Best Cryptos to Invest In for 2026 – Top 7 List

The crypto market is clearly shifting as we move closer to 2026. After a wild 2025 with Bitcoin hitting new highs, pulling back, then settling at $88K, the market feels a bit different now. Big institutions aren’t just watching anymore; they’re actively using blockchains, launching ETFs, and shaping where money flows.

At the same time, everyday investors are still searching for the next project that can actually grow, not just pump and dump. Because of this, the focus has changed, and it is no longer just about hype or guessing the next meme coin.

More people are paying attention to projects that solve real problems, projects with features like faster networks, better wallets, scaling solutions, or tokens that actually do something useful. However, this doesn’t mean speculation is gone; it’s just more selective now. Bitcoin is still the leader of the market, but currently, many investors are looking for smaller and cheaper projects that offer more room to grow, even though they come with more risk.

So, to help you get ready for 2026, in this guide, we have highlighted the seven best crypto projects to invest in as we head into the next year. This is a mix of established names with the new projects in the market that offer higher returns.

7 Top Cryptos to Buy for 2026 – Full Reviews

The following reviews analyze these top projects based on their 2025 performance, technical fundamentals, and growth potential heading into 2026.

Solana – High Performance Network Powering Internet Capital Markets, Payments, and Crypto Applications

Solana has become one of the fastest and most widely used blockchains in the crypto market, and honestly, it is very hard to ignore this coin going into 2026. The network is built to handle thousands of transactions per second while keeping fees extremely low.

This is one of the major reasons why so many DeFi apps, NFT projects, games, and meme coins have settled there. Solana’s Proof-of-History system gives it an edge when it comes to speed and cost, even if it’s not perfect. 2025 was a major year for Solana. It started around $150, climbed close to $290 during the bull run, then pulled back with the rest of the market later in the year.

At the time of writing, Solana is trading at approximately $126 per SOL/USD. Although this drop has scared some people, it has also helped reset expectations, and currently, long-term charts now show consolidation rather than collapse, which usually matters more.

As we anticipate 2026, there are several reasons investors are still paying attention to this crypto. Network upgrades like Firedancer have improved performance, outages are far less common than before, and developer activity remains high. There’s also growing talk of institutional involvement and even potential Solana ETFs, which could bring in new capital.

Additionally, many analysts expect prices to average between $250 and $350 in 2026, with more optimistic targets pushing toward $400 or higher if market conditions stay strong. Not to mention, Solana is no longer an early-stage gamble. It’s a more established project now, which means there’s less extreme upside but also less risk compared to smaller projects.

The main concerns are still technical reliability and competition from Ethereum. Even so, with strong adoption, real usage, and a dominant position in meme coins and fast trading, Solana remains one of the best cryptos to invest in for 2026.

Best Wallet Token – The Ultimate 2025 Crypto Wallet

Best Wallet Token ($BEST) is a new popular token that powers the Best Wallet app, a non-custodial crypto wallet built for people who want control without unnecessary complexity. It supports thousands of cryptocurrencies across dozens of blockchains, letting users store, swap, stake, and manage assets without relying on centralized exchanges.

With Best Wallet, you keep full control of your private keys, but the experience is designed to be fast and beginner-friendly. In 2025, the project gained real traction. The presale raised over $18 million before it went live on the 28th of November, 2025, demonstrating strong investor interest in practical tools rather than pure speculation.

One of the things that makes $BEST interesting is that it’s tied directly to how the wallet works. Holding the token unlocks lower trading fees, higher staking rewards, priority early access to the crypto card, a guaranteed whitelist spot for the physical card, elevated cashback tiers reserved for early stakers, and early access to crypto presales through the wallet’s “Upcoming Tokens” section.

Many users download the wallet specifically to access these presales early, and holding $BEST improves that access. As more people use the wallet, demand for the token naturally grows.

Currently, Best Wallet has attracted hundreds of thousands of users and has continued to expand its feature set, including cross-chain swaps, built-in security checks, and staking tools. Plans for 2026 include support for more blockchains, portfolio tracking, NFT features, and a crypto debit card offering cashback on everyday spending.

For investors looking at 2026, $BEST stands out as one of the best cryptos to buy for 2026.

