In the era of stablecoin expansion, how can BNB Chain become the highway of future finance?

Author: Frank, PANews

Over the past year, the market value of stablecoins has increased significantly, and their application scenarios have gradually increased. In addition to playing the role of "hard currency" in crypto-native scenarios such as DeFi, their role is also constantly expanding. The bigger trend is to break into Web2's payment, cross-border settlement, value storage and other aspects.

The huge market and potential of stablecoins make them a key resource that all major public chains must compete for. In order to support the implementation of these larger-scale real-world application scenarios, higher requirements are placed on the basic performance of public chains and the preferred characteristics of the ecology.

In this silent financial pipeline revolution, BNB Chain has built a three-dimensional infrastructure system based on the "performance axis-ecological axis-scenario axis", quietly paving the way for the future financial highway network.

Data is the most direct evidence that more and more users, projects, and institutions choose to conduct stablecoin-related activities on BNB Chain. Recently, the US dollar stablecoin USD1 launched by the Trump family WLFI also uses BNB Chain as the main battlefield for issuance. The chain accounts for nearly 90% of the current total circulation, and the market value of USD1 on the BNB chain has now exceeded 110 million US dollars.

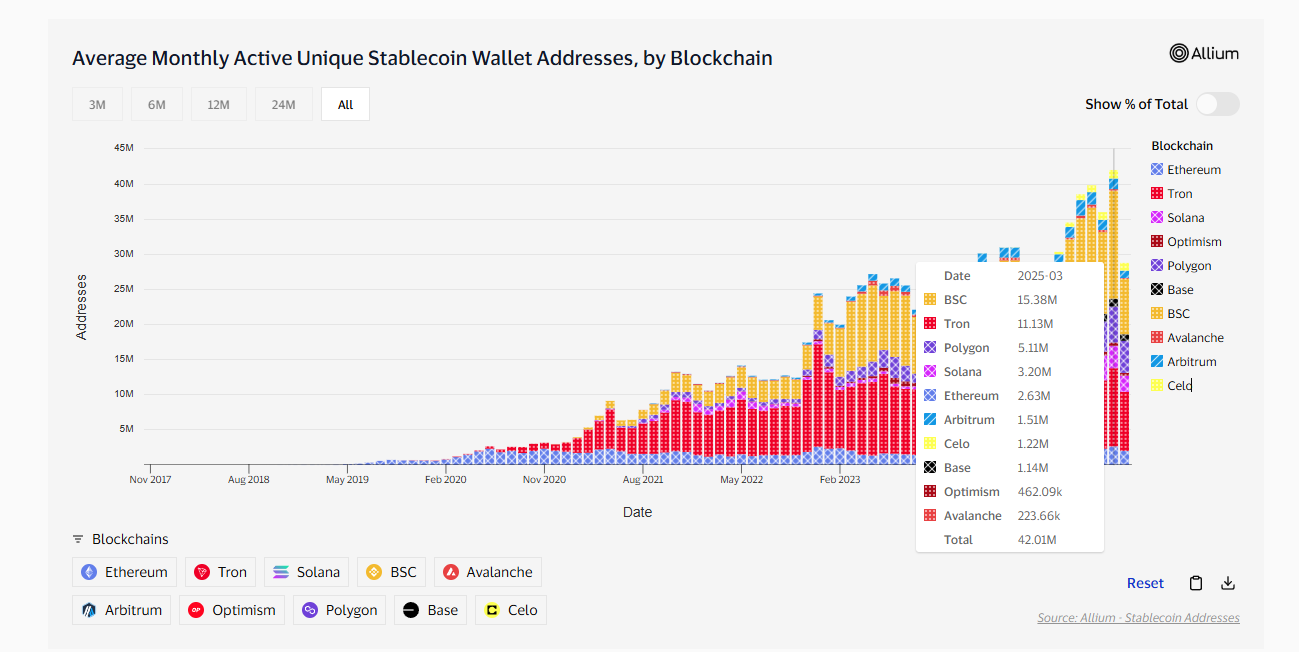

In March 2025, the number of active stablecoin independent wallet addresses on BNB Chain reached a record high of more than 15.38 million, leading other public chains. The number of active USDT addresses on BNB Chain reached 12 million in the past month, ranking first. In the past year, the market value of stablecoins on BNB Chain has increased by about 75%, showing strong capital attraction.

