The True Value of Data Availability: Celestia’s Revenue Potential

Author: DE Analytics

Compiled by: Felix, PANews

This article aims to explore Celestia's revenue potential, point out common misconceptions and narratives that are currently flawed or at least lack substance, and finally propose hypotheses to illustrate Celestia's true revenue potential.

“DA is a commodity”?

A common criticism I see about Celestia’s revenue model is that in the long run, DA (data availability) should be considered a commodity, meaning that fees will inevitably trend towards the bottom.

For this to be true, DA as a resource must be the same across all services. This is not the case for the following reasons:

Celestia DA ≠ any other DA

An important thing to note here is that Celestia not only provides DA, it also provides consensus for rollups. Obviously, some DA providers offer stronger security guarantees than others. Additionally, some providers will have stronger network effects. This alone differentiates the DA service, which means it is not a commodity by definition.

Let’s look at it from the perspective of rollup.

Rollup POV

Rollups are consumers of DA and consensus. They don’t just choose who is the cheapest, they also have to consider security. In addition, they want to use what everyone else is using so they know they won’t get scammed because it’s battle-tested.

Additionally, seeing other protocols switch can instill confidence, further differentiating DA providers from one another. This is a network effect in itself — one that cannot be forked and is difficult to replicate.

So DA is not a pure commodity – but how should it be valued?

Given that DA is not a commodity, it is reasonable for the transaction price to have a certain premium relative to its cost, but it should not be so high that Rollups are prevented from choosing it. After all, it should provide positive results for these rollups. Currently, this positive factor is a significant reduction in fees. Let’s take a look at these data:

Fees are intentionally low

You may have seen people complaining on Twitter that Celestia's current revenue is too low and its valuation is too high, even after a huge drop from its ATH. But they completely ignore that the current revenue is deliberately low. Here's why:

Gaining market share

Low fees are a strategic choice for Celestia to gain market share and beat competitors. The goal is to attract users with free DA, let them try the product, and then become dependent. Once you have a large number of users (rollup), monetization is not a problem. However, gaining users and beating competitors is difficult, which is why you can't set high fees at the beginning and expect a large influx of users.

Celestia co-founder Mustafa Al-Bassam once discussed this point.

Celestia's estimated annual income

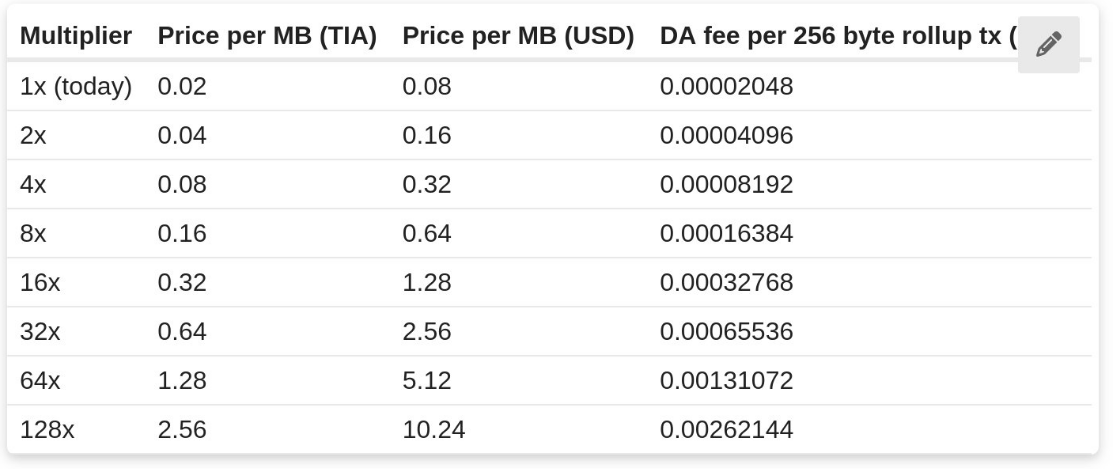

Recently, Mustafa Al-Bassam started a discussion on the Celestia forum about whether to gradually increase the current fees. The first proposed increase was 4 times (possibly more), and the table shows fee increases ranging from 2 times to 128 times.

There is also discussion about anchoring fees to USD and protecting them from TIA volatility. It is worth noting that this is just the beginning and there is still much discussion to be had.

Now that we have some figures available, we can try to assess DA fee income. This is a very difficult exercise, so some assumptions must be made.

Assumptions

As more modular projects enter mainnet, the total data released by Celestia will increase significantly (currently 1.5TB). So far, we have only seen Eclipse stress-test its chain, and more are expected in the future.

To provide some context, Initia, Movement, and Abstract are just some of the many projects laying the foundation for building killer apps. But what do all of these apps have in common? They will completely rely on having secure, fast, and cheap DA.

With this in mind, let's assume that Celestia will eventually publish 50TB of data per year and continue to grow.

TIA Revenue Estimates

The total amount of fees paid by TIA so far is 313,000. At TIA $3.2, that’s about $1 million. But again, these fees are intentionally set low.

If you raise the fee by 15x, it’s still much cheaper than ETH DA. Still a great choice for rollups without adding too much cost: ~66x cheaper than EIP-4844. While you can adjust it higher or lower, 15x is used as a baseline here.

Revenues are now $15 million.

Next, substitute the DA requirement into the formula:

$15 million x 50 TB = $750 million in annual revenue.

If the total figures released increase year-over-year, annual revenues could easily exceed $1 billion.

Final Thoughts

There are actually many variables that affect this calculation, and it's obviously not that simple. Increase or decrease certain variables, and the income will adjust accordingly. But since people like exact numbers, here's an exact number that most people can agree on.

Of course you can continue to tweak the numbers and come up with different revenues, but my personal view is that $1 billion in annual revenue is easily achievable.

The above is just my personal opinion, DYOR.

Related reading: Celestia is suspected of "pumping up shipments": selling coins is packaged as financing before large-scale unlocking

You May Also Like

Tesla Stock Forecast: Will $1.25T SpaceX-xAI Merge Boost TSLA?

Moku Pledges $1M to Launch Grand Arena Season One, a 24/7 AI-Athlete Fantasy Platform