Visit Best Wallet Token

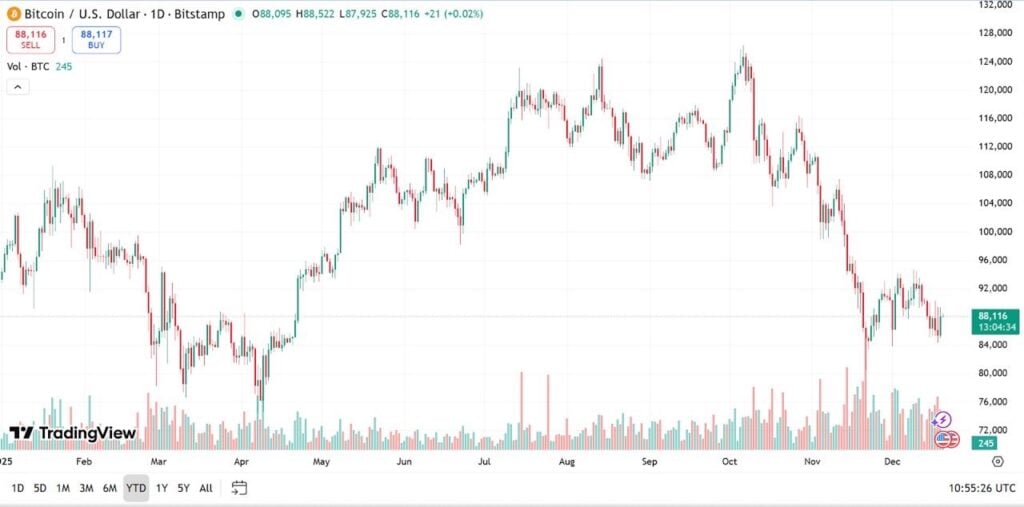

Bitcoin – Largest Cryptocurrency By Market Capitalization

Bitcoin is still the backbone of the entire crypto market. People often call it “digital gold,” and that description still fits today. There will only ever be 21 million BTC, and that fixed supply, combined with growing institutional interest, is a big reason money keeps flowing in.

For many investors, Bitcoin isn’t about quick gains anymore. It’s about protection, scarcity, and long-term value. This year was another reminder of Bitcoin’s influence. Prices surged past $125,000 during the year, driven by spot ETF inflows, the impact of the 2024 halving, and companies adding BTC to their balance sheets.

Later in the year, the market cooled off, and Bitcoin pulled back into the $80,000 to $100,000 range. That correction worried some people, but it also looked healthy. Historically, Bitcoin tends to pause and build support after big runs before moving higher again and as we head into 2026, the outlook remains strong.

Continued ETF approvals, deeper institutional involvement, and even early signs of nation-state adoption are all supporting Bitcoin’s long-term trend. Many analysts expect average prices between $180,000 and $250,000, with more optimistic forecasts pushing above $300,000 if institutional demand accelerates.

Long-term charts suggest Bitcoin is in an accumulation phase rather than a breakdown. That said, it is important to know Bitcoin isn’t a get-rich-quick asset anymore. Turning a small investment into a massive return is unlikely at this stage. But the point is, Bitcoin provides stability, sets market direction, and lifts the rest of the crypto ecosystem when it performs well.

For anyone building a balanced crypto portfolio for 2026, Bitcoin remains a core holding that helps reduce risk while anchoring long-term exposure, making it a must-have crypto for the next year and beyond.

Pepenode – Frog Themed Mine to Earn Meme Coin

Pepenode takes a different path from most meme coins. Instead of just buying a token and waiting, users earn rewards by running virtual mining nodes. There’s no hardware involved and no technical setup; you just have to open the app, set up a virtual rig, and it generates rewards over time. It’s simple, and honestly, that’s part of the appeal.

The project essentially mixes meme culture with GameFi ideas. It uses the familiar Pepe theme, but adds real interaction through upgrades, staking, and token burns. Moreover, when users upgrade their nodes, a large portion of the tokens used is permanently burned, and this helps to lower supply and limit sell pressure.

On top of that, top miners can earn bonus rewards in popular meme coins like PEPE and Fartcoin, which keeps things interesting. So far, Pepenode has raised over $2.3 million from its presale, and this early traction shows there’s demand, especially from users who like game-style rewards rather than passive holding.

Staking rewards are also very high right now, with early APYs exceeding 500%, which has helped attract attention. The project has announced through their X platform that the presale will come to an end on the 8th of January, 2026.

As we look ahead to 2026, Pepenode’s growth depends on one main thing, which is engagement. Like most GameFi projects, Pepenode needs users to stay active, and if people stop upgrading or playing, demand could fade.

That is a risk, but compared to meme coins that rely purely on hype, Pepenode at least gives users something to do. For investors looking at cheap meme coins with an actual product behind them, Pepenode stands out. It’s risky, yes, but it offers interaction, rewards, and scarcity mechanics that many meme projects simply don’t have, making it one of the best cryptos to buy for 2026.

Visit Pepenode

Bitcoin Hyper – The Fastest Bitcoin Layer 2 Chain

Bitcoin is still the backbone of the crypto market, and that hasn’t really changed. This is where Bitcoin Hyper comes into play; it presents an even better long-term investment than Bitcoin.

In 2025, BTC had another massive run, pushing past $120,000 and even touching around $126,000 before cooling off. By the end of the year, prices settled closer to the $90,000 range. Some people saw that as a weakness, but it looked more like a pause after a strong move.

Going into 2026, many analysts remain optimistic, especially as Bitcoin becomes harder to ignore for institutions and even governments. The long-term picture still points upward. Supply is limited after the 2024 halving, spot Bitcoin ETFs have made access easier, and concerns around traditional currencies aren’t going away.

Because of that, price expectations for 2026 often sit between $150,000 and $170,000, with more bullish forecasts going higher if institutional demand keeps building. Now, this is where Bitcoin Hyper comes in. Bitcoin is secure, but it’s slow and expensive to use.

Bitcoin Hyper is a Layer-2 project built to fix that. It uses the Solana Virtual Machine to process transactions faster and cheaper, while still relying on Bitcoin’s base-layer security. This opens the door to things Bitcoin struggles with today, like DeFi apps, staking, gaming, and faster payments. Investors’ interest in Bitcoin’s secure and innovative Layer 2 solution has been strong.

Currently, the presale has raised close to $30 million, which makes it among the best crypto presales of 2025. The $HYPER token is used for network fees and staking, so it has a clear role inside the system. Although Layer-2 projects are complex, and adoption isn’t guaranteed, if Bitcoin DeFi grows in 2026, Bitcoin Hyper could become an important piece of Bitcoin’s next phase and potentially one of the more impactful infrastructure plays in the market.

Visit Bitcoin Hyper

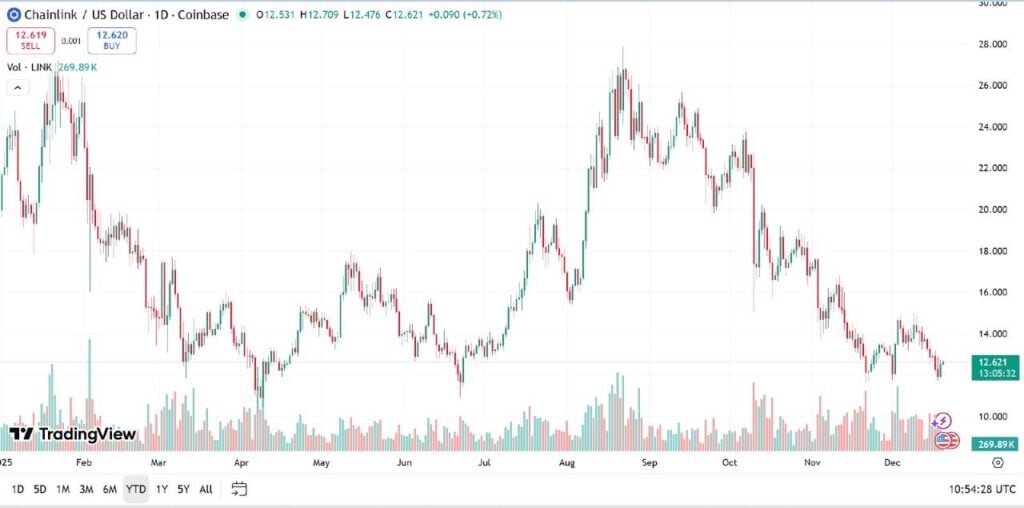

Chainlink – The Industry Standard Oracle Platform

Chainlink is one of those crypto projects that doesn’t get as much attention as it deserves, but without it, a lot of the industry simply wouldn’t work. Its main job is to provide reliable real-world data to smart contracts. Things like prices, interest rates, and external events.

Without accurate data, DeFi apps, games, insurance platforms, and tokenized assets just can’t function properly. That’s why Chainlink has quietly become the standard oracle network across crypto. In 2025, Chainlink continued to expand its role. The project pushed further into cross-chain communication through its Cross-Chain Interoperability Protocol, or CCIP, which allows different blockchains to securely share data and value.

At the same time, Chainlink became more involved in real-world asset tokenization, working with institutions testing on-chain versions of bonds, funds, and other traditional assets. Price-wise, $LINK spent much of 2025 trading between roughly $12 and $18, moving steadily rather than explosively.

Looking ahead to 2026, many investors see Chainlink as a long-term infrastructure play. As more assets move on-chain and enterprise systems adopt blockchain technology, demand for secure data feeds and cross-chain tools should grow.

Because of this, price forecasts for 2026 often sit in the $25 to $45 range, with more bullish scenarios reaching $60 or higher if institutional adoption accelerates. Chainlink isn’t a high-risk cryptocurrency, and it probably won’t deliver overnight gains.

But that’s what makes it a solid pick to invest in because it is a lower-risk project with real utility, strong partnerships, and an important role in the blockchain economy. For investors focused on long-term exposure rather than short-term speculation, Chainlink remains one of the best cryptos to buy as we head into 2026.

Maxi Doge – Dog Themed Meme Coin Trading on Permanent 1000x Leverage

Maxi Doge is a new meme coin built for traders who enjoy risk and fast-moving markets. It leans heavily into classic Dogecoin culture, but with a louder, more aggressive style focused on leverage, competition, and constant community activity. This isn’t a long-term “set it and forget it” project; it is designed for people who thrive on volatility.

The project has so far raised over $4 million from its presale, indicating strong interest from investors. A large number of tokens have already been staked, showing that early supporters are willing to lock in and participate rather than flip immediately.

Maxi Doge also offers high staking rewards, with yields around 70% APY, which encourages holders to stay involved while the project builds momentum. One of Maxi Doge’s main ideas is a gamified trading culture. The branding revolves around extreme leverage, up to 1000x in marketing terms, and competitive tournaments where traders try to turn small balances into large wins. A portion of the token supply is set aside for marketing through what the team calls the “Maxi Fund,” which helps keep the project visible during meme cycles.

As we approach 2026, Maxi Doge could certainly benefit if meme coins regain attention during a strong bull market. Price estimates often sit between $0.0006 and $0.0012, with higher upside during viral runs. Some bullish forecasts even stretch further if hype builds quickly.

However, this token’s low market cap allows for big percentage gains, but it also means sharp drops are possible. Maxi Doge isn’t about safety or fundamentals. It’s a momentum-driven meme coin best approached with small allocations and realistic expectations, especially for traders comfortable with risk.

Visit Maxi Doge

Crypto Market Prediction for 2026 – Key Trends and Insights

The crypto market heading into 2026 feels different from past cycles. After the strong momentum of 2025, the conversation has shifted away from pure speculation and more toward long-term adoption. Bitcoin and Ethereum are still leading the market, but this time, institutions aren’t just testing the waters; they’re actively involved through ETFs, corporate treasuries, and clearer regulations.

One big change many analysts are talking about is the possible end of the classic four-year crypto cycle. Instead of a sharp boom followed by a deep crash, steady institutional inflows could keep the market more stable overall. This doesn’t mean that volatility will disappear; no, it just means that volatility may be less extreme than in previous cycles.

The following are some of the trends that are expected to shape the crypto market in 2026.

Bitcoin Layer-2 Growth

Bitcoin is evolving beyond just being a store of value. Attention is now shifting toward building on Bitcoin, especially for DeFi, payments, and faster transactions. As adoption increases, Layer 2 projects designed to improve Bitcoin’s speed and lower cost could see major upside if this trend continues.

Real-World Asset Tokenization

Tokenizing real-world assets is becoming more than just a buzzword. From bonds and credit to commodities, traditional markets are slowly moving on-chain. Infrastructure projects like Chainlink are helping bridge the gap by connecting blockchains to real-world data. If adoption continues, this trend could unlock trillions in value and redefine how assets are owned and traded.

AI, DePIN, and Utility-Driven Meme Coins

Investors are beginning to shift from hype to usefulness. Tokens tied to real use cases such as AI tools, decentralized physical infrastructure, games, or functional meme projects are gaining more lasting attention. Even within meme cycles, projects that offer something tangible are starting to stand out, meaning that utility is making a comeback and beginning to matter again.

With that being stated, it is important to note that risks are still everywhere. Regulations can change, macro conditions matter, and crypto remains unpredictable. Even in a strong market, not every project will succeed. That’s why diversification and risk management matter more than ever. Overall, 2026 looks promising for crypto, especially for projects with real utility and strong fundamentals. Bitcoin is likely to remain the anchor, while altcoins and early-stage projects could outperform during strong market phases.

Wrapping Up

In sum, the seven cryptos we have covered here offer a mix of stability and growth potential. Some, like Bitcoin, Solana, and Chainlink, are already well established and benefit from strong adoption and institutional interest. Others, such as Bitcoin Hyper, Best Wallet Token, Maxi Doge, and Pepenode, are earlier-stage projects with higher risk but also greater growth potential. Together, they show the different ways investors can approach the market going into 2026.

It is important to note that there is no perfect crypto investment; some projects focus on long-term stability, others on infrastructure or real utility, and some are purely speculative. What really matters is balance because relying only on hype usually ends badly, but ignoring early opportunities can also mean missing out.

As 2026 approaches, a smart approach is to combine established assets with a few carefully chosen early-stage projects, keep position sizes reasonable, and stay updated as things change. Remember, always do your own research, spread your risk, and only invest money you can afford to lose.

Visit Best Wallet Token

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

VectorUSA Achieves Fortinet’s Engage Preferred Services Partner Designation

ZKP Crypto, Deepsnitch AI, Bitcoin Hyper, & More!