Forging the "three-pole engine" of the financial highway

In the process of stablecoins penetrating into the real economy, BNB Chain builds a value transmission infrastructure through a three-level power system, which includes an ultra-fast transmission shaft with 3-second block confirmation + 5000TPS processing capacity in terms of performance; zero-friction bearings as low as $0.03 and zero Gas plan; and a modular chassis of BSC main chain + opBNB expansion layer + Greenfield storage.

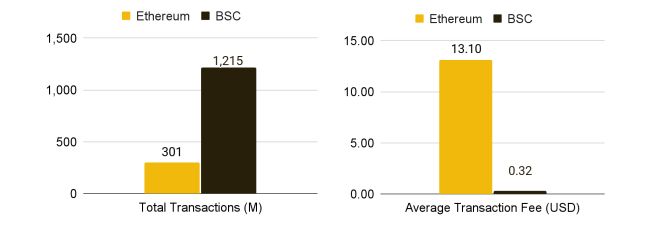

In terms of performance, the block time of BNB Chain mainnet BSC is about 3 seconds. After the Lorentz upgrade is completed this month, it will be reduced to 1.5 seconds, which is much faster than the Ethereum mainnet of about 12 seconds. In terms of transaction processing capacity (TPS), the theoretical capacity can reach 5000TPS. In comparison, Ethereum's TPS after the merger (PoS) is about 30, and the historical highest measured is about 22.7. The powerful performance provides a basic guarantee for the large-scale and real-time application of stablecoins.

In terms of architecture, its multi-chain architecture (general BSC, expansion layer opBNB, storage layer Greenfield) is meeting the needs of different application scenarios and providing a flexible foundation for the integration of stablecoins in various applications. This strategic shift means that BNB Chain is not only satisfied with being a channel for stablecoins, but also wants to become a core platform for stablecoins to create value.

Cost is also a key factor in the large-scale application of stablecoins, especially in small payment scenarios. The average transaction fee of BSC is extremely low, ranging from about $0.03 to $0.11, which is 1/30 of the Ethereum fee. This means that even if a user transfers 100 stablecoins on BSC every day, the total cost may be only about $3 (calculated at $0.03 per transaction).

Building a “Rainforest” System for Stablecoins

Ecosystem construction has always been a prerequisite for the large-scale application of stablecoins. BNB Chain has built a unique stablecoin ecological rainforest by creating fertile ground for developers, external resource reserves, and safety protection forests.

Attracting developers to build stablecoin applications is one of the keys to ecological prosperity. BNB Chain lowers the development threshold by providing a compatible environment and a rich tool chain. BNB Chain is fully compatible with the Ethereum Virtual Machine (EVM), which means that smart contracts and decentralized applications (dApps) developed for Ethereum can be migrated to BSC with minimal changes. BNB Chain has also established a variety of developer support programs, including Builder Grants with financial support, growth incentive programs, and the Most Valuable Builder (MVB) Accelerator Program, to support the development of ecological projects in all aspects.

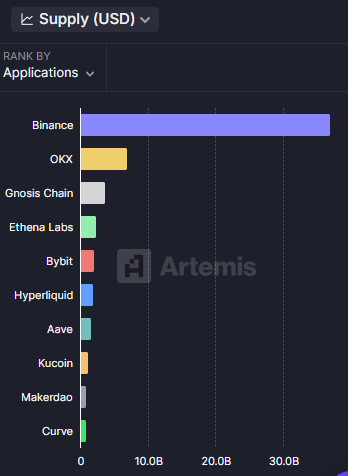

In terms of ecological environment, BNB Chain has unique advantages. It has one of the most active and large user groups. In addition, it has abundant liquidity - not only due to its close connection with Binance, the world's leading exchange, but also through most mainstream exchanges and wallets in the market as well as cross-platform channels, making it the most widely used public chain.

