digital capital worth holding for the long term. He predicted that the current market value of the Bitcoin network of $2 trillion will grow to $20 trillion in the next 4 to 8 years, surpassing the growth rate of other global assets, and said that "volatility is a gift for loyalists." Saylor even said that he would donate his personal shares to public charities that support Bitcoin after his death, which also shows his deep belief in Bitcoin.

"From selling software to selling Bitcoin, Saylor's orange empire has taken shape." In order to emphasize its crypto-centric business, Strategy recently rebranded. In early February of this year, Strategy stated in an announcement that as the world's first and largest Bitcoin financial company, the brand simplification was a natural evolution of the company, reflecting the company's focus and broad appeal. The new logo includes a stylized "B", representing the company's Bitcoin strategy and its unique position as a Bitcoin financial company. The brand's main color is now orange, representing energy, wisdom and Bitcoin. At the same time, Strategy also launched a new software website strategysoftware.com and a branded merchandise website store.strategy.com. (Related reading: MicroStrategy changed its name to "Strategy", and its Bitcoin holdings in Q4 almost doubled, and it wants to be a Bitcoin "smart leverage" )

In terms of the advancement of the crypto industry, Strategy not only launched the Bitcoin Hub co-working space to attract innovators to promote the development of the Bitcoin ecosystem, but also met with the SEC Crypto Working Group to propose a digital asset regulatory framework and try to establish clear boundaries for the market. In the industry's view, Saylor is not only hoarding Bitcoin, but also shaping industry rules, showing the attitude of a long-term player.

It is worth mentioning that Strategy announced that it would adopt the latest FASB accounting standards in the first quarter of 2025. If Bitcoin closes above $96,337 in the first quarter, Strategy's positive profitability is expected to meet the conditions for inclusion in the S&P 500 index. Once achieved, Strategy will further enhance its market influence. In its previously released financial report, Strategy announced that its Bitcoin revenue target for 2025 is set at $10 billion, with an annualized return of 15%.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates