The TechBeat: The Invisible Line Item: Why Pollution Is Missing From Every Balance Sheet (12/19/2025)

How are you, hacker? 🪐Want to know what's trending right now?: The Techbeat by HackerNoon has got you covered with fresh content from our trending stories of the day! Set email preference here. ## From AI-Supported to AI-First: What We’ve Learned Re-Engineering How We Build Software  By @dataops [ 3 Min read ] AI-first engineering shifts developers from coding to intent-setting, delivering 3× faster releases, better quality, and a new engineering mindset. Read More.

By @dataops [ 3 Min read ] AI-first engineering shifts developers from coding to intent-setting, delivering 3× faster releases, better quality, and a new engineering mindset. Read More.

Real-Time Write Heavy Database Workloads: Considerations & Tips

By @scylladb [ 6 Min read ] Key architectural and tuning strategies for real-time write-heavy databases, covering storage engines, compaction, batching, and latency trade-offs. Read More.

Leader or No Leader, That is the Question

By @chris127 [ 9 Min read ] For most of human history, leaders were necessary. We needed them to coordinate, decide, organize and share their vision. But technology is changing this. Read More.

Before Bitcoin: The Forgotten P2P Dreams that Sparked Crypto

By @obyte [ 5 Min read ] Before crypto, pioneers dreamed of decentralized money and fair sharing. Their wild ideas shaped today’s digital freedom. Go explore how it all began! Read More.

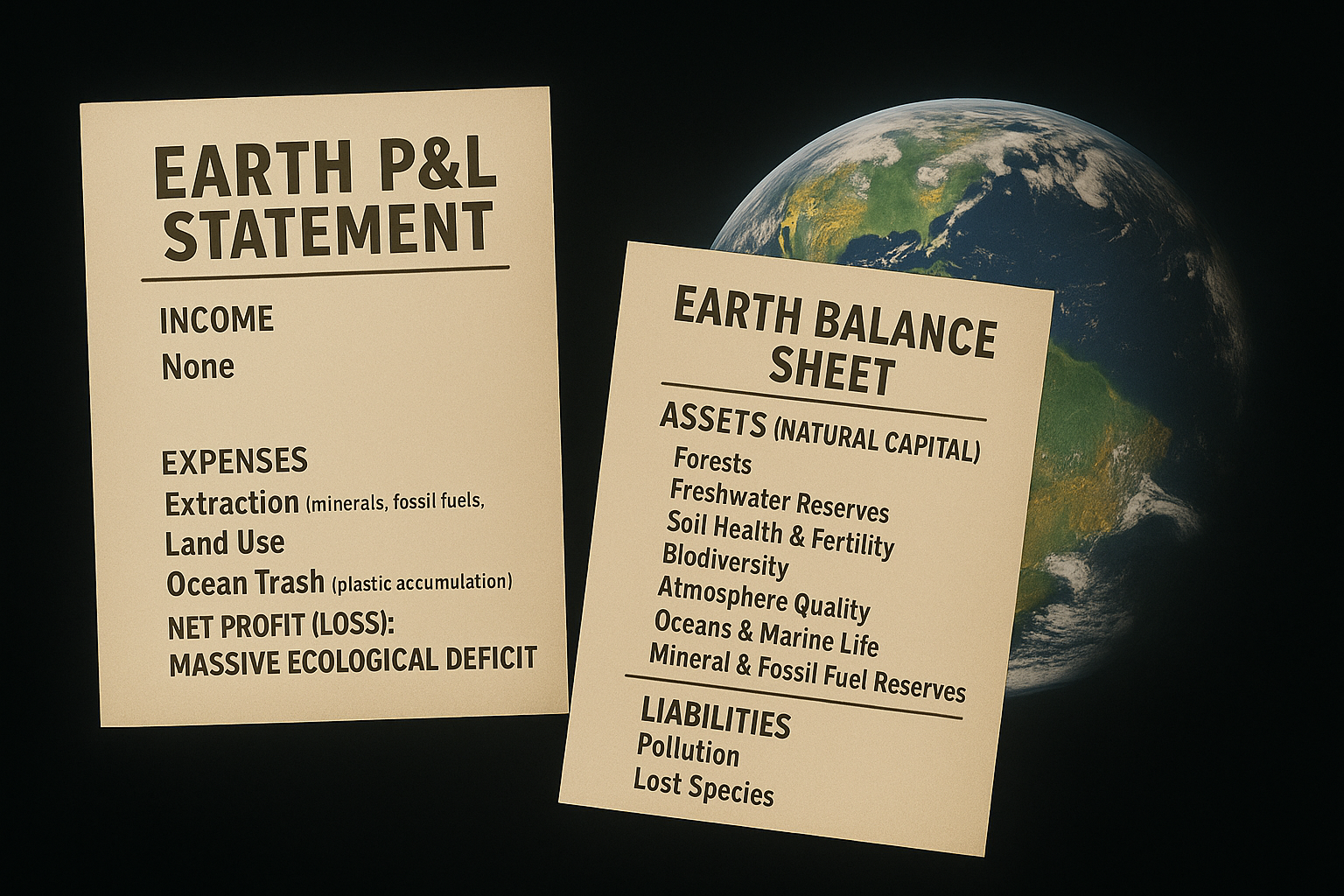

The Invisible Line Item: Why Pollution Is Missing From Every Balance Sheet

By @chris127 [ 12 Min read ] For centuries, pollution has been the missing line item of our accounting. First from ignorance. Then from choice. Now, from necessity. We must account for it! Read More.

Exploiting EIP-7702 Delegation in the Ethernaut Cashback Challenge — A Step-by-Step Writeup

By @hacker39947670 [ 18 Min read ] How to exploit EIP-7702 delegation flaws: A deep dive into the Ethernaut Cashback challenge with bytecode hacks and storage attacks Read More.

Earth Cleaning Technologies: The Current R&D Status and Why We're Still Losing the Race

By @chris127 [ 7 Min read ] Imagine if you could reverse decades of pollution. Remove tons of CO₂, Clean oceans, restore forests at scale. The good news? We can! The bad news? We don’t! Read More.

Code Smell 316 - The Syntax Police Review Anti-Pattern

By @mcsee [ 3 Min read ] Syntax-focused code reviews hide architecture flaws, waste human attention, and lower quality. Automating style checks lets teams review what truly matters. Read More.

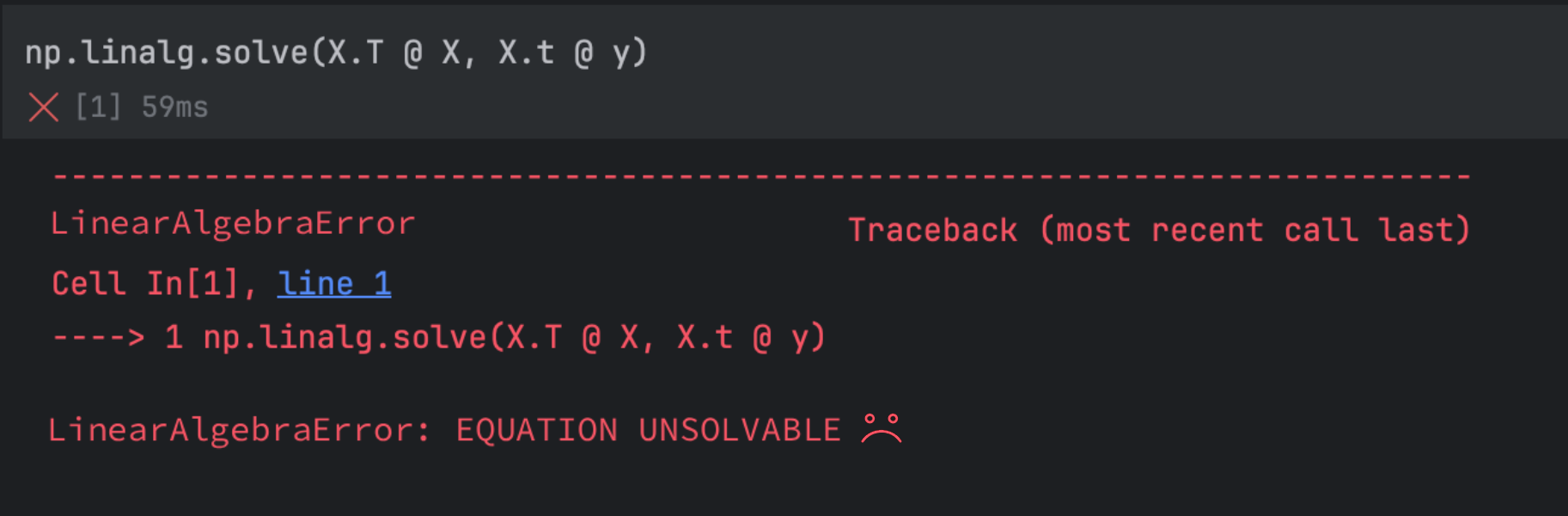

Model.fit is More Complex Than it Looks

By @loneas [ 9 Min read ] Deep dive into why model.fit beats naive normal equations in linear regression, with SVD, conditioning and floating-point pitfalls explained. Read More.

The Hidden Cost of Invalid Traffic: Why IP Data Is the Missing Link

By @ipinfo [ 3 Min read ] IPinfo stops invalid traffic by detecting bots, VPNs, and proxies with real-time IP intelligence, helping ad platforms cut waste and improve ROI. Read More.

Not a Lucid Web3 Dream Anymore: x402, ERC-8004, A2A, and The Next Wave of AI Commerce

By @mickeymaler [ 30 Min read ] Explains how x402, ERC-8004, and agent discovery turn APIs and AI agents into usage-based micro businesses. Web3's future is in Agents doing the work for you. Read More.

Flight Recorder: A New Go Execution Tracer

By @Go [ 11 Min read ] Flight recording is now available in Go 1.25, and it’s a powerful new tool in the Go diagnostics toolbox. Read More.

From Launch to Exit in 10 Months: Inside Neri Bluman's Bet on Answer Engine Optimization

By @stevebeyatte [ 3 Min read ] Neri Bluman is the co-founder of XFunnel, a forward-thinking platform built to demystify AI search engines. Read More.

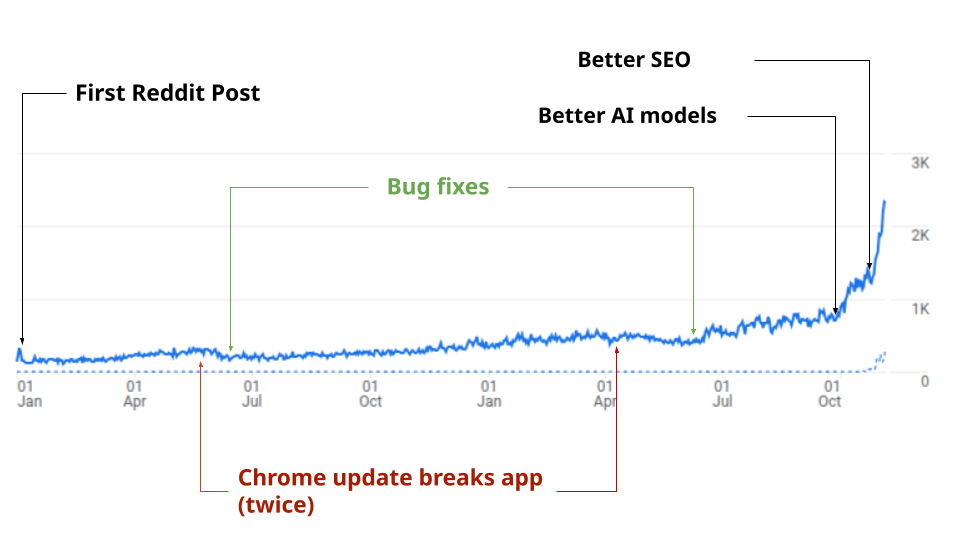

How a Demo Page for my Abandoned Open Source SDK Accidentally Found Product Market Fit

By @sb2702 [ 10 Min read ] How a free browser based video upscaling tool I built as a demo for an open source project accidentally found product market fit, growing to 70k MAU. Read More.

BDX on LayerZero and Stargate: Privacy Meets Cross-Chain Interoperability

By @beldexcoin [ 3 Min read ] BDX goes multi-chain with LayerZero and Stargate, enabling seamless cross-chain asset transfers across Ethereum, BNB Chain, Solana, Arbitrum, and Base networks. Read More.

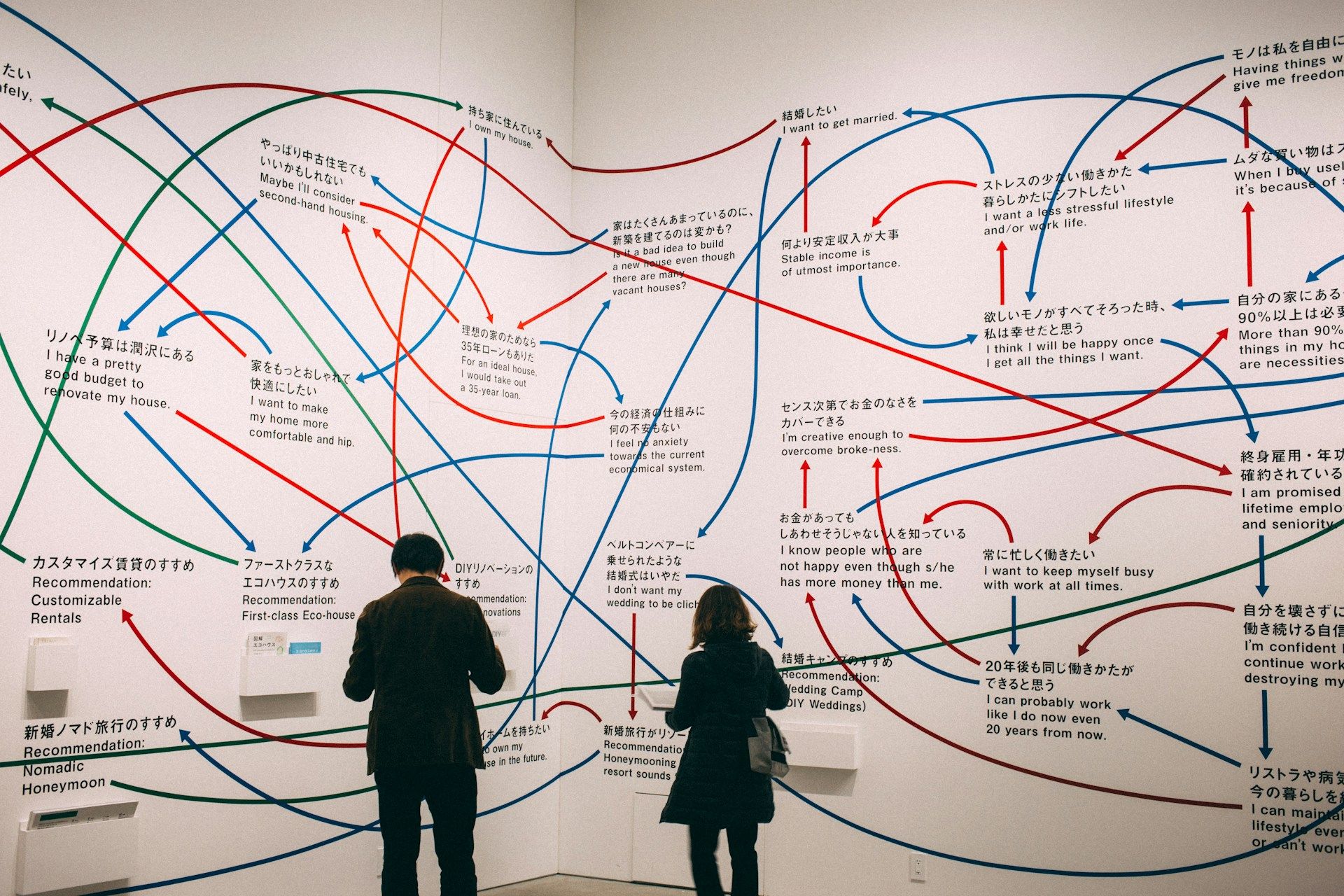

Microsoft Fabric IQ Puts Ontology Back on the Map — and Back in the Confusion

By @linked_do [ 13 Min read ] Everyone is talking about ontologies. Why, what is an ontology actually, and how is it related to graphs? Read More.

Why We Misjudge Our Own Effectiveness at Finding Software Bugs

By @escholar [ 15 Min read ] Controlled experiment compares perceived vs actual defect-detection effectiveness across testing and code reading, measuring mismatch cost and project loss. Read More.

SDG 2025 Year in Review: A Bold Leap Into the Future of Social Discovery

By @socialdiscoverygroup [ 4 Min read ] We built, learned, traveled, collaborated, and celebrated — with many more milestones to come! Read More.

How SCOR Plans to Rescue Thousands of Dormant Sports NFTs from Digital Graveyards

By @ishanpandey [ 5 Min read ] Soccerverse secures licensing rights for 65,000+ professional footballers through FIFPRO partnership, bringing unprecedented authenticity to blockchain gaming. Read More.

Code Review Anti-Patterns: How to Stop Nitpicking Syntax and Start Improving Architecture

By @nikitakothari [ 5 Min read ] Code reviews are pricey. Let machines catch style issues so humans can focus on what matters: security, scalability, and architecture. Read More. 🧑💻 What happened in your world this week? It's been said that writing can help consolidate technical knowledge, establish credibility, and contribute to emerging community standards. Feeling stuck? We got you covered ⬇️⬇️⬇️ ANSWER THESE GREATEST INTERVIEW QUESTIONS OF ALL TIME We hope you enjoy this worth of free reading material. Feel free to forward this email to a nerdy friend who'll love you for it. See you on Planet Internet! With love, The HackerNoon Team ✌️

You May Also Like

XAG/USD Plummets To $76.00 As Anxious Investors Await Critical FOMC Minutes

THETA Surges Toward $6: Analysts Forecast Explosive Bullish Reversal