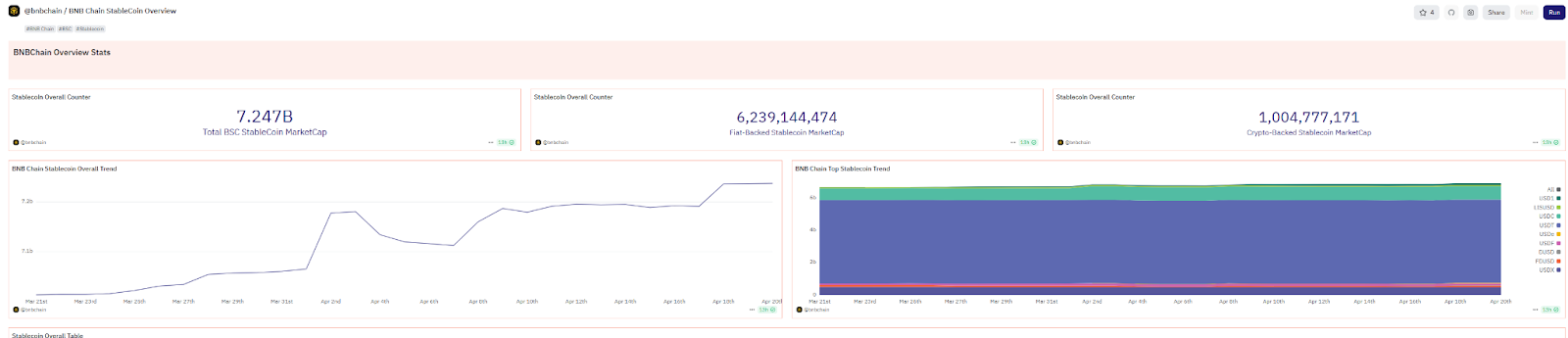

As of April 2025, the total market value of BNB Chain stablecoin has reached US$7.2 billion, ranking fourth in the entire network, and has become one of the most important public chains for the issuance and adoption of stablecoins.

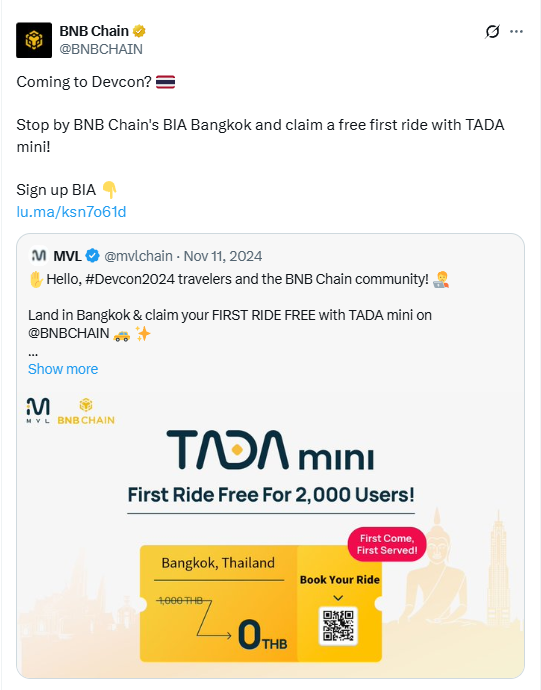

At the same time, Binance Labs (now renamed Yzi labs) also continues to invest in the BNB Chain project. In 2024 alone, 14 of the 46 projects invested by Binance Labs are from BNB Chain, including the long-term cooperative MVB project. This kind of ecological support may provide more room for stablecoins. These resources together constitute a powerful "synergistic" effect on the development of the BNB Chain stablecoin ecosystem.

