SOL Price Drops as TVL Declines and Memecoin Hype Fades

Solana’s Ecosystem Faces Growing Challenges Despite Developer Initiatives

Despite recent technological advancements and an active developer community, Solana’s native token (SOL) has experienced sustained price weakness over the past month. Market signals indicate waning investor confidence amid declining on-chain activity and a broader slowdown in blockchain application demand, raising concerns about Solana’s near-term trajectory.

Key Takeaways

- SOL’s funding rates indicate diminished bullish momentum after a 46% price decline, signaling cautious trader sentiment.

- Decreased decentralized application (DApp) revenues and falling total value locked (TVL) suggest increasing market fatigue, even as ecosystem developments continue.

- Network activity on Solana remains relatively stable compared to competitors, yet transaction volumes have not translated into renewed investor interest.

- Recent protocol upgrades, like the launch of Firedancer, aim to improve scalability and performance but have yet to reverse bearish trends.

Market Indicators Reflect Caution

Solana’s token has struggled to hold above the $145 level, with on-chain metrics highlighting a rapid decline in ecosystem engagement. The total value locked, a key measure of user and investor confidence, has fallen more than $10 billion since its September peak of $15 billion. Correspondingly, DApp revenues have shrunk from $37 million to about $26 million weekly, reflecting cooling demand for decentralized applications on the network.

Solana TVL (left) vs. 7-day DApp revenues (right), USD. Source: DefiLlamaOverall network activity remains relatively resilient compared to other blockchains. Fees on Solana have decreased by 21% in the past month, less steep than on BNB Chain (down 67%) and Ethereum (down 41%). Transaction volume on Solana increased by 6%, contrasting with a 42% drop on BNB Chain, suggesting some retained network interest despite the broader market downturn.

Trader Sentiment Under Pressure

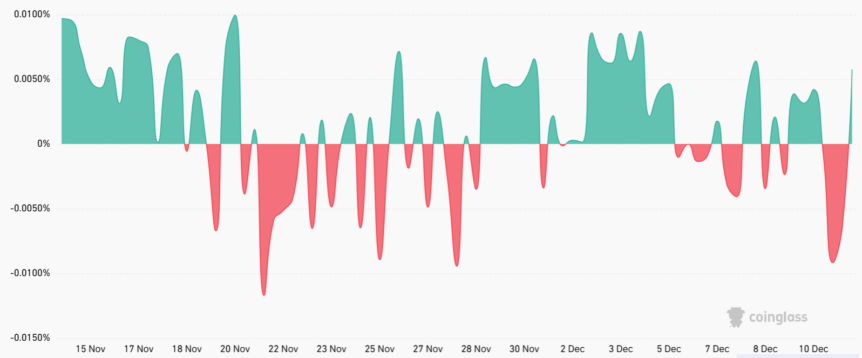

Analyzing futures market data reveals a subdued risk appetite among traders. The perpetual futures funding rate, which indicates market sentiment, stood at 6%, reflecting tepid bullish conditions. An unusual negative rate of 11% briefly appeared but was quickly stabilized, hinting at cautious optimism rather than strong bearish pressure. The recent 46% price drop over three months has likely dampened bullish sentiment, requiring time to rebuild confidence.

SOL perpetual futures 8-hour funding rate. Source: CoinGlass

SOL perpetual futures 8-hour funding rate. Source: CoinGlass

Meanwhile, recent strategic developments aim to stabilize and grow the ecosystem. The launch of Firedancer, an innovative validator client developed over three years with Jump Trading, seeks to boost transaction capacity. Early responses, such as a validator node re-synced in under two minutes, signal promising technical improvements.

Additionally, Kamino, the second-largest Solana DApp by TVL, unveiled new products including fixed-rate loans, off-chain collateral, and Bitcoin-backed institutional credit, with annualized fees of $69 million and an average yield of 10%. These moves suggest ongoing ecosystem expansion despite cautious investor sentiment, which has yet to translate into a sustained bullish trend for SOL. Whether the token can reclaim levels around $190 remains uncertain, especially if broader macro conditions persist.

This article was originally published as SOL Price Drops as TVL Declines and Memecoin Hype Fades on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

Nomura Alters Fed Rate Cut Prediction for 2025