As the founder of Binance, CZ has always been optimistic about the application prospects of stablecoins. As early as 2023, he pointed out on social media that stablecoins have great potential in cross-border payments, inflation hedging, etc., and emphasized that the gradual clarification of supervision will accelerate its popularization. Recently, in the face of the intensification of the "stablecoin war", CZ said that the healthy competition in the market has just begun.

In order to further promote the application of stablecoins, BNB Chain launched the Zero Gas Fee Carnival Plan in September 2024, which has been extended to June 2025. The plan is a key measure for BNB Chain to promote the application of stablecoin payments, and has currently covered more than $3 million in fees. Major exchanges, wallets, etc. have been included as event partners, and the recently launched USD1 also enjoys 0 gas fees, further reducing the cost of using stablecoins on the chain for users.

These resources together constitute a powerful "feedback" effect on the development of the BNB Chain stablecoin ecosystem. At the same time, this deep integration and positive externalities with top CEXs have brought BNB Chain a liquidity entrance and user base that is difficult to match with other public chains.

As technology soars, a safety net has been laid out. As part of AvengerDAO's security system, the Red Alarm tool continuously monitors and marks high-risk projects and contracts, building a firewall against fraud for users.

From DeFi to offline payment, creating a three-dimensional space for stablecoin scenarios

On the basis of building an ecosystem and excellent performance, entering more application scenarios is the ultimate value destination of stablecoins. By more actively deploying key areas such as DeFi, GameFi, AI and real-life payments, and creating and promoting the prosperity of the diversified on-chain financial environment layer application ecosystem, BNB Chain provides stablecoins with rich application scenarios and opportunities for value amplification.

DeFi is one of the most important application areas of stablecoins. BNB Chain has a prosperous DeFi ecosystem, in which stablecoins play a core role. For example, PancakeSwap, as the flagship DEX on BNB Chain, has become the main place for stablecoin on-chain transactions and liquidity. Its weekly trading volume often exceeds 10 billion US dollars, which means that users can exchange with low slippage.

Venus Protocol is a long-established and leading lending platform on BNB Chain, with a TVL of approximately $1.55 billion on BNB Chain as of April 2025. Users can deposit stablecoins on Venus to earn interest, or pledge other crypto assets (such as BNB, ETH, etc.) to borrow stablecoins.

The emerging ListaDAO is a new trend in the lending space, combining Liquidity Staking Derivatives Finance (LSDFi). Users can pledge assets such as BNB or its liquidity staking token slisBNB to borrow the protocol's native stablecoin lisUSD or the recently launched stablecoin USD1 pegged to the US dollar. As of April 2025, ListaDAO's TVL on BNB Chain has reached US$748 million, with a total loan amount of approximately US$155 million.

These lending protocols have greatly expanded the use of stablecoins, making them an important tool for obtaining liquidity, adding leverage, or implementing income strategies.

In addition to DeFi, BNB Chain is also actively promoting stablecoins to enter the payment scenarios of the real economy, connecting on-chain value with offline consumption.

On the streets of Bangkok, users have enjoyed free first orders and BNB Chain stablecoin payments through the TADA Telegram applet; in Singapore shopping malls, dtcpay's visa card allows stablecoins to be converted into legal currency in seconds. These scenarios are turning crypto experiments into daily financial realities.

From DeFi to payment, from on-chain to off-chain, from transaction processing to value transfer, BNB Chain continues to expand the application boundaries of stablecoins and plays a key role in promoting their integration into the global payment system, laying a solid foundation for the popularization and mainstreaming of stablecoins.

As stablecoins gradually move from crypto-native finance to a wider range of real-world scenarios, the public chain infrastructure behind them is also undergoing a profound reshuffle. In the reconstruction of this new order, BNB Chain is quietly becoming the backbone of this change with its high performance, low cost, strong ecology, security and top resource integration capabilities.

Here, stablecoins become the starting point for building the future financial highway and reaching the next 1 billion